American Butterfly – book 4

The Butterfly

By Nick Ray Ball January to April 2013

Chapter 1.

A SWOT Analysis and The Butterfly

Index.

Part 1. American Butterfly Title Origins (take me there)

Part 2. American Butterfly Key Strengths (take me there)

Part 3. Strengths Presented as Facebook FC (take me there)

Part 4. Opportunities – Brands & Institutions (take me there)

Part 5. Opportunities and The Butterfly (take me there)

Part 6. Weaknesses (take me there)

. Part 7. Threats (take me there)

Part 1. American Butterfly Title Origins

The name “American Butterfly,” is reflective of two considerations: the first part is simple enough, having originally been considered for roll out in Zimbabwe, then Libya, then Greece. With nearly a quarter of the worlds GDP and most of the world’s leading technology companies based in the USA. When it came down to it, the USA was the starting point with the highest probability of success.

The Butterfly comes from the Butterfly Effect. The discipline within Chaos Theory often described by the phrase “Can the flap of a butterfly’s wings in Brazil, cause a tornado in Texas?” However, instead of considering the weather, economics was considered, in particular a consideration of Greece and the Eurozone Economy.

In essence we simply look at cause and effect. If Greece defaults, then many banks will suffer. In France this may lead to their banks requiring a government bailout, a bailout the French government may not be able to afford, the knock-on effect further stifling output and lowering GDP. The ripple from one action in Greece adversely effecting most French citizens. This effect would not be exclusive to France as it would have a similar effect in many Eurozone counties. On the other hand, if Greece were to strengthen, the scenario would reverse and the Eurozone would collectively strengthen with it.

This incite is far from rocket science, more like common sense. However, it illustrates cause and effect. And whilst the world generally looks at Greece as an impossible situation, it should be noted that they have a small population. And so comparatively, Greece has far less social security and medial commitments than most western counties. If Greece found a way to collect the tax that is currently being evaded, it would have a zero annual increase in deficit, as the tax evasion is suggested to be equal to the same. If Greece had no annual deficit it would be one of most financially successful countries in the world.

This consideration was made whilst creating the first Facebook business plan in July 2011. The base of operations for which were to be in a Eurozone version of Silicon Valley in Greece called New Sparta “City of Science.” After reading a definition of Chaos Theory and considering an adaptation to the S-World financial software design which links directly to banks and calculated tax.

It was considered that for Greece if the software were to go further and pay tax automatically and the country were to have a referendum on compulsory use of the software and the referendum passed, they would be well on their way to becoming a positive force within Eurozone finance and not a potential instrument of its downfall. Good for Greece, good for the Eurozone. And perfect for S-World as there are a few more effective ways of marketing a product than to make the use of it law. Not that any part of “American Butterfly” presumes this.

From that point onwards the entire American Butterfly project concentrated on cause and effect. Every action and every single business plan is created to enhance or is enhanced by other initiatives, often many initiatives. As such, one cannot consider any one initiative on its own merits, rather one needs to consider all initiatives in terms of “The Butterfly.” Hence the project title “American Butterfly.”

Part 2. American Butterfly Key Strengths:

-

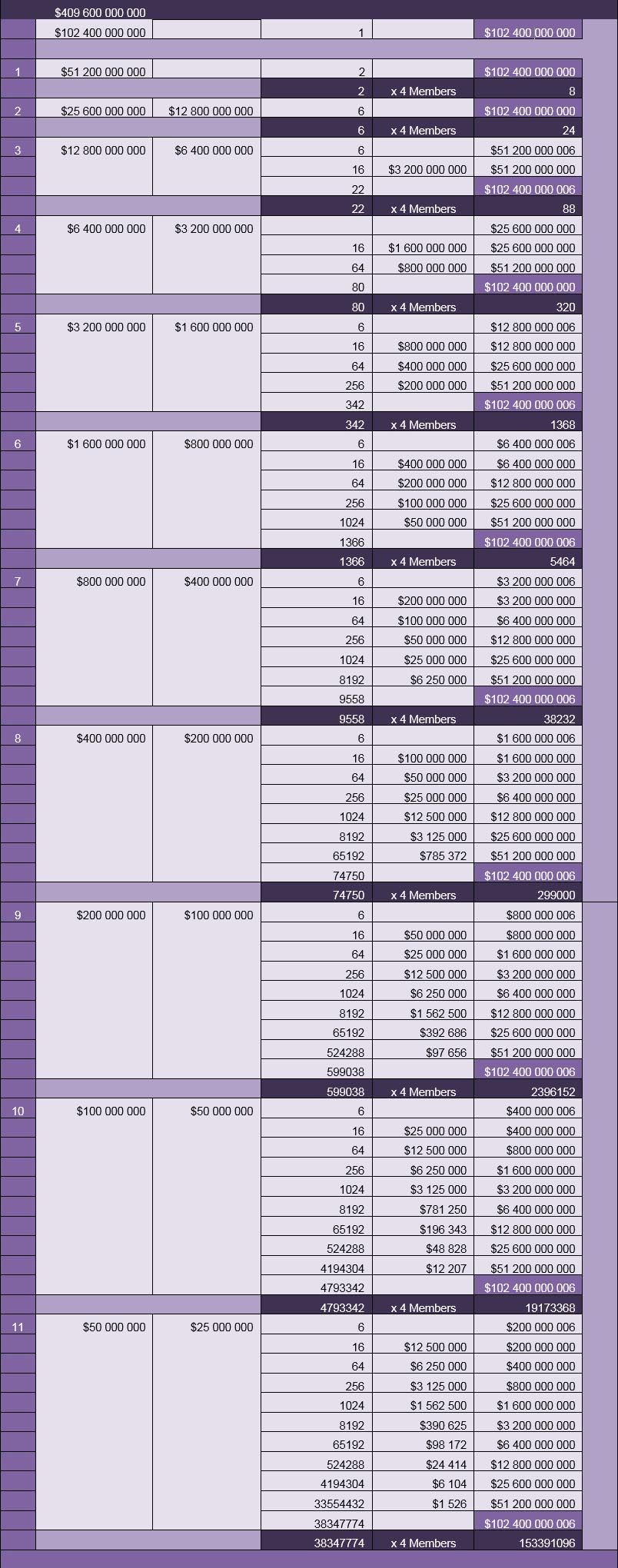

The Higher Math: A powerful economic science originally created to eliminate rounding errors within computation. Creating a digitally enabled stable economic system, from which one has great control over economic factors. Allowing long term accurate forecasting and real time manipulation of economic conditions.

- The Suppliers Butterfly and Economic Stimulus: An initiative that improves the manufacturing sector in various areas whilst providing additional trade for network companies.

- Resort Networks & The Locations Butterfly: Various initiatives designed to stimulate property development and urban planning, seeing the creation of small resort styled towns based around network operation centres. Where all the companies that build, supply and then trade within, become the core network. A number of large scale projects are also planned.

- S-World VSN, VBN & UCS: A virtual 3D representation of the network and the world we live in. A real time registry of network events and a simulation of future events. Used as a social and business network, a game, an education devise, and a logistical planning application.

- S-World.Biz & S-World PQS: Next generation business/economic and probability software linked directly to financial institutions, providing the power to run future simulations of network economic growth.

- S-World Commerce and Facebook Businesses Development: Retail and e-commerce plans see the world’s technology, media and possibly pharmaceutical companies work collectively to monopolize e-commerce alongside making bold steps into high street retail. This initiative takes into consideration and boosts the profits made by the network supplier and manufacturing companies.

- Sports, Media, Arts: Initiatives to encourage and boost investment and participation in sports, media production, and the arts. Essential to achieve the medium and long term goals of becoming the dominant global trade network.

- PR – The love of the people 1: The philanthropic, health, educational, and ecological ambitions of American Butterfly will capture the hearts and minds of all. Alongside gaining the support of strategic foundations.

- PR – The love of the people 2: As an effective global economic solution, the prospect of a return to prosperity and thereafter increased prosperity will further capture the hearts and minds of all. Alongside gaining the support of governments and budgetary offices.

- PR – The love of the people 3: As an immediate starting point a number of books, documentaries, TV series, films, and games are being prepared.

Part 3. Strengths as Facebook FC

At the beginning of writing “The Theory of Every Business” a football analogy was made. Already half way through writing “American Butterfly V1:02” it was said in regard to the “Baby POP” Investment principle, “I needed to start again, building the team around the man, like Barcelona and Lionel Messi.”

In continuance of that analogy, we now highlight the importance of the team that has been built. As we see to our right our proverbial Facebook Gifts football team, with Lionel adopting the Facebook roll. In respect of Facebook generating the money to enact the “Baby POP” investment principle and becoming the main goal scorer. Behind Facebook however we see a significant team, all designed to improve the chances of people purchasing from Facebook and in general increasing the brand love and loyalty.

Before offering detail on all items, it needs to be pointed out that the mathematics supports all initiatives. It may, without reading and exploring the work in full, seem fanciful in today’s chaotic economic climate. Like many discoveries in history. In 399BC Socrates was put to death for his ideas. Years later Copernicus waited 36 years before he was on his deathbed releasing the fact the earth rotated around the sun. Not long after in 1633 Galileo was forced to recant his mathematical claims under pain of death.

Dramatic, but true. However, what is also dramatic but true is the mathematical certainty that if via Facebook or other methods enough investment to start the “Baby POP” process is generated, then all of the following philanthropic, economic, and ecological initiatives are highly probable.

One may argue profit forecasts and estimates presented in “The Theory of Every Business,” indeed that is the point. “The Theory of Every Business” as its name suggest is a Theory, it is open to scrutiny, conjecture, and debate. However, the mathematics used in Baby POP and as are detailed within “16 Points of SUSY similarity” are a lot more certain, not perfect. Isaac Newton’s laws were not perfect but they were certain enough to put a man on the moon.

Once verified, the verification itself causes a circular event. As it will be said, “If the Facebook business development plan works, then all that is presented will come to be true.” And so just about everyone on this planet will want the Facebook development plan to work.

Staying within the theme of a summary, a bullet point will be assigned to each member of the team. More details available throughout American Butterfly and on www.s-world.biz.

-

Economic Stimulus: In goal, we see as with all goal keepers a continual cycle of redistribution. For Facebook and other network companies “Economic Stimulus” is a circular event all to itself. Effectively taking half of Facebook’s profits and distributing them in the form of Network Credits to Facebook shareholders, staff, and local cliental alongside supporting operations, medical initiatives and investing in renewable energies. Recipients of network credits are then obliged to spend their credits within a fixed timeframe, often three months. This act continually reinvigorates the network economy.

Applied on mass considering the profits vs. revenue approach to American Butterfly, this act of redistribution generates more than its initial cost. In short, the mathematics supports the fact that the redistribution of half of Facebook’s profits will generate Facebook more than has been redistributed (For the mathematics behind this please see point three of SUSY similarity).

The defensive line highlights the philanthropic PR. Which is enabled by the critical mass of networks created via “Baby Pop” by the mid century. As a starting point in the USA two phases creating 512 mother networks are planned by direct investment. In terms of size, if using the resort network method to put that into perspective in English terms, that is the equivalent of building 7 mixed commercial residential property developments each containing about 20,000 homes between now and 2020. To add more perspective, as highlighted in the Independent, the Future Homes Commission tells of an urgent need to build 300,000 houses a year. As such this initiative is about one-fifteenth of what is already recommended.

Once created the “Baby POP” investment principle is designed for each development to create 15 equally-sized subsidiary developments before the mid-century. Considering the timeframe, still greatly under what is currently recommended. Further to which, in terms of successes it needs to be appreciated that the initiative is a direct result of following the finite mathematics. Which as proposed results are surprising economic efficiency.

- Medicaid, Medicare & World Health: Before “American Butterfly” came “Sparta Rises Again” which looked at the network starting in Greece and analysed ways to bring Greece into profitability. When moving onto the USA, placing financial inefficiency of institutions aside, it did not take long to work out that Medicare and Medicaid were the main problem. In 2010 costing 34% of the US Federal Budget, predicted to more than double within 15 years.

The Theory of Every Business begins with this point. And in chapter three the solution is presented in the form of the network in its “for benefit” capacity over time absorbing all US Medicaid and Medicare costs. It is also suggested that as the network adopts a profits vs. revenue approach, corporate tax which only brings in only 4% of US tax revenues should be reconsidered for “for benefit” companies.

On the third world scale within The Network on a String “Angel POP” point 7 of SUSY Similarity, the mathematics are such that before the middle of the century six hospital bed nights per year, plus pharmaceuticals will be made available to those that are in need.

- Economy Pensions: US Social Security liabilities have various statistics. In 2010 they cost $700 Billion, just under the cost of US medial liabilities. However, if one looks at the USA debt clock we see the unfunded liabilities at $122 trillion, with medical and pharmaceuticals counting for $105 trillion and social security just $16 trillion. In general, when reading various papers from various harbingers of USA economic future doom such as “Ben Bernanke, Alan Greenspan and the Congressional Budget Office,” all place social security as a minor consideration in comparison to medical liabilities. As such, if the network can absorb the medical liabilities, it frees up enough money to pay for social security.

As an added bonus, should Ben Bernanke, Alan Greenspan and the Congressional Budget Office accept the American Butterfly initiative as credible, confidence in long term US economics will return. Which should have the effect of jump-starting the economy seeing investment and spending in general flowing again. US big business is after all currently sitting on $2 Trillion in cash, which in GDP terms may not sound like a lot. However as is explored in point 3 of SUSY similarity, $2Trillion is cash is far more than $2Trilllion in GDP, as money circulates many times.

- Global Cooling: Working under the same principle of the medical liabilities, the critical mass of the network has been designed to invest in enough renewable energy sources to power the world by the mid-century. See The Theory of Every business chapter three and the network on a string SUSY Similarity point 7 Angel POP.

However, unlike the medical liabilities which ultimately look to become a profitable initiative due to corporate tax incentives, creating alternate energy is an immediately profitable exercise. Which if completed before others will ultimately become the single greatest income stream for the network.

Form a philanthropic perspective, the global cooling initiatives are seen as the No#1 principle initiative, as with the exception on a number of coal producers global warming is seen as a menace by all.

- Special Projects: Looking to the near or distant future there are many ELE (Extinction Level Events) to be concerned about: Asteroids, Super Volcanoes and Ice Ages to name but a few. Special Projects plan for such eventualities, looking amongst other initiates at creating underground sanctuaries and the glamour of the colonisation of space.

More immediate projects such as “The Babylon Project” and “African Rain” form part of the global cooling initiative. As mass solar powered desalination projects are designed to turn select parts of the African and Middle East deserts back to their pre Roman fertile states. Information on Special Projects will be presented within the opening chapter of Superstring Economics/ Strings of Life, to be continued within book five “Quantum Time” within the concluding 8 points of SUSY Similarity.

- Superior Products: Moving out of the of philanthropic PR defensive line and into the mid field, having given the general public a gazillion reasons to want the see Facebook business initiatives successful, we concentrate on the products.

Be it a CD, a house or a Super Yacht precise attention has been placed into the sophisticated “per human experience” search engine. All persons who receive network credits are required to rank items purchased before receiving more credits. Safeguards are in place against general high or low voting and one can only vote if one has made a purchase. For a limited time period Facebook will have exclusivity on all goods ranked 90% or above, to further compliment this initiative a vast customer service initiative has been budgeted for.

- Sports Media and Arts: When analysed within “Economic Stimulus” the sports initiative was deemed to be a highly profitable exercise for the networks. As such a large amount of network credits are made available for participants in amateur sports leagues alongside sponsorship of major sports leagues/events. For instance, it seems well within the budget to bid for premiership TV rights alongside many other top events combined with creating new products. The initial starting point for this is the consideration of a FIFA Global League.

Equal investment has been placed for film and TV production. The initial result in terms of standard advertising and sponsorship seeing large exposure for network brands.

- The Accidental Physicist: Is one of a number of books and film scripts written or in the process of being written to compliment the launch of American Butterfly. The Accidental Physicist is in particular specific to Facebook, and is a pun on the title “The Accidental Billionaires.” Which was also the book from which the film “The Social Network” was created.

- S-World VSN/VBN/UCS/PQS: An array of products, S-World VSN is designed to become the virtual environment that simulates our planet. Where users of Social Networks can see themselves within a planet wide simulation and virtually teleport (jump) to each other’s positions via the GPS’s in their phones. Intertwined within S-World is S-World VBN, presenting many ways to purchase products alongside general exposure for network brands.

S-World UCS and PQS will collectively increase popularity, exposure, and efficiency for all network companies.

- Facebook Stores: (The Theory of Every Business chapters 5 and 6) Bringing the Economic Stimulus Full Circle. Of the 50% of all network profits that are mainly distributed to business owners, staff and local cliental, in this example we see $100 million in Network Credits given as credits for Facebook Stores. Granted that this is less than Facebook will have given away, however the case is made that this in the USA by 2036, this initiative generates Facebook over $1.5 trillion in assets before a single paying customer enters a store.

- Facebook: To conclude the Facebook team, comes Facebook themselves. Who would by most people’s reckoning already be the world’s most popular brand. Led by Mark Zuckerberg, a boy now a man who has a reputation for doing things that are best for Facebook and Facebook members as opposed to financial gains.

It is worth noting that many major brands already advertise Facebook on their TV ads and websites.

Part 4. Opportunities – Brands & Institutions

Part 5. Opportunities – The Butterfly

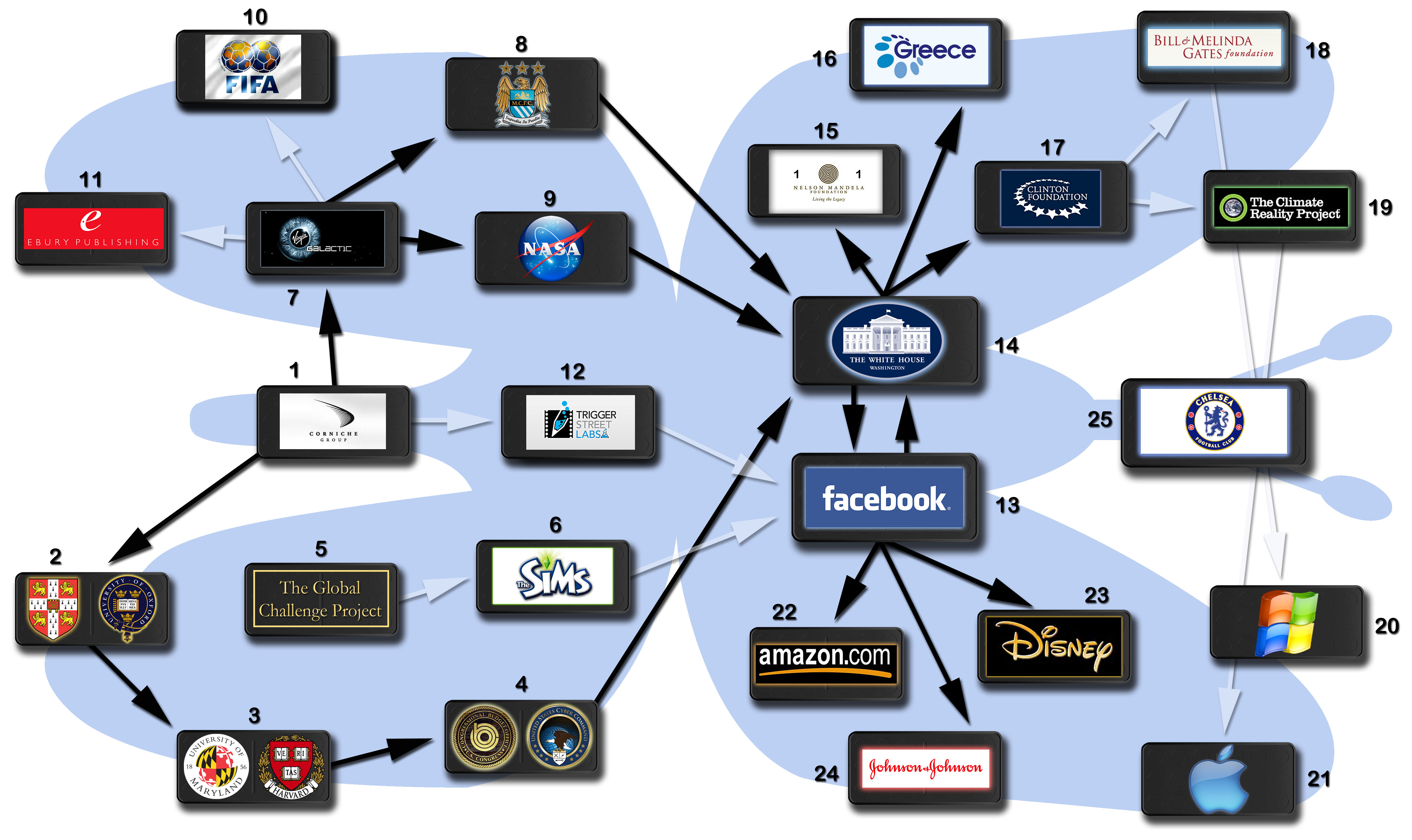

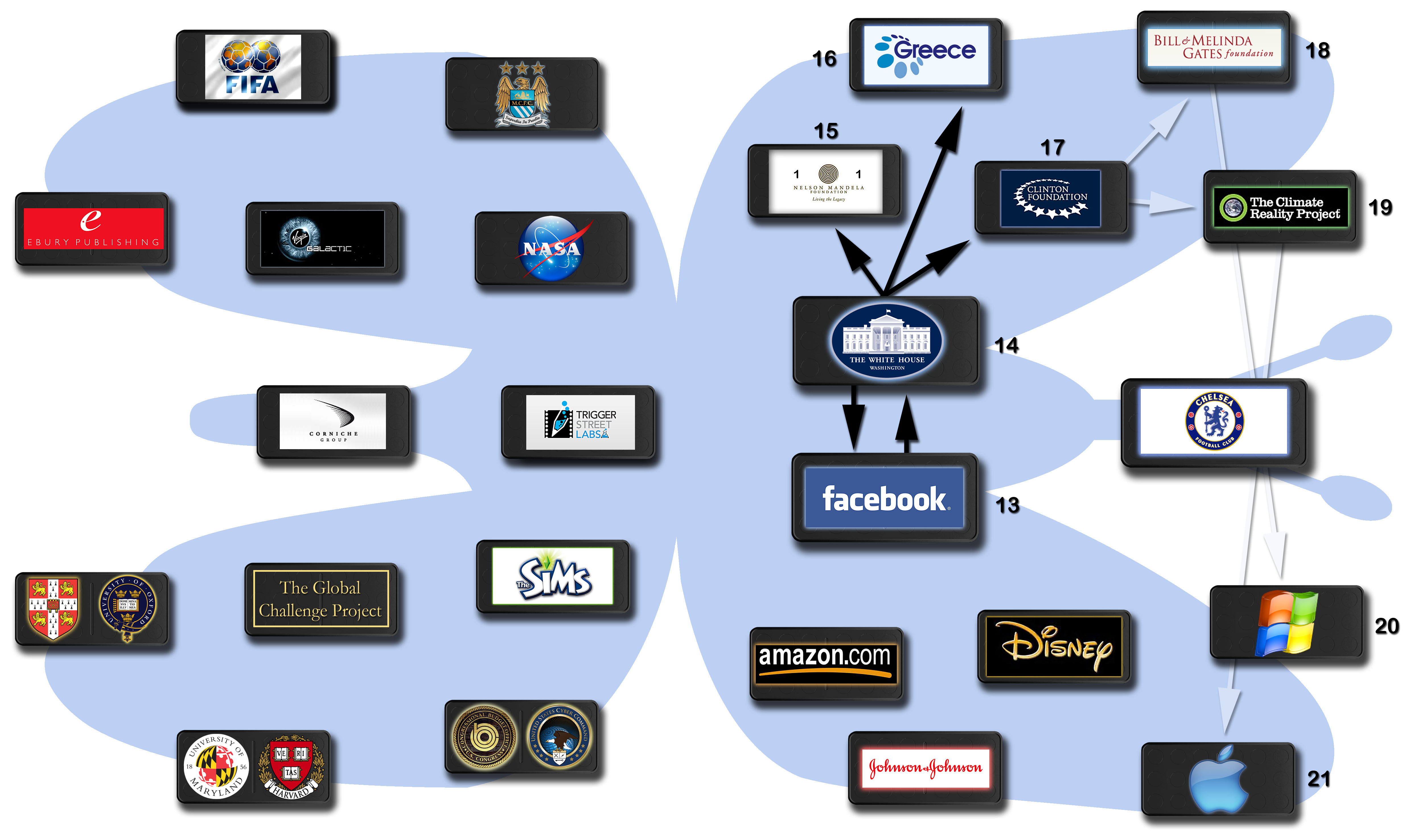

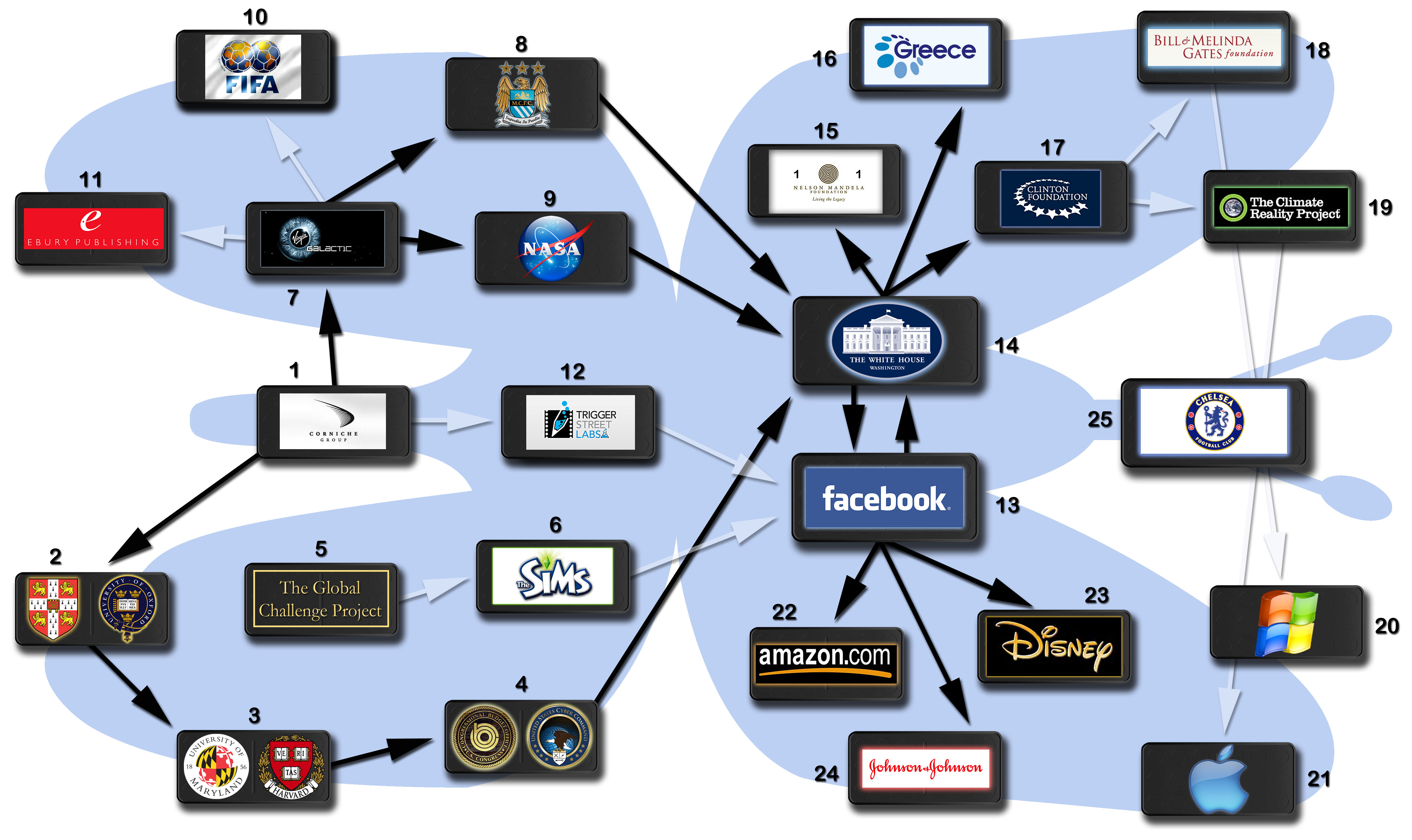

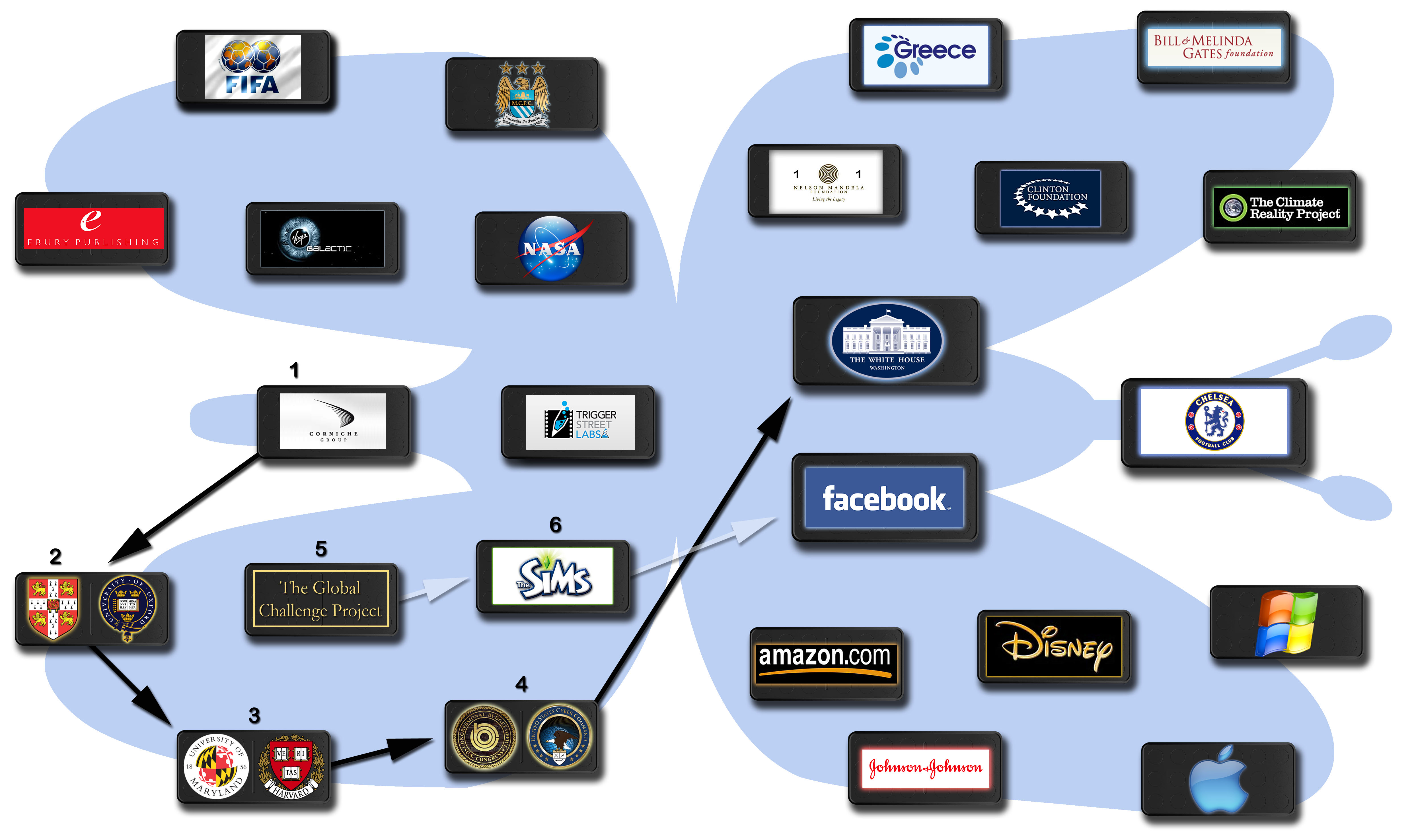

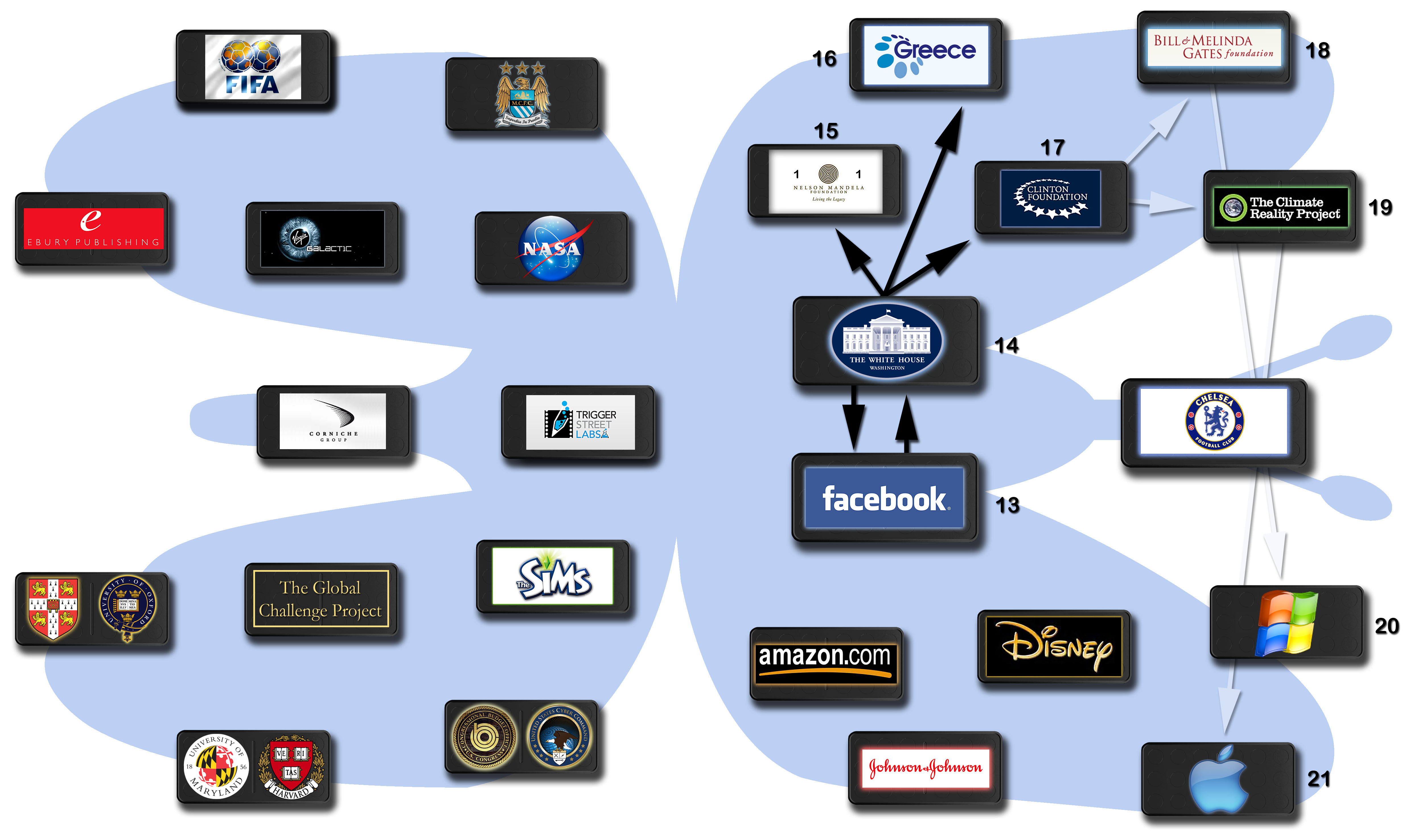

Below we see the selection of brands and institutions. All of whom can befit from and/or be of benefit to the network.

As always we look to maximise cause and effect, this time of one brand to another. Aiming to create a Butterfly Effect where each brand that assists increases the strength of the project and so increases the desirability of others to join in. So we look at the exercise as a set of dominos which we need to place in order, before pushing the first one over and seeing all fall in its wake.

This consideration has been planned since the beginning of The Spartan Theory. It is named the “Pressure of Participation,” the stable mate of the “Pressure of Profit” (POP, Baby POP and Angel POP).

To keep in theme, all the brands and institutions have been laid out as dominos on the shadow of a butterfly, within which, various roots or paths from one brand to another have been presented.

There are many possible journeys. The one presented is to an extent mindful of geography.

As this section is written as a book as well as a proposal, each section will in a way become a mini pitch to each company.

“Root One”

Root 1: This simple academic root allows the mathematics and the products S-World UCS and PQS carry American Butterfly straight to the White House and Facebook.

A secondary parallel path is presented including laying the foundations for the S-World Virtual products.

1. The Corniche Group: Were the first company contacted post “Spartan Theory” (8th April 2011), alongside being the company addressed to within the final eight chapters of The Spartan Theory, or as is now referred to as “American Butterfly” (www.s-world.biz).

The only brand presented with specialist experience in property developments and urban planning. However accurate or not, the costing and returns forecasts are within the “Locations Butterfly.” The 16 points of strength presented alongside added strengths presented within Facebook FC will, when assisted by experts in the field, be enough to create a credible property development and urban planning presentation. Alongside this, as an equity company, the Corniche Group are as qualified as any to scrutinise and improve the various investment models.

The Corniche Group has significant experience and contacts in many other fields and passion, in the sports and film. With this in mind the Corniche Group has been considered the springboard for American Butterfly for quite some time, taking the position as the first domino.

2. Oxford and Cambridge: The mathematics presented within “The Network on a String” are significant. Currently I am waiting for an opinion from Cambridge’s Michael Green and others from their department of applied mathematics and theoretical physics.

3. Maryland & Harvard University: In the same way, “The Theory of Every Business” was written and addressed to The Corniche Group, but designed for all companies. “Quantum Time,” the fifth American Butterfly book was written for Dr James Gates but designed for all physicists. Dr Gates is on President Obama’s science and technology council and with his team has been working in the field of Supersymmetry and parallel universes for close to a decade. It is highly likely that areas of his work are classified as such respect needs to be shown to those who would classify it.

Staying within the academic accreditation theme, this time moving to Harvard from a general, historical, and economical perspective. Professor Niall Ferguson (also a fellow at Oxford) would be well placed to assess American Butterfly in terms of its impact on the efficiency of corporations and in general US and global economics. This, before moving to the next domino which includes the CBO, the Congressional Budget Office.

4. The CBO and US Cyber Command, US Government Agencies: Both have an important say in any US internal initiative. Bringing them on side before approaching the White House would seem advantageous. No specific person has been identified at the CBO.

When we look at the USA Cyber Command we look specifically at Dr. Floyd B. Cole, III; who is head of the mathematical sciences division and is a fellow professor to Dr James Gates at Maryland University. The consideration for the USA Cyber Command is in regard to building the S-World PQS. As the central software platform, one can’t have a main brand like Apple or Microsoft build it. As if one did, the other would not use it. The USA Cyber Command employs more mathematicians than any other US institution. It also has world class security and advanced probability software. Their parent institution, the NSA, is one of the most powerful institutions in the world. If one see’s approval from the NSA and the CBO, it’s an open invitation to the White House, with enough backing to win over most of Congress and the House of Representatives.

For further consideration within Root one, presented with grey arrows is the secondary parallel path which lays the foundations for the creation of the S-World Virtual products. Which are in essence simulations of our world complimented by supersymmetry and as such complimentary to the work of Dr Gates.

5. The Global Challenge Project: Is the work of Lee Chazen, whose article “Chaos Theory, Self Organisation and the Role of Government” assisted in shaping the early foundations of American Butterfly’s mathematics. Lee was contacted in June 2012 and sent the first half of “The Theory of Every Business,” up to, but not including the Facebook section. His response: “Based on what I’ve read from your writings so far, you may really be onto something, I was thoroughly impressed with the magnitude of this project and its global implementations, with your permission I’d like to forward this on to my brother, he runs an asset management company in Silicon Valley.”

Whilst it was not time to consider equity companies at that point, Lee’s words of encouragement inspired a closer look at “The Global Challenge Project.” Which in turn greatly inspired S-World UCS and the concluding 8 points of SUSY Similarity. It would seem fair and advantageous to have Lee’s further input, particularly as education is a founding pillar of every network.

6. The Sims: Will Wright, the designer of the Sims computer game, could become a key player within all S-World Virtual Products. For all intents and purposes, assisted with a little help from Pixar, a touch of fractal geometry and some satellite usage, the visual medium used for S-World VSN could well be The Sims game engine. Its simplicity of usage, especially in designing homes and cities is its major credit.

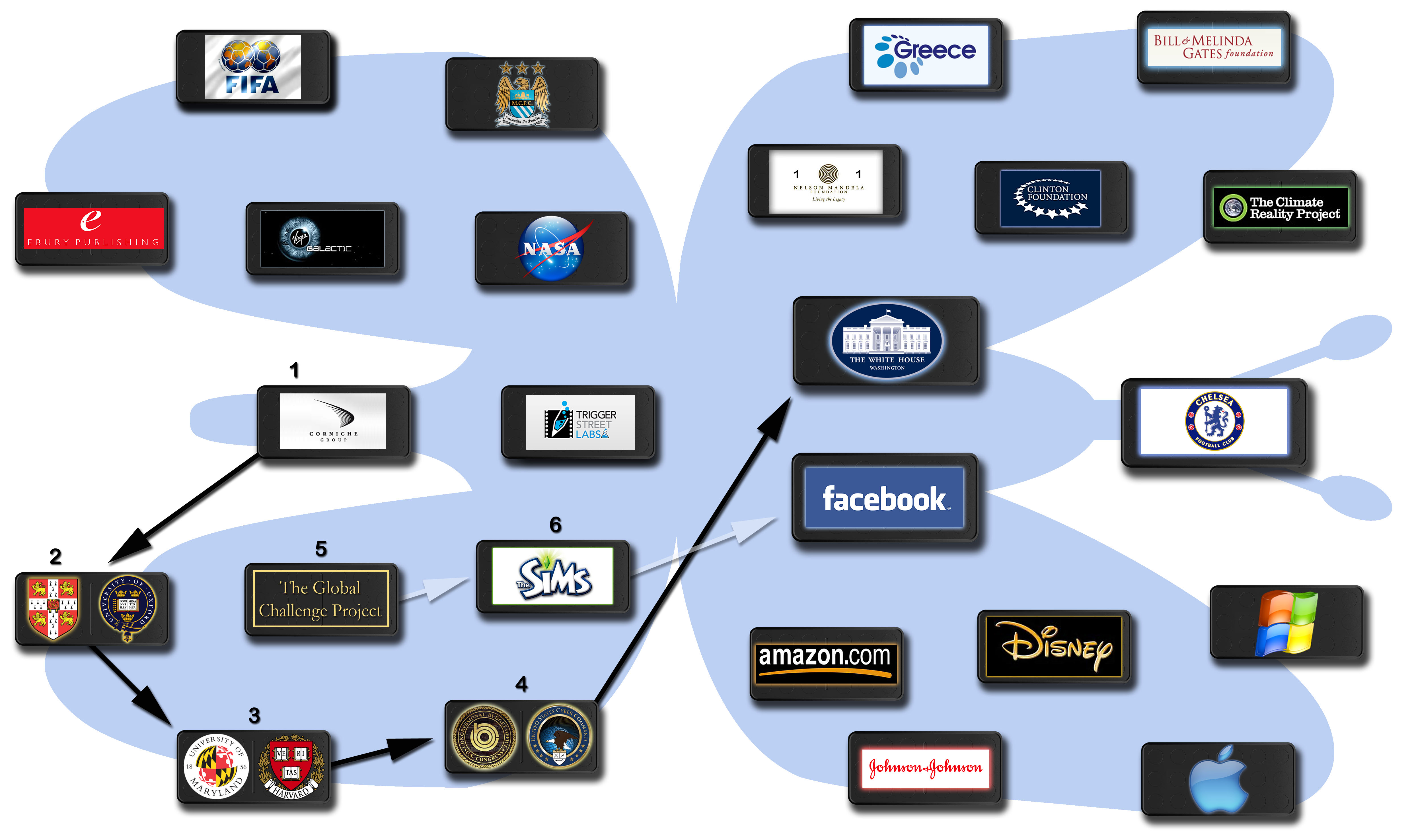

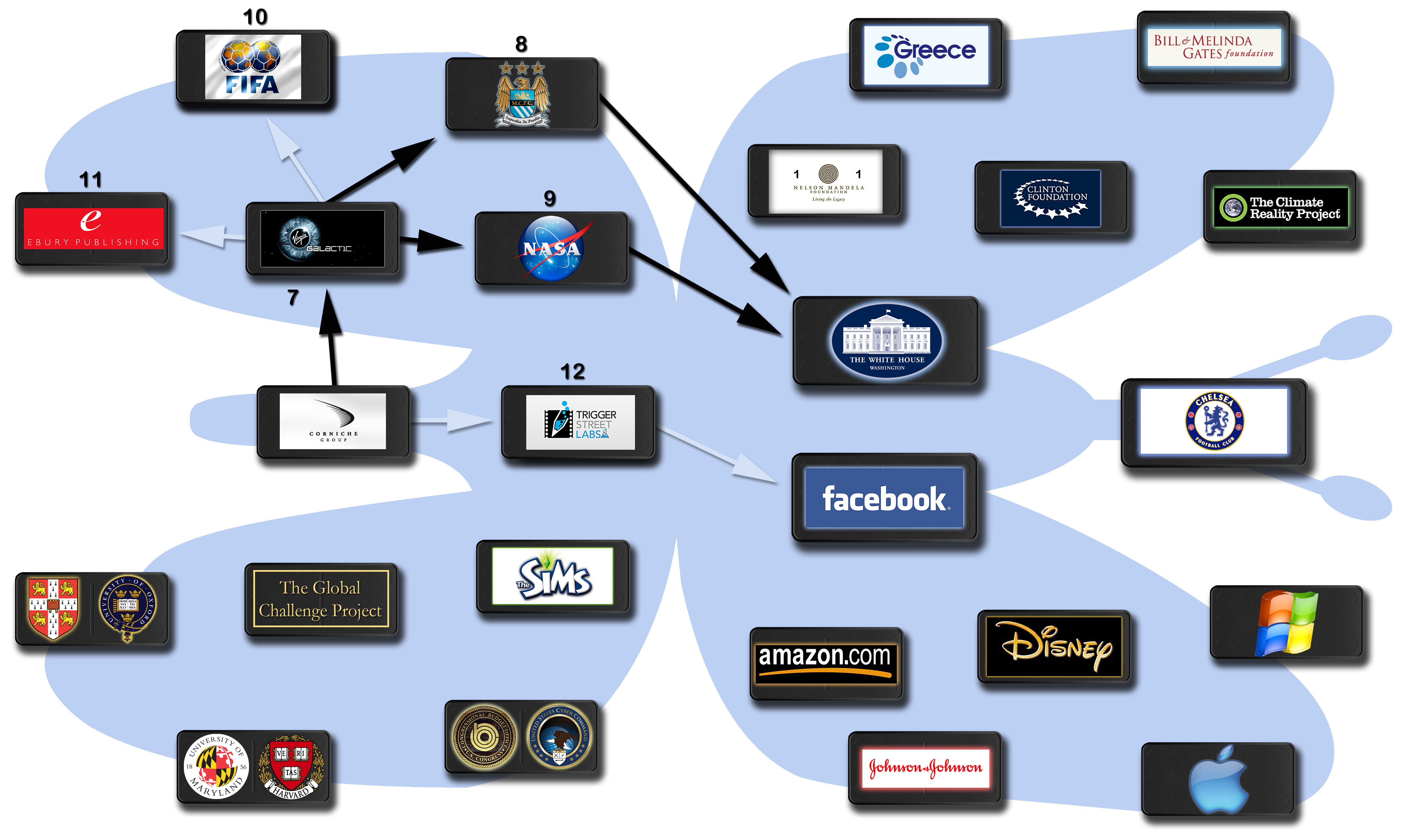

“Root Two”

Root 2 looks at previously considered roots to the White House and Facebook. Considered before the mathematics and points of SUSY Similarity were strong enough to make a direct path. All still relevant and all add to the Pressure of Participation principle.

7. Virgin Galactic: See’s two birds awakened with one stone, more obviously is Sir Richard Branson and Virgin. From 2007 to 2011 Sir Richard Branson and Virgin were the primary target for the project. Initially, the network was primarily focused on travel and real estate. However, when the first business plan was written and presented (18 March 2011 chapter 1 www.s-world.biz) it concluded with the notion that the network software and affiliate design could be adapted to other industries.

It took Virgin Brands SA only three weeks to assess and approve the business plan for consideration by their London committee. However, at the time I was in a very spiritual place and a poorly presented philanthropic request saw an end to proceedings.

Across the world Sir Richard is well respected. And the Virgin corporation is in essence a network of about 300 companies, their experience concerning the interplay between different industries would be very useful. Over the months that followed, within the various journal entries on www.S-World.biz, the concept of adopting the network into other industries was explored and an outline business plan for 16 different Virgin brands we written. Many of these considerations became the foundation of “The Theory of Every Business.”

The reason for singling out Virgin Galactic over and other Virgin company is in part due to the glamour and wow factor associated with space travel, in part due to “Special Projects.’ In part as Virgin Galactic would have many physicists on their team and in part due to co-owner HH Sheikh Mansour bin Zayed Al Nahyan.

8. Manchester City Football Club: The inclusion of Man City or more to the point Sheikh Mansour was considered during the three weeks between Virgin receiving and accepting the business plan. The initial consideration in line with the current “Pressure of Participation” exercise, in essence to forge an elite group of 16 brands interested in progressing the network designs. The 16 brands were to be spread out into 16 global territories. Already considered and strategically important were Virgin, Sky, Google, Microsoft, Apple and Facebook.

Having followed the fortunes of Roman Abramovitz, particularly the escalation in his personal wealth the year after he bought Chelsea, I have always seen the purchase of Chelsea as a very clever marketing idea. When Sheikh Mansour purchased Man City, I continued the presumption. It said to me “Hello world, if you want to do business in Dubai, or with Dubai, talk to us.” A little research showed he was the half brother of the current President of UAE, and suggested that president Obama had his number on speed dial. Since these incites Sheikh Mansour has now been appointed deputy prime minister of UAE.

However, to include Sheikh Mansour or for that matter Roman Abramovitz, a business plan or at least consideration was required. And in so doing, the consideration that the network should be both online and physical with Man City and Chelsea becoming networks. Diversifying by selling the goods and services created by network companies and where pertinent expanding into new territories. This consideration has since developed into resort networks and the POP investment principle. In general, be it from the Corniche Group or Sheikh Mansour or preferably both, it is considered in terms of the resort network contingent to American Butterfly. There will be no better assessors and advisors on resort networks that those who have experience in building in Dubai.

Alongside Roman Abramovitz the consideration of Man City becoming a Network is still very much on the cards. And now I expect with the new rules of profitability within the FA, it is a welcome consideration.

9. NASA: In 2009 to aid the presentation to VIRGIN, a number of branding lectures and workshops were attended, one short film on NASA stuck out. There was a corridor and within a janitor was sweeping the floor. He was asked “what are you doing?” He replied without due excitement “sweeping the floor.” Cut to the same scene except a NASA badge appeared on the wall. When asked the same question, this time the janitor replied, “I’m helping to put a rocket on the moon.”

The exploration of space is a unifier and a wow factor, so long as it is not done to the determent of the tax payer. Case in question, recently regarding India’s space program a UK government minister was asked, “Should we really be giving India development money, when they have a space program and we don’t?” The minister’s answer was, “the prestige of the space program greatly increased investment into India.” Which was not enough to stop the aid being given a few months later, but once again highlights the positive benefits of having a space program in terms of prestige and subsequent investment gained from the said prestige.

From an ecological point of view, with absolute certainty, in the long term we know the only way to protect our complexity, ecology, and ourselves is within the colonisation of space

NASA of course alongside Virgin Galactic will have plenty of physicists.

10. FIFA: The consideration of the number 16 initial brands split into 16 global territories was to enable the creation of the FIFA Global football league. A concept they converted that would bring excellent PR to all 16 networks. From that point onwards whenever increasing or decreasing the size of the network it would always be done to fall in line with an extended knock out tournament. This simple numbering system later evolved considerably and now forms the backbone of the “POP” investment principle and the 16 points of SUSY Similarity.

22 months after the initial consideration of a FIFA global league, the concept has grown into a monster initiative to drive and incentivise the world into fitness. FIFA and many other sporting bodies are encouraged to join the network.

11. Ebury Publishing: This initiative is specific to book publishers. Ebury have been symbolised simply due to their affiliation with Virgin. There are many books to publish, each of the ten points of strength raised within the general executive summary. And to the ten points of strength within Facebook FC require a dedicated publication. Alongside this, a technical manual is required for each brand. Institution and opportunity highlighted within this Pressure of Participation exercise, but before such considerations comes the duo: “The Accidental Physicist” & “The Virtual Network.”

“The Theory of Every Business” has already passed the layman as well as the academic test with flying colours and to the casual reader will continue to do so. Effectively demonstrating to the general public in all shapes and sizes that the amount of money per network that requires to enact “Baby POP” is easily achievable. Indeed, on paper the figures and 8 questions asked and answered for Facebook alone pay for the process three times over.

The continuing book “Superstring Economics/Strings of Life” follows the development of the physics in elementary fashion. Very simply introducing the reader to some very complex considerations, from a perspective never explored before. Along the way the path to mathematical certainty in network creation and the benefits associated are presented.

By the time the reader will enter the third part of the book, “The Network on a String,” even if they have no experience in physics, mathematics, business or economics; the reader will be able to grasp the “POP” investment principle and most if not all of the 16 points of SUSY Similarity. The book will be as educational as it will be enlightening.

The point of course is simply in the spreading of the idea. American Butterfly tells the story of a utopian idea that is mathematically possible, indeed very possible. The more people read the book, the more people can believe in the network and all its promises. A big network priority at this stage is the perfection of “The Accidental Physicist,” American Butterfly parts one to two or one to five.

The technical manual “The Accidental Physicist” is complimented by the story behind it, told with “The Virtual Network.”

12. Trigger Street Productions: The documentary film on the rise of Facebook, “The Social Network” won 3 Oscars. Imagine a follow up of sorts, where the original documentary film played an intrinsic part within its own plot. So far within this business plan or any of the “American Butterfly” presentations we have not heard mention of the original “think bigger” inspiration, “The Sienna Project” written on the 4th July 2011.

The Sienna Project described the creation of a new type of digital economy assisted by a supercomputer and software far more advanced that any current designed. But it was not a technical document, it was a film script written in part to silence those that may shout “SkyNet!” The film started by following the rise of S-World Virtual Network and references the film “The Social Network” before entangling with first the Jedi Universe and later Middle Earth.

That’s influence No1. Before being seen the film The Social Network was written into the most influential document within The Spartan Theory.

Just over two months later on the 15th June 2011, the film The Social Network was seen for the first time. Paused shortly after the point where Mark Zuckerberg mentioned uploading a music application he designed onto the web for free despite Microsoft’s interest in purchasing it. Affinity was seen and from that point onwards as found from www.s-world.biz chapter 4 “A Change in Direction” for the next 11 months. A journal was started, following the progress and development of ideas. Noting down some abstract observations along the way which eventually just so happened to mimic the cleverest of the universities interactions.

If one looks at the web address of chapters 4 to 10 up to the Facebook presentation, one can still read the original web chapter folder’s name “The Social Network 2.” However, after consideration, the title changed to “The Virtual Network” and the first part to “The Spartan Theory.”

As a third point of reference, shortly before starting American Butterfly in December 2011, a letter of introduction was sent to Trigger Street Productions; the production company of Kevin Spacey and the executive producer of “The Social Network.” It was considered by one of a number of producers of the film.

Considering that the films he makes and plays in particular “pay it forward,” Kevin will be truly inspired by the potential of the network. Which may not result in a follow up to The Social Network in name but a good film with plenty of hooks in a similar line, propelling the network capabilities and possibilities to a wide audience. Of course so far, only about a third of film has been written. And by including Trigger Street productions early within the Pressure of Participation, an additional looping hook will appear as they are on both sides of the camera, so creating an anomaly of sorts.

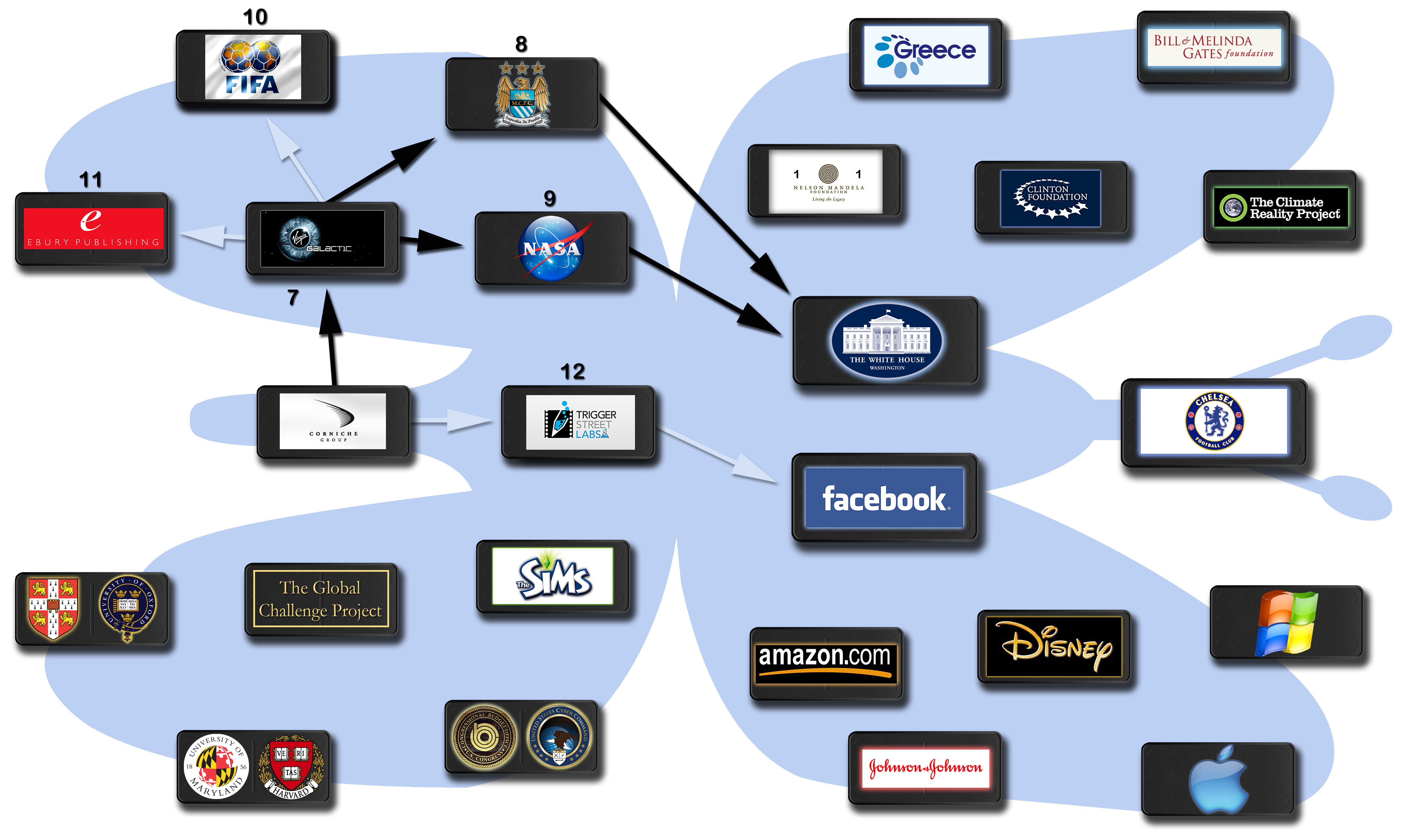

“Root Three”

Before considering Root 3, which starts with The White House and Facebook, a note on Roots 1 & 2. Whilst it is possible to follow both roots, it would seem more prudent to simply follow root one to the White House, where-after consider options. One particular option would be to hold back on root two and move straight on to root three.

Root three as illustrated brings on board some political partners in South Africa and Greece before approaching the major foundations which have been tactically organised to make an approach to Microsoft and Apple, both of whom are essential partners.

13 & 14. Facebook and the White House: The main consideration between Facebook and The White House is who to contact first. Current opinion suggests considering Root 1, universities, academics and mathematicians to the CBO and NSA; the White House is the obvious choice. With the backing of the NSA and the CBO and considering the content, the White House would surely have no objections. And thereafter, the approach to Facebook gains a very valuable ally, indeed if considered from the perspective of “The Virtual Network.” Where hooks are golden, it would be ideal to inform Facebook at the White House.

15. The Nelson Mandela Foundation: The original consideration for The Nelson Mandela Foundation was significantly greater than a simple “Rubber Stamp of Approval” and it still can be, but respect needs to be paid to Madiba’s health and years of public service already served.

It has been desired since its conception to have S-World considered as Madiba’s final legacy, this is warranted for a number of reasons. The original network designs from 2001 to 2012 were all created for and in South Africa. In 2003 Madiba’s grandson Dumani Mandela alongside the grandsons of his mentor Chukka and Moweaqua Sisulu assisted greatly in the attempt at launching the network. Attending and adding prestige to the meeting that secured the TV channel and a number of meetings regarding connecting to a Global Distribution System, untimely and unsuccessfully. But in terms of setting the bar for future successes, invaluable.

A number of interactions occurred over the years that followed, particularly between myself and Dumani. The most significant in terms of American Butterfly were the request to utilise The Nelson Mandela Foundation as a place for the original 16 brands to pay a token payment.

Later having being shown the first version of the “POP” investment principle and the economics and business plans applied to Greece, Dumani’s advise to consider politics led to the work of Lee Chazen’s and ultimately the move from Europe and China to the United States.

A number of major initiatives have been considered for Africa, not the least of which is the “Special Project” “African Rain.” Early, light political dialogue may warrant some strategic advantages.

16. Greece: As mentioned within the general executive summary, the large scale consideration of cause and effect planning as is being currently demonstrated, came from an incite regarding Greece when considering the “Butterfly Effect.” At that time (August, September 2011) “The Spartan Theory” part two “Sparta Rises Again” was mid flow, centred on software and a Dubai scale development in Laconia, Southern Greece to be named “New Sparta, City of Science.” Which is now considered as the prime contender for the Global Network Capital.

In exchange for this title and the various other incentives as described within “Sparta Rises Again,” the Greek people would need to have a referendum and be asked two questions.

1. Do you agree in making Greek businesses legally obliged to use the network financial software, which will assist and fairly tax all?

2. Do you agree the Greek government should use the governmental network financial software?

Considering Greece’s main troubles are tax avoidance and prior governmental mismanagement, before even considering the possibilities of New Sparta, an overwhelming consensus would surely vote yes. And so the mathematics of POP will usher in a new age of prosperity. Greece can then transform itself back into a butterfly. That gives a positive effect on all that engage her.

If/when implemented and successful, there are plenty of countries with democratic systems that are concerned about government corruptions and would also vote in to the mathematics of the network on a governmental level. It is possible the governmental software will spread across the world faster than the S-World Virtual Network.

First of course one needs to create the software. It was earlier mentioned that the core software is currently earmarked for assistance by the US Cyber Command. However, alongside the core we require business software, CRM (Consumer Relationship management) and Network software which are integrally connected. Since the outset of “The Spartan Theory” it has been considered that Facebook should deal with the network side. Which may well include the Virtual Network, Microsoft the business, and Apple the CRM and organisational software. From this core all other tech companies would add applications and modules. Playing to everyone’s strengths and avoiding many potential patent wrangles.

Redirect: The concept of Greece and other countries using the software governmentally is secondary consideration, it seems to make sense. However, the priority is creating the software for the Network proper. Any approach to Greece would be better undertaken after Apple and Microsoft have been consulted.

17. The Clinton Foundation: When working on a business plan around the “Butterfly Effect,” from time to time, one looks to make opportunities from what would appear to be coincidences. Mid way through the plans for New Sparta, President Clinton gave a speech in which he referenced the 300 Spartan warriors from Greek Mythology. One would be forgiven for thinking “The Spartan Theory” was named after “New Sparta.” As it happened the opposite was true, Greece and New Sparta were considered due to the name of “The Spartan Theory.”

“The Spartan Theory” was a peace initiative aimed at Libya written on the 8th April 2011 as the 11th and concluding part of the original network summary. Like all points it was brief.

11. The Spartan Theory. (8/4/11)

In exchange for guaranteed NATO Protection, Libya destroys all weapons.

Sienna’s companies fund compulsory education for 16 to 21 year olds.

Education is geared towards environmental awareness and physics.

All students are rigorously tough martial artists.

If it comes to war again, 300 warriors will fight hand to hand.

In short the promises of networks and the benefits they bring in exchange for peace, with an additional consideration that as for each embracing country a grand capital network will be built. Where, maybe the previously non democratically elected rulers who still have significant love of the people might consider making that place their new home.

At the time of consideration there was enough belief that this was enough of a carrot. Which when added to whatever other incentives were already being offered, to gain and hold a cease-fire in Libya. To the point where pressure was put on Virgin in the form of an overly forced request for £1 million to be transferred to the Nelson Mandela Foundation, saw an end to relations. It should be noted, the business plan financials that had passed phase one suggested over $50 Billion within 6 years. At the time I was utterly broke, so this was quite a sacrifice.

From that day on, the work has a title and an added ambition. Peace could be achieved from the network and the theory about making it so became “The Spartan Theory.”

Due to President Clinton’s mentioning of the 300 Spartans, some research was done. As it would seem that of all the US Presidents, President Clinton was closest and fought harder for peace in Palestine than any other. Then so would appear to be the best consultant and enactor of possibilities brought forth from the Spartan Theory and the Network in general in terms of peace.

18: The Climate Reality Project: is symbolic of Al Gore and the fight against global warming which is currently the philanthropic brand leader, as it is considered the only such initiative that will see a global consensuses supporting with very little debate.

To understand the history of when and why Al Gore in particular was chosen, we need to go back to the 1st August 2010 and a promise made to Sienna’s Mother. The promise was to dedicate my life to raising money to help people. Half a year later with a business plan that was already projecting over $50 Billion in profits, I was in a position to keep that promise. The first consideration was to give 75% to good causes. But as the figures grew, 90% seemed reasonable. And the initial draught business plan to Virgin mentioned that I would like to see 90% of profit used for good.

Then came the breakthrough and what we now refer to as “Give Half Back.” I would give all profit to good causes and Virgin would give none. Virgin and all other companies, instead of seeing a profit split with an outsider, saw only goodwill for all the good that was being done. It was brilliant and indeed was the real start of “The Butterfly.” Maximising the benefits in terms of branding and PR from the initiative took a different type of business planning, the planning that is currently being expressed.

Shortly after, the concept was simplified down to me not taking any money for the creation of the network.

It was to be like the internet or penicillin, free to the world, with the provision that half the profits were used constructively. This, however, left one slight worry over enforcing such an action. With no control, what if the network was abused? It was considered I should hold a VITO over any spending over a certain figure, just in case. But what if I were to die, who would inherit the VITO to? After some consideration Al Gore was chosen and a letter written, which alongside most never got sent.

It was over a year later that research lead to the realisation that Al Gore was also on the board of Apple. Current consideration says, if it can be shown to Al Gore that with Apples assistance the network can bring an end to Global Warming, he would do whatever it would take to get Apple to assist.

19. The Bill and Melinda Gates Foundation: Despite their “must include” status, since the beginning of “The Spartan Theory,” Bill Gates and Microsoft have not had much of a mention. However, Bill Gates has been instrumental in most things. On hearing that Bill Gates does not donate his billions, rather he uses his billions to create more billions to and so he can help more as well as to create direct help via his foundation, this seemed like a clever form of philanthropy. The catch a fish, not give a fish philosophy.

And with the Give Half Back initiative, came the opportunity to explore this charitable model…….

23 Months on and we have “American Butterfly” and all associated benefits on paper, an evolution of the concept. But without the original inspiration there would be little chance of American Butterfly developing the way it did.

I hope Bill and Melinda get this and understand their part in its making and help take the project forwards from the foundation’s perspective and a Microsoft perspective.

20. Microsoft: Putting the creation of the core software to one side, the primary objective with Microsoft is for Windows to become compatible with S-World, Virtual Network and software (software that they will be in part creating). The purpose for this and the purpose for looking to embrace the S-World environment into telephones and Smart TV’s is to make the S-World environment the norm. When one opens up the computer, phone, device or put on your TV its there. Subtle or direct, but always there.

This way if the most accessible way to purchase or consider for purchase is via S-World, it will be the network companies, the environment, and to the people’s advantage every time a purchase is made. The midterm aspirations for the S-World environment has always been for it to become an evolution of the internet, very widely used.

To explain why Microsoft would want to do this we consider the pre Spartan Theory core affiliate business model, with a few upgrades. First to explain affiliate marketing, an example in travel. A real life example being implemented currently is www.experienceafrica.com, the system used. Simply create a website, brand, and create enquires for the accommodation and services. Then give that to one experienced local travel agent and split the profit. Far better service and save the small split in advertising costs and a little admin. Which would by rights be covered by the financial software. It’s an extremely profitable exercise for the person who made the brand system and website. As for ever more they will do nothing and receive 50% of the profit. For the agent it’s priceless, as before they were making far less and did not have the prestige of being the owner (For more see 1. The Virgin Business plan and 14. Facebook Travel on www.s-world.biz).

In travel the commission is usually around 25%, more for big players (not airlines). The system as outlined above would see about 10% of all money spent on travel as profits from the system. If we consider 50% of market share of $2 Trillion spent a year on travel (including business travel not including airlines) that equates to $200 billion in profits per year. Which go to the people that made the system? And that’s just travel. Add real estate, e-commerce, financial services sold on line, and pretty much half of everything that is sold in a year adopting the same slightly modified procedure. To suggest the pot would be over a trillion would pass most scrutinisers.

Not all this would go to Microsoft of course. For a start Microsoft will only be eligible for a slice if the user purchased from a windows source or used an application created by Microsoft. However, current thinking and online purchases would suggest more purchases are made from the windows operating systems that any other individual mechanism.

Often the slice would be split between various enablers. For example, a Google search engine leading to a product on a windows operating system would see a split of sorts. Many other smaller referring mechanisms could feature, for instance the computer or device manufacturer may well revive a slice, alongside if watching a T.V. the broadcasting company.

The complexity of the affiliate system aside with the option to make applications that generate profit and entangling Windows with the S-World environment. Microsoft has the capacity to generate great profit, and of course with great profit comes great good.

21. Apple: In Dec 2011 just before staring American Butterfly, at Heathrow Airport in London I picked up a copy of Steve Jobs’ Biography by Walter Isaacson. It has been a constant companion. Steve, or a picture of Steve looks over my desk every day. The influences and teachings were significant from the desire to have Pixar assist with the creation of the Virtual World, to the inclusion of Disney. The biggest influence was the development of the Facebook Stores concept. A concept that if Facebook is to be as successful at retail as we would all like will greatly assist not so much in the sales from the stores, rather the fact that they are there giving a physical side to the retail wing.

Apple of course via their dedicated computers, tablets, and phones would have as large if not a larger pool of persons who could potentially purchase via their devices and operating systems than Microsoft. And so it is equally desired for the S-World Environment to become entangled with Apple.

Another more immediate fact emerged whilst reading Steve’s Book. The number of members they had signed up who have paid for goods by credit card was in the region of 275 million. If we consider the figures for Facebook e-commerce were based on 85 million who would actually use the service as a starting position, and to follow a similar model is starting from a position of great strength. In assisting to build the software, Apple will be contributing to a devise that may well keep Apple as the world’s most financially successful company for many years to come.

“Root Four”

Root 4 starts under the pretext that the US government has in principle sanctioned the creation of the Network in the USA. The software, hardware, and Network devices are being created by a collaborated effort from US Cyber Command, Facebook, Microsoft and Apple. Alongside which any other dominions deemed useful have been activated.

As we look at the Butterfly we see three brands addressed by Facebook with the support of network partners. The three brands whilst important are significant to three industries. 22 Amazon: represents every technology company in the world. 23 Disney: represents every media and production company in the world. 24. Johnson and Johnson: represents every pharmaceutical and medical technology company in the world.

22. Amazon (and other technology companies): The rise of Amazon is a sold success story with all profits continually reinvested into infrastructure and devices. Amazon would seem to be by quite some way the world’s e-commerce leaders.

Of course the standard e-commerce opportunities as presented within the Microsoft and Apple dominos’ apply. However, it may be advantageous in terms of logistics and custom care for Facebook to consider some sort of partnership with Amazon re Facebook Gifts.

This logic also applies to other leaders in the field with good infrastructure in other territories.

Expanding further, it is desirable for all technology companies to work within a compatible format to the network. It’s not easy to find technology profits as a percentage of GDP. But with the world’s leader Apple on $7 Billion per year, it’s probably less than a few trillion a year. If we move to the 2040’s network specifications and profits, it would have for the best part become what we now know as GDP. It would have been accelerated by the RES equation, whilst inflation was kept at bay by the Suppliers Butterfly.” It’s a really tough call to predict but maybe we would be in the region of $225 trillion GDP (Un-inflated). Which is about the equivalent of everyone with money having twice as much and everyone without money having money.

Of that 225 trillion, in one way or another be it Facebook Gifts, S-World VBN or a random technology company that made an application; that encouraged a sale 10% maybe 25% of that $225 trillion GDP will be in created as revenue for the affiliate pot. At a minimum $25 Trillion, of which as the bulk of operations are affiliate and so most of the revenue will be profit. So in theory, the technology companies in existence today can make 10 fold their expected annual profit by creating devices and applications for the network.

That’s the big picture, the long view.

23. Disney: represents all media and production companies, in part representing all sports and arts. If we look at the figures for Angel Pop, as presented within point 7 of SUSY similarity, we see that the funding for Sports Media and the Arts are significant at $250 million per network. It is more than has been allocated to alternate energy.

This was initially created out of necessity. The necessity, if necessary, to have the financial power to buy the sector. As if one controls what will be seen on a device, one to a degree has control over the device manufacture. It is essential that the S-World environment, in particular S-World UCS, is as widely available as possible. It is essential for the guaranteed successful implementation of the network. More to the point, it is essential for “The Spartan Theory” and all ecological and philanthropic endeavours. It may be considered a bullish tactic, however, there is too much at stake to risk it. The money needed to be made available, and it was, certainty needed to made a result one way or another.

But like a nuclear deterrent, one does not make such a weapon without any intent of using it.

And there is no need to. By including the media and production companies, sports teams, music and art companies within the affiliate share from the system, and in general assign money from the Economic Stimulus as sponsorship, all stand to make far more money than they currently do. And the money can just go to creating a lot more productions and sponsorship of amateur leagues across the globe to encourage the world into fitness.

As for Disney specifically, well of course there is the Steve Jobs connection. But well before, on the 1st May 2011 Anthony Rauba, the man who introduced String Theory to the project in the form of our S-World PQS (Predictive Quantum Software) mantra, Assimove’s ”Psychohistory”: “You may not predict what an individual may do, but you can put in motion, things that will move the masses in a direction that is desired, thus shaping if not predicting the future” alongside this founding pillar of network science, Mr. Rauba also recommended Disney as a company worth talking to.

Finally, of course, there is the matter of Disney owning the rights for Star Wars.

24. Johnson and Johnson: representing the pharmaceutical and medical technologies companies and la Pièce de résistance of Pressure of Participation network planning.

In time the network will hold or be partnered with companies that hold 90% of the worlds pharmaceutical and medical technology patents. To paraphrase Luke Skywalker: “The pharmaceutical companies can either profit from this, or be destroyed by it.” Unlike the sports and media initiatives, there is no intended bluff. It is essential as the network is responsible for world health for all that cannot afford it and can only be truly efficient and effective in a controlling position.

With a dedicated research and development team budgeted for in each network and a city of science planned for each of the 8 continental network cubes; when it comes to research and development, in any quarter, and in particular pharmaceuticals there will be no competition, only allies.

Any pharmaceutical company that ignores the network will have a short life span. However, like the media companies and device manufacturers, the pharmaceutical companies are allowed to invest into the technology sector and have the opportunity to diversity in the way considered for Man City and Chelsea football clubs; imagine Pfizer Travel, Glaxo industries or Johnson and Johnson Retail. At the end of the day, it’s the shareholders that have the sway. And if an offer is presented that increases shareholders net worth and dividends, they will vote yes. So that’s the challenge.

Johnson and Jonson are the obvious starting place as most of their patents run out next year. Income from patents will not be their major revenue, not by far. We are looking for patent free usage of all their pharmaceuticals for Medicaid Medicare, other western equivalents, and in general across the third world. In exchange, opportunities greater than their losses will be presented. Alongside this comes the opportunity of great brand appreciation, as the public like their contribution.

The exercise will require a dedicated Pressure of Participation Butterfly. But the result, after much dealing would be instant. Possibly within 6 months of American Butterfly publication 50% or all pharmaceuticals could be made patent free. A running start for the networks ambitions.

“Root Five”

25. Chelsea: I hope in the not so distant future, I will have created the S-World Network and given it freely to the world. At this point, to a degree my obligation, my promise will have been kept.

This does however leave me penniless. And so it seems appropriate to join all the other network money hungry maniacs in the early land grab. As for whatever I would earn, I will have automatically given half back, American Butterfly and The Spartan Theory are a far more karma driven capitalistic exercise. Plus, having designed the system, I would obviously be quite good at capitalising on it. And as others would follow I’d make even more for the karma kitty simply by becoming rich.

My trouble is negotiating. I have a tendency to get over excited. I trust everyone and I have a habit of giving things away for free. So I need a tough business partner to do the negotiating on my behalf. And after due consideration Roman Abramowitz is currently the front runner.

It helps a little that I was born in Belgravia and Chelsea is my local team. It also helps that history supports this initiative as when analysed alongside Man City, Chelsea was considered as the first physical network.

The concept would be to create a dedicated network, branded appropriately. I’m currently considering Chelsea Galactic, where after the general idea is to make a s*** load of cash.

Chelsea and Roman Abramowitz are also symbolic of a move into Asia. Within “Sparta Rises Again” China has a significant role to play and still does. Chelsea Galactic alongside western markets will look to the East.

Part 5. Threats

Population Growth: The greatest threat for the network in its success would be population growth. This issue has been a continual source of concern. Currently, this issue is addressed within S-World PQS. If one considers the virtual network, with Facebook and other social and business network members meeting in a Sims Environment with everyone trading within it, one has a very simplistic version. Consider further that all network events from the creation of a new resort network to the purchase of a beverage from a network restaurant are recorded within the S-World UCS database. For all intents and purposes, S-World UCS is the network, with most events available via a 3D simulation and databanks available for analysis by all.

With this simulation we have the ability to make duplicates. And either place them in the future, or have them sent slowly into the future at a pace faster than our own. The business connotations are immense, businesses learning from mistakes and seeing opportunities in the future before they actually happen.

The day to day network will to an extent appear to be a game, an income source and an educational and social devise. Given success of the network it is expected that many of the people born this century will use S-World UCS on a daily basis. Like Facebook and LinkedIn, just virtual and income generating.

In the game, the future UCS and PQS simulations called “Voyager Simulations” will predict various futures, which will be effected by various population levels. Current thinking considers the most probable future in 2049 will see the world’s population at plus 10 billion and the network all encompassing, with the global currency largely seen in terms of network credits. At this point in time however, as a necessary measure; education, medical and carbon resources debits will be made from bonuses of all network employees for child costs.

Implemented now such a measure would cause outrage. However, having grown up for 36 years knowing it was coming and accepting the economics behind it, it will just be the norm. In short the majority of people who are capable of having children will be well aware that in the future, if the world’s population increases past economically comfortable numbers with bonuses and profit share expected to be around 80% of an average salary, those that chose to have many children will be severely economically limited.

Of course with the network championing education and in particular physics and ecology, it is hoped that the world will become more aware of the risks of overpopulation and such a scenario will never happen. However, if it does, having grown up knowing of the potential costs, it will not be seen as an unfair tax. Rather, simply how it was always going to be.

Facebook Gifts: The launch of a product like Facebook Gifts, before American Butterfly is presented to Facebook would be highly inconvenient. Especially as it would dissipate some of the goodwill associated.

Rival Networks using POP mathematics: The POP Investment principle is a sure-fire money spinner, for all intents and purposes the direct opposite of a pyramid investment. It is highly probable that others would adapt the mathematics for their own benefits leaving out the “for benefit” ecological and philanthropic contingents. To a fashion, this is acceptable as an increase in financial efficiency creates accelerated wealth for the users and the tax man, as such an economical improvement.

Such actions also create independent networks that are compatible with the mathematics of the S-World Network, so potentially opening the door to future affiliation. Particularly if we see a scenario where more companies wish to join the S-World Network that can be accommodated at any particular time.

Under such circumstances, the creation of mathematically compatible networks would be encouraged.

Companies losing out to the Network: The network runs primarily on a profit vs. revenue approach. This is needed to create the amount of profit necessary to accomplish the economic, ecological, and philanthropic ambitions as presented within “American Butterfly.” It is inevitable that a number of large revenue based companies will eventually lose out to the efficiency of the network. Which to a fashion is the point, however some or indeed most such revenue based companies employ a lot of people and via payroll and sales tax contribute significantly to their governments tax yields. There is a fair argument that for each revenue based company that went down, the employees and sales would go to various network endeavours; however, this is far from ideal.

For this reason, alongside the consideration of an accelerated growth model for the network, the consideration of “Independent Networks” has been placed firmly within the network design. Until experts in big business are available to contribute, only the basic principle is outlined. The principle being that any large company can over time integrate into the network. The first consideration, the usage of the software once created and the usage of the network for its supply and distribution.

A further consideration suggests that companies can join the network from a supply and distribution perspective only, with a long term view to integration. However, as one of the key factors to network company success is in guaranteed orders or economically stimulated extra orders, products available from “affiliate” not “partner” business would need to be subject to a network mark-up. The profits used for further economic stimulus.

Give Half Back Misconceptions: As mentioned at the beginning of Facebook FC, half of Facebook’s profits will be used to pay for dividends, staff profit-share, economic stimulus actions (Sports, Media, Arts, S-World UCS), operations, medical liabilities, or the purchase of reusable energy sources. This action is desired for all companies on the network. So if we consider our sample manufacturing company “The Window Factory,” which took a vulnerable small company making zero profit and boosted its profits to $129 million by 2036, in effect The Window Factory will have only generated $64.5 million (alongside the owner receiving substantial dividends and gains due to the Locations Butterfly and new businesses created).

Considering “the story” an easy misconception would be to consider the “Give Half Back” action as simply the original idea that the creator of the system has given his half back. This action was deemed unworkable within the preparatory chapters of American Butterfly and reworked targeting specifically the medical liabilities and renewable energy requirements.

However, with the creation of the RES equation (point 3 of SUSY Similarity) and the need to make large funds available for the Sports and Media initiatives, the mathematics supported the conclusion that the reinvestment of 50% of profits, largely in terms of network credits to be spent within three months; generates a continuously expanding economy. And as such, all companies on the network would be more profitable for it.

Big Brother, 1984: Having checked various definitions of Civil Rights, at no point does the network design come close to impeding them, indeed quite the opposite. However, the definitive large organisation that is the-network-in-planning may be seen by some as George Orwell’s 1984 Big Brother state in the making.

To this argument, instead of arguing, maybe it’s best to concede the point and suggest better the angel you know than the devil you don’t. Virtual and simulated universes or versions of earth are coming in the future. However, with the S-World network transparency in dealings is as democratic as possible. As in many occasions it will be the general public via S-World UCS that define the actual network.

On this same time, once again, it’s worth considering the benefits of the network in ecological and philanthropic terms.

To sum up, yes, the network does intend to bring people and businesses under one roof and at times encourage the general populous into healthier and more ecological lifestyles. But that’s pretty much it, there is no greater control desired in any way, indeed any such control would be counterproductive.

Energy Companies Backlash: If the world spends 10% of its wealth on energy each year, in GDP terms we would be looking at a sector worth $7 trillion. Which whilst not conclusively researched, sounds a reasonable estimate. Whatever the actual figure, it will be a big figure. And as such an initiative that looks to illuminate carbon energy usage by the mid century, unchecked, one could anticipate quite a backlash.

If an energy company does not see American Butterfly fulfilling its carbon ambitions, then such companies would have no reason to create a backlash. However, for those that do, during the planning for American Butterfly a separate investment model was created for energy companies. Which saw them invest and profit from the creation of the various sources of renewable energy to be created. In the short term, it is more financially taxing than the average investment, but profitable by the mid-term and highly profitable in the long term.

This point aside, considering flight, space flight and performance vehicles, and the abundance of coal in the East; the idea of illuminating carbon fuels by the mid century is highly unlikely. A sensible target would be to aim to reduce usage by 75% and increase the creation of oxygen. Oil and Coal are by its very nature not renewable. In effect, slowing down its usage is in the long term is a wise investment for the countries that have the recourses. As countries that rely on such recourses for their development would see catastrophic economic conditions thrust upon them when their main income source is depleted.

Pharmaceutical Companies Backlash: The safety of the author aside, the main concern of a pharmaceutical company’s backlash would be the slowing down of research. The idea that the network has the research capacity to match and increase that of the current marketplace does not consider the free market and the acceleration of development caused by basic capitalism. Removing that incentive could have negative consequences.

To this we need to consider the market now and the market that will be in the future, if the network is successful. The network does not advocate or support a UK styled National Health Service, rather a US based Medicare and Medicaid model. Where those that can afford to pay for health insurance do so. As it is the network’s ambition to bring the entire world above the poverty line with the exception of retirees, ultimately if successful, the network will have sizably increased the market for paid prescriptions and medical technologies.

This point is in addition to the current initiative to place pharmaceuticals who wish to join and invest in the network within the “priority members,” offering greater share options and profit share from “system profits”.

Key man retirement: The author has no intentions of retiring, indeed has barely started. However, sometimes retirements are not voluntary. As things stand right now in such an event the five parts of American Butterfly: “The Theory of Every Business,” “Superstring Economics,” “The Network on a String,” “The Butterfly,” & “Quantum Time” when backed up by supporting files and the www.s-world.biz website contain enough information for the network and economic science to be created and implemented.

The largest problem would be within the creation, and in particular the simplistic presentation of the software. Without consultation as well as the knowledge of exactly which companies will be assisting in its creation and which patents can be utilised, there is currently not enough information to build the software to the specifications desired without the input of the author.

Monopolies and Mergers: Add Section

Open markets: Add Section

Part 6. Weaknesses

Logistics: Even at the significantly decreased initial roll out of 256 US Network, when considered globally, a tally of 1,024 networks in some process of development or at least planning is desired by the end of 2014.

In any ordinary scenario, such a target would be either logistically impossible or at the best prone to many areas of error, or “could have done it better” hindsight. Where-after the creation of the Global Network Cube and Satellite Networks is planned to reach a number in the region of 50,000 by the mid century.

Fortunately, S-World UCS and S-World PQS deal with all logistical issues, in such a fashion as to enable the network creation efficiently within the time scale (so long as the product is created in time).

No Product: currently there is not a workable S-World product or software. Just the specifications of what is required, and some old prototypes that are of no current use. In short the product needs to be made from scratch.

Initially, looking back to the creation of “The Spartan Theory” a meeting with a company with regard to business software development lead to the opportunity to utilise a Virtual World product. Which had seen $200 million in development for next to nothing as it was a VC project that ran out of funding. This opportunity is I’m sure still active. However, in terms of Virtual Worlds there seems to be no substitute for adapting the SIMS and SIM City products. This consideration highlighted by their inclusion within Root 1 of the Pressure of Participation Butterfly.

As for the business and financial software, again there would seem no reason to re invent the wheel. A few additions yes, and of course the linking to financial institutions. However, the base business software created by Microsoft could be adapted nicely to serve the purpose. Facebook of course have developed significant and highly popular networking software and the US Cyber Command have proficient security and probability software.

For the first roll out, in terms of “getting it done” and having a workable product made within a year or preferably half, this type of pick and mix of available technologies to a degree may serve the purpose.

However, when it comes to the creation of the product proper, it is highly probable that all involved agree it is best to start from scratch. Build a purpose made model that in time can supersede the workable combined product.

To put a time scale on this, within the point 14 of SUSY Similarity which describes the S-World PQS (Predictive Quantum Software) includes the creation of a dedicated future “Voyager Simulation” for the year 2049. It is currently considered that this simulation will be ready for launch in the latter part of 2017. So in essence three and a half years to create the products most complex contingent.

Before even considering the creation of the “from scratch” S-World product, consultation is required with Dr James Gates with regard to Supersymmetry within the code, computer languages, and in general the work done over the last decade regarding Supersymmetry and physics of all kinds within simulated universes.

Redirect: However, the core software is initially created and further redeveloped. The basic principle of applications and functions being added to it in a similar way to the current usage of Facebook and computers and Cell phones is to be replicated. It is generally desired for the vast majority of the S-World System to have been created by the many technology companies affiliated to the network, not the core few involved in the initial system creation.

No on line visual stimulus: Currently with the exception of the www.s-world.biz website and the www.AmericanButterfly.net websites there is no screen visual stimulus.

Here and now, American Butterfly would benefit significantly from a visual DVD demonstration for potential partners to watch, at their pleasure. At a later stage, the general public will also benefit significantly from a visual medium telling the story, both online and via broadcast.

Planning for such products should be started shortly after the mathematics is verified.

Grammar: Before considering a DVD demonstration the grammar and wordage within American Butterfly and particularly within the website www.s-world.biz needs great attention.

Fortunately to an extent assistance has been given in regard to the work presented thus far. However, the work is far from perfect and requires the assistance from technical and creative editors. At the same time a DVD script can be created.

Big Business Considerations: Having minimal personal experience with large corporations is a weakness in itself. However, once those with experience have contributed, it is expected that the benefits will outweigh the negatives. To qualify this, we need to consider opportunities within this point of weakness. Specifically, the opportunity to add new profit centres to network profitability.