The Peet Tent

By Nick Ray Ball March 2016 to November 2017

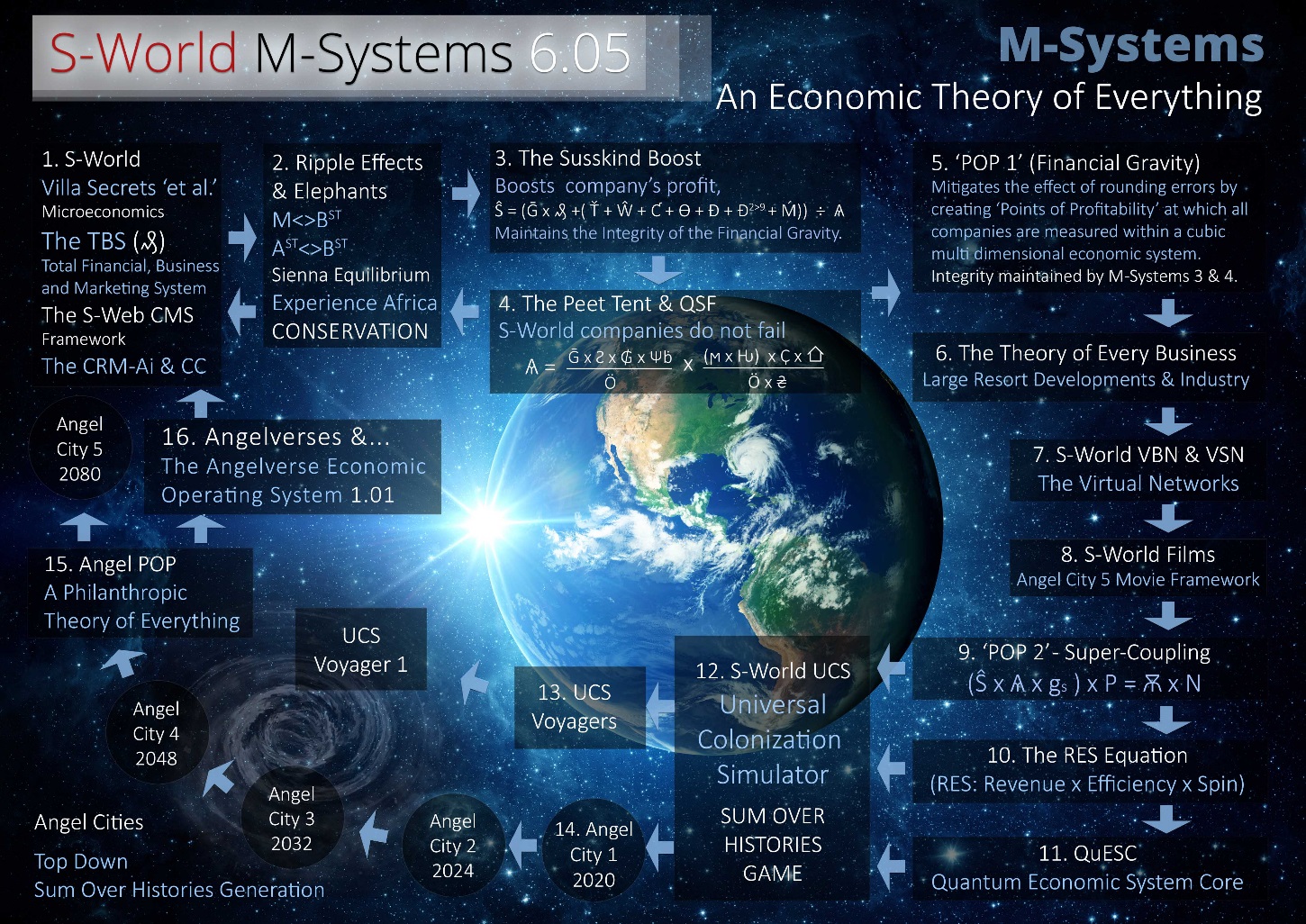

M-Systems 4. The Peet Tent (V4.03b2)

URL: http://www.angeltheory.org/m-systems/4/the-peet-tent

By Nick Ray Ball 30th March 2017

Part 1. The Peet Tent, MCQPS, & QSF

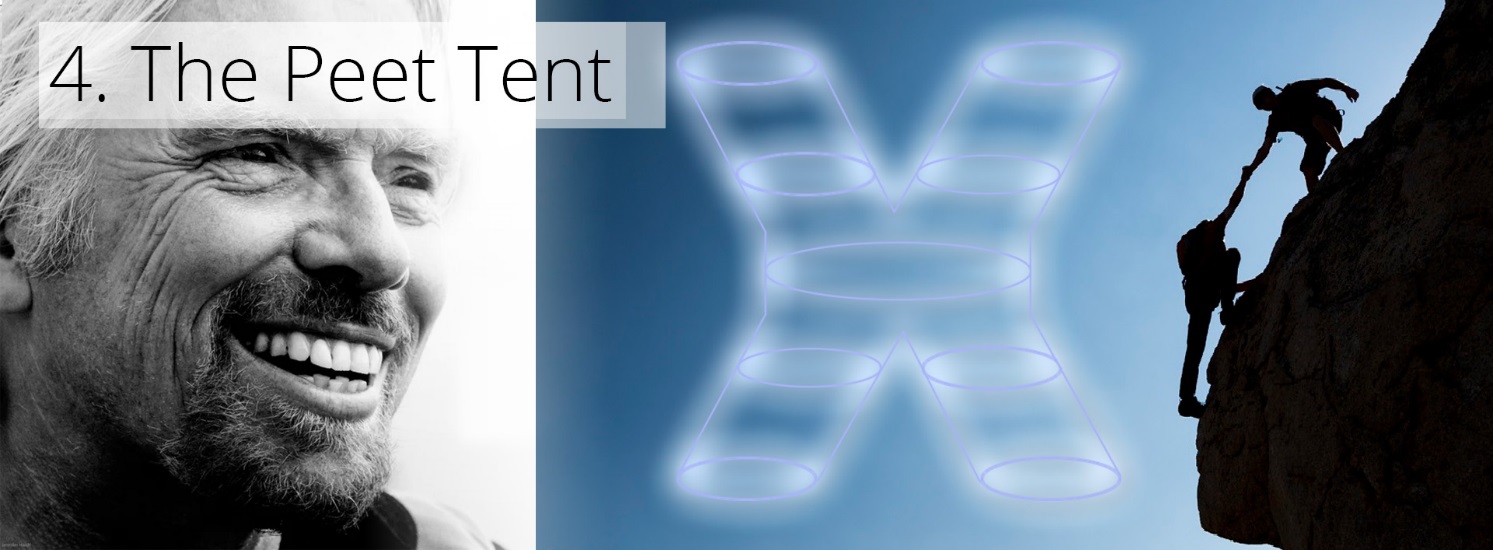

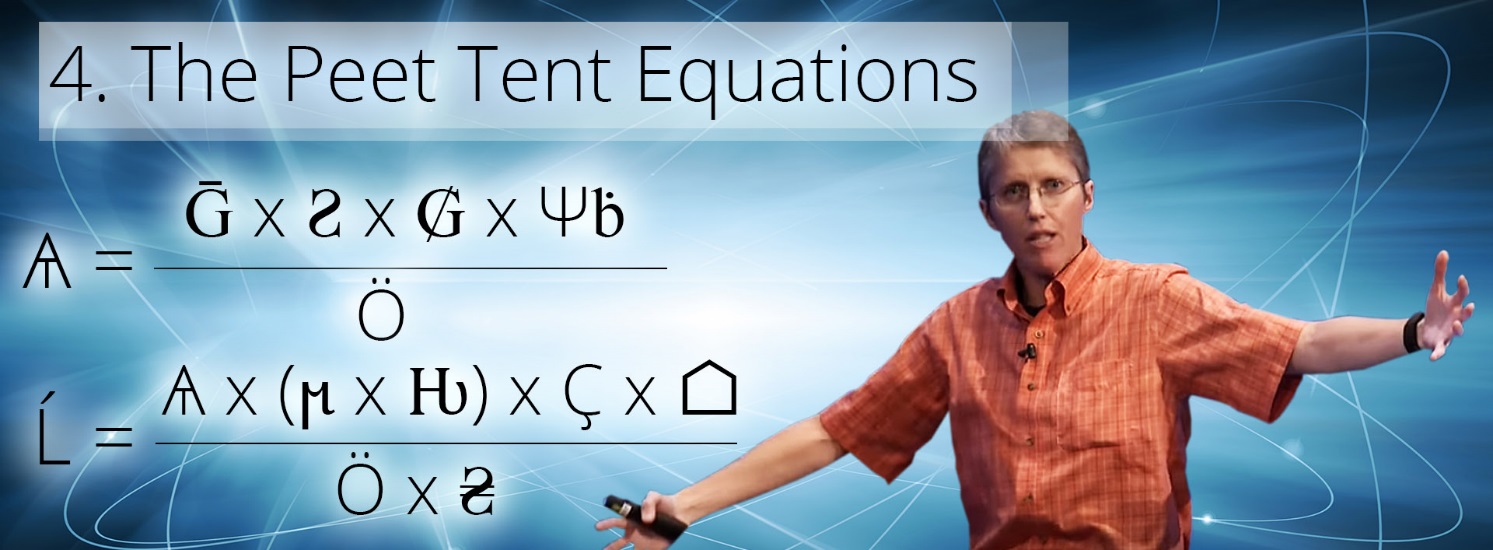

In 2012, ‘The Peet Tent’ was first inspired by Dr Amanda Peet’s lecture String Theory for the Scientifically Curious, in which Peet presents a string version of a Feynman diagram and explains how this makes string theory very economical. But how can we simulate this within the S-World Network’s financial framework?

http://www.angeltheory.org/m-systems/4/the-peet-tent-_-quick-summary

Part 2. Peet Tent Due Diligence

With the String Feynman diagrams simulated within the S-World Network’s financial framework simply by making S-World (The GGW String) guarantee companies liquidity, the question changes to… ‘Can S-World afford to do so?’

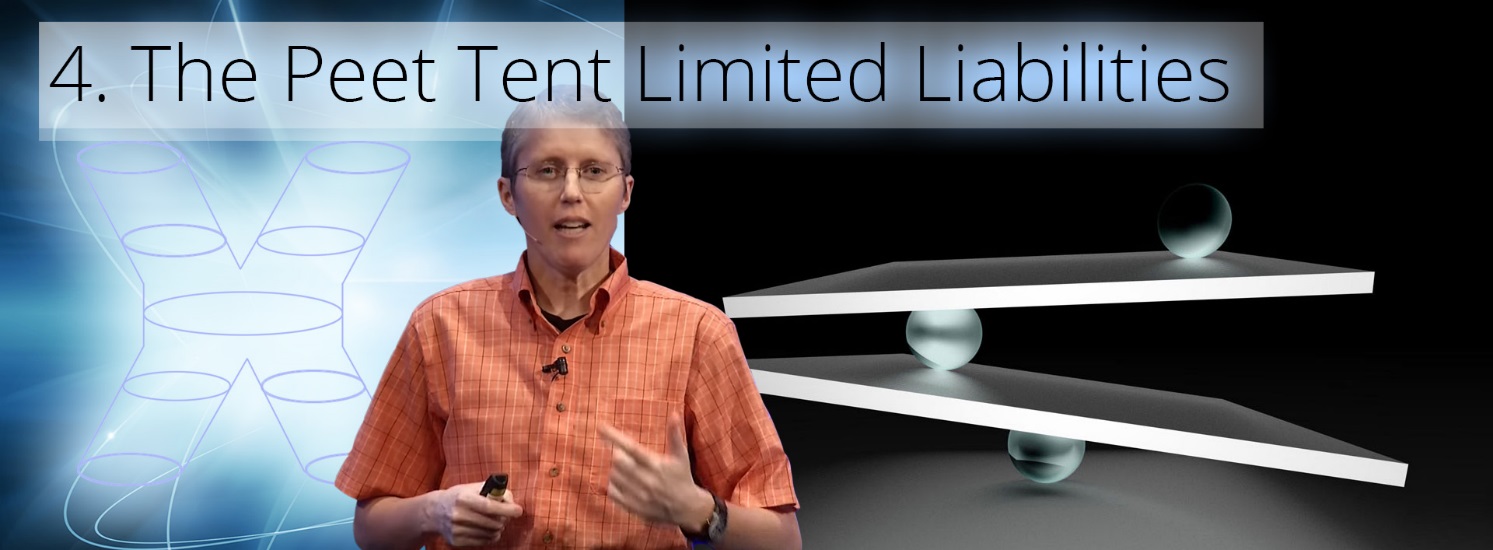

Part 3. Peet Tent Limited Liabilities

At this stage, before S-World is massive, we can’t create a complete Peet Tent; certain limitations need to be made in case of legal actions on members, members fraud, staff fraud, company directors not working for the company, and other limiters. But in general, if one follows the operations manual, a company is safe and will be protected.

Part 4. Quantum Safe Forecasting (QSF)

Of course, picking only companies with a high probability of success in the first place is careful due diligence in its own right. For this, I am developing what I call ‘Quantum Safe Forecasting,’ which simulates some basic laws of quantum mechanics, and acts as a limiter within financial forecasts.

Part 5. The Peet Tent Equations

The Peet Tent & QSF then combines some industry realtered boosters and limiters to its forecasting, which can be summed up in the following equation.

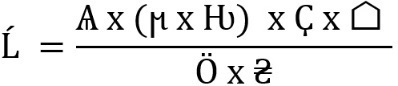

Part 6. The Peet Tent – System Architecture

Once all the boosts and limiters have been calculated, a score is calculated, companies with high scores go on to M-System 5, and companies with lower scores go back to System 1, 2, or 3 and start again creating an improved strategy.

M-System 4. The Peet Tent, MCQPS, & QSF

Influencers: Dr Amanda Peet – R Feynman – L Susskind – S Hawking – E Witten – Sir Richard Bradnson

# String Theory / String Feynman Diagram / M-Theory / Quantum Mechanics / Uncertainty Principle

In 2012, ‘The Peet Tent’ was first inspired by Dr Amanda Peet’s lecture String Theory for the Scientifically Curious, in which Peet presents a string version of a Feynman diagram and explains how this makes string theory very economical.

I thought, If I could translate that into S-World economics it would surely be significant. At the time, I added a new section to the 3rd American Butterfly book ‘The Network of a String,’ but I did not fully appreciate its significance. (Please note that an explanation of the physics of the String Feynman diagram is presented within M-System 0. The GGW String.)

It took three years for me to come up with a suitable simulation within the network design. The point that Dr Amanda Peet is making is elaborated in her more recent lecture String Theory Legos for Black Holes. As the vibrating loops of strings do not have specific points, they could accept any variety of result. This is, in fact, how string theory unifies general relativity and quantum mechanics. Peet describes the jittery results of quantum mechanics unifying with the smooth results of general relativity by string theory creating a big tent for them to sit under. This effect is also presented by Professors Susskind, Greene, Witten [2]& Hawking (in Chapter 2)

The Peet Tent took quite a bit of thought within the microeconomics, and required the creation of the GGW-String. Or to be precise, the idea of the GGW-String was a result of the Peet Tent. The answer, in the end, was simple. One just changes the shape of the GGW-String to emit enough capital to boost any company result that was not sufficient. Given that there is enough money in the network, all businesses that correctly used the system are safe… permanently, which amongst other positives would make it easier for banks to loan companies start-up funding at low interest rates.

Added to the Peet Tent was the MCQPS (Monte Carlo Effect Probability Software) and what I have labelled QSF (Quantum Safe Forecasting). QSF adapts the Heisenberg uncertainty principle to tell us that one can increase the probability of achieving a set gross profit target at a point in the future simply by lowering the gross profit forecast. And that we should consider doubling the uncertainty when we double time. The MCQPS tells us that for each expected reaction, we should always pick the lowest probability, as we now do to all TFBMS forecasts (1, 2, 3). Collectively, when used to create financial forecasts, QSF & MCQPS help to make sure that a company will not get in to trouble in the first place. This was further assisted by limiting liabilities and some industry realtered boosters and limiters, as are collectively presented on the following pages.

M-System 4. The Peet Tent Due Diligence

Influencers: Sir Richard Branson – Dr Amanda Peet – R Feynman – L Susskind – S Hawking – E Witten

# Business Networks / Accounting Software / String Theory / String Feynman Diagram / M-Theory

With the String Feynman diagrams simulated within the S-World Network’s financial framework simply by making S-World (The GGW String) guarantee companies liquidity, the question changes to…‘Can S-World afford it?’

There are a number of considerations regarding affordability, but first a little history. Before starting S-World in 2011, while researching the Virgin network, I noted Sir Richard Branson mention that the Virgin Network is a network of different companies (as is S-World). But in the case of Virgin, (and most such groups) if one company failed, it was detached from all others, so all others were safe. I completely understand why and without an equivalent of the TFMBS (Total Financial, Business and marketing System) this is the only sensible way create such networks.

However, as we have the design for the TFBMS and its financial component The TFS (Total Financial System) can be created quickly once we have some members, all companies in the network will disclose all financial transactions on a tri-weekly basis, to be displayed in various different ways: management accounts views, network overview, winners and losers, projections vs actual etc. etc.

Prevention is better than cure…

S-World financial department will be warned the moment a company falls behind their target, and it will be flagged. As months pass, if the company is still behind target (but still profitable), it will receive additional boosting such as new websites, PR, changing to higher ROI advertising strategies, exclusive stock opportunities, offering prime positions in S-World magazines, and other promotional materials. The idea being, per the Susskind Boost, to always boost the weakest companies in a network, as so all companies stay profitable in the first place. The next step if a company is still behind target is to use their S-World GGW-String contributions, being used directly for boosting its own company. And finally, as a last resort, we shall see GGW-String income from the collective used to boost a failing company.

GGW-String income is between 2.5% to 5% of turnover. And in the travel industry, one can buy failure insurance for between 1% and 2%. However, this is with the insurer knowing next to nothing about the financials of a company, and without companies being boosted prior to failure. So, we should really be thinking of a cost of 0.1% to 0.3%, which can be afforded, given the following exclusions.

M-System 4. The Peet Tent – Limited Liabilities

Influencers: Richard Feynman – Dr Amanda Peet – L Susskind – S Hawking – E Witten – Sir Richard Branson

# Law / Accounting / CRM / HR / String Theory / M-Theory / Quantum Mechanics / Uncertainty Principle

At this stage, before S-World is massive, we can’t create a complete Peet Tent, and certain limitations need to be made in case of legal actions on members, members fraud, staff fraud, or company directors not working for the company.

1. Legal Action Against Members. In this case, S-World will provide legal assistance, and good legal assistance. But it will not be liable for any pay out. If the S-World legal team lose in court and the company owners can’t pay the damages, the company will fold. So, making a lawsuit against an S-World company is the definition of a frivolous lawsuit.

2. Members fraud. Every financial action that involves the business must be recorded in the TFS, (Total Financial System). If this has not happened and as a result the company is in financial trouble, it will be detached from the network. (Note that stage 3 of the TFS development sees automated banking with all supplier payments made as soon as the money hits the bank; and with all suppliers paid, most of the damage that can be created by fraud is avoided.)

3. Staff Fraud. One sure way to lose money is if staff do ‘outside deals,’ where an enquiry for a company is converted privately by a staff member (this can happen in small companies). To severely limit such behaviour, we have the Disruptive CRM (consumer relationship management). I am creating the CRM specifically, so all enquiries are logged and tracked, and clients who do not book will have communications once the deal is cold; asking how we could have done better, so deterring staff from making ‘outside deals,’ as the clients will be aware that an S-World company did not receive the booking.

This point is greatly assisted by our equity partner vs staff ratio; making top sales people equity partners and ensuring that all staff are monitored and are part of the team.

For more on this, see M-System 9 POP Super Coupling.

4. The Company Directors Not Working for the Company. This happens, but if it does, the directors will need to forgo their equity. If a company fails due to lack of attention, it may be protected, but its ownership will be changed.

M-System 4. Quantum Safe Forecasting (QSF)

Influencers: Dr Amanda Peet – Stephen Hawking – Leonard Mlodinow – R Feynman – E Witten – L Susskind

# String Theory / M-Theory / Quantum Mechanics / Heisenberg Uncertainty Principle / Monte Carlo Method

Of course, picking only companies with a high probability of success in the first place is careful due diligence in its own right. For this, I am developing what I call ‘Quantum Safe Forecasting’ (QSF), which simulates some basic laws of quantum mechanics and acts as a limiter within financial forecasts. Our source for this exercise is the 2010 book The Grand Design by professors Hawking and Mlodinow…

“According to the uncertainly principle, if you multiply the uncertainty and the position of a particle by the uncertainty in its momentum (its mass times velocity) the result can never be smaller than a certain fixed quantity, called Planks constant.

That’s a tongue twister but its gist can be stated plainly: The more precisely you measure speed, the less precisely you can measure position.”

From this we simulate as follows: Momentum = Profit, and its position is a position in time, such as 1, 2, 3 or 4 years.

To increase the probability of making one’s financial target, one simply needs to lower the estimated forecast. In the Villa Secrets forecasting scenarios 3, 4, & 5; the agency income is based on real world gross profit of $110,000, but instead I used $85,000 for the forecasts; and obviously by doing so, I increase the probability of the forecast being above the forecasted target.

A second exercise is in when forecasting for 2, 3, and 4 years; to double the uncertainty each year, so if in year one we have a 20% uncertainty, in year 2 it will be 40%, and in year 3 it will be 60%, and the year 4 projection will have an 80% uncertainty.

Lastly and very importantly comes an exercise inspired by Monte Carlo Method physics, which has been a part of the process since 2012, and an original component of the PQS (Predictive Quantum Software) which until mid-2016 is the original name for M-Systems.

We simulate the Monte Carlo Method in by the TFBMS software, where each of the 43 different systems has a low and high forecast of its effectiveness. But when creating forecasts, we always use the low forecast for all systems.

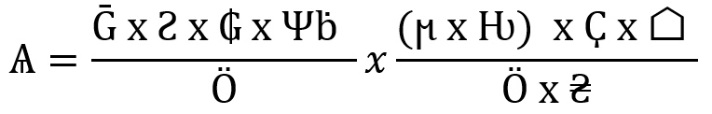

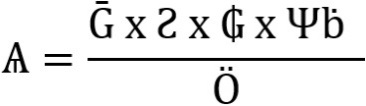

M-System 4. The Peet Tent Equations

Influencers: Dr Amanda Peet – R Feynman – L Susskind – S Hawking – E Witten – Sir Richard Branson

# Business Science / String Theory / M-Theory / Quantum Mechanics / Uncertainty Principle / Accounting

In addition to QSF, The Peet Tent also applies some industry realtered boosters and limiters to its forecasting, which can be summed up in the following equations.

Ѧ = The Amanda Stretch

Ḡ = Gross Profit ($270,000)

Ƨ = 80% (First Year Jitters) (QSF)

₲ = 60% (Limiting Variable, made to increase probability of each forecast) (QSF)

Ѱḃ = 85% (Disasters and ELEs Renormalized) (QSF)

Ӧ = Operational Costs, which is $117,000

Ѧ = $270,000 x 80% x 60% x 85% = $110,160

($270,000 x 80% = $216,000.00 x 60% = $129,600.00 x 85% = $110,160.00)

Ѧ / Ӧ = $110,160 / $117,000 = 94.1% A good score, as I have used very high limiting variables.

| Ĺ = The Location | Hawaii |

| Ѧ = The Amanda Stretch | 94.1% and $110,160 |

| ϻ = Market share | 1000% (As the market is 10 times bigger) |

| Ƕ = Manual Override Limit | 50% (Added as caution due to large market) |

| Ҫ = Competition | 200% (As there is less competition) |

| ⌂ = Accessible Stock | 25% (As access to the bulk of stock is uncertain) |

| Ӧ = Operational Cost | $117,000 |

| ₴ = Operational Cost Variable | 200% (Increase if operational cost more in richer locations) |

Ĺ = $110,160 x (1000% x 50%) x 200% x 25% = $275,400 / (117,000 x 2 = $234,000)

$275,000 / 234,000 = 117.5% (An excellent score)

Ideally, if we have 1000 applicants, the 100 best performers move forward, and the rest start again.

We see this journey pictured on the next page.

M-System 4. The Peet Tent – System Architecture

Influencers: A Peet – R Feynman – L Susskind – S Hawking – E Witten – P Allen – B Gates – M Zuckerberg

# M-Theory / Software Development / Economic Strategy / Business Science / Conservation / Equality

Once all the boosts and limiters have been calculated, a score is calculated, companies with high scores go on to M-System 5, and companies with lower scores go back to System 1, 2, or 3 and start again creating an improved strategy.

Below, we see this process in the M-Systems system architecture, currently this is a manual process. But, in time (and quicker time with assistance from Silicon Valley philanthropists backing), this process will be mostly automated, with the best strategies presented within M-system 12. S-World UCS tutorial game. So, it is simple for applicants to experiment with different strategies. And later still, the entire system architecture will work as a single unit, providing best strategies to new users and various strategies and scenarios to existing users.

The Peet Tent & Quantum Safe Forecasting

From American Butterfly Book 3 ‘The Network on a String,’ The Peet Tent is a shape of the S-World string that protects companies from failure within the network. QSF or ‘Quantum Safe Forecasting’ borrows from the Heisenberg uncertainty principle, making safer forecasts.

Here is an example of the Peet Tent which includes 3 different limiting variables, inspired by quantum mechanics. Hence, we call this ‘Quantum Safe Forecasting’ or ‘QSF.’

The initial forecast ‘N x gs x Ŝ x = Ѫ’ creates a first-year estimate of $270,000 shareholder profit. So…

Ѧ = Ḡ x Ƨ x ₲ x Ѱḃ / Ӧ

Ѧ = The Amanda Stretch

Ḡ = Gross Profit ($270,000)

Ƨ = 80% (First Year Jitters) (QSF)

₲ = 60% (Limiting Variable, made to increase probability of each forecast) (QSF)

Ѱḃ = 85% (Disasters and ELEs Renormalized) (QSF)

Ӧ = Operational Costs, which is $117,000

Ѧ = $270,000 x 80% x 60% x 85% = $110,160

($270,000 x 80% = $216,000.00 x 60% = $129,600.00 x 85% = $110,160.00)

Ѧ / Ӧ = $110,160 / $117,000 = 94.1% A good score, as I have used very high limiting variables.

Or one can simply minus the operational costs from the QSF forecast.

Ѧ = Ḡ x Ƨ x ₲ x Ѱḃ – Ӧ

$110,160 – $117,000 = -$6840 Which is acceptable as a worst-case first year figure; as in general, the first year is not about profit, it’s about setting up for the future.

Part 2

Ĺ = Ѧ x (ϻ x Ƕ) x Ҫ x ⌂ / Ӧ x ₴

| Ĺ = The Location | Hawaii |

| Ѧ = The Peet Tent | 94.1%and $110,160 |

| ϻ = Market share | 1000% (As the market is 10 times bigger) |

| Ƕ = Manual Override Limit | 50% (Added as caution due to large market) |

| Ҫ = Competition | 200% (As there is less competition) |

| ⌂ = Accessible Stock | 25% (As access to the bulk of stock is uncertain) |

| Ӧ = Operational Cost | $117,000 |

| ₴ = Operational Cost Variable | 200% (Increase if operational cost more in richer locations) |

Ѧ = ($110,160 x 1000% x 50% x 200% x 25%) = $275,400 / (117,000 x 200%) = $234,000

$275,000 / 234,000 = 117.5% (An excellent score)

Or $275,400 – $234,000 = $41,400 Which is an excellent first year result.

Ĺ = Ѧ x (ϻ x Ƕ) x Ҫ x ⌂ – Ӧ x ₴

There are of course many other variables that we could include, and the variables we have need tightening. But in general, the Peet Tent and QSF create a worst-case scenario, and then the second equation adjusts for different locations, different sized marketplaces, and different base costs.

If we look at the M-System system architecture, we can see that companies move forward to the Peet Tent; and after, either move forward to POP or move back to Systems 2 and 1. The Peet Tent is a critical look at every business plan and the ripple effects associated with it. Companies that pass the test get going and others move back and try again. This process will be greatly simplified when we have created it as a simulation within S-World UCS, and one can experiment with many variables seeking a way to pass the Peet Tent and become an S-World company.