the-s-in-the-res-equation

The Ś in the ŔÉŚ Equation

Welcome to the ŔÉŚ Equation (Ŕevenue x Éfficiency x Śpin)

(Note that I have placed accents over the Ŕ, É, and Ś so that when they are written, they stand out.)

For those new to Angel Theory – Paradigm Shift, I suggest starting with this short video that quickly summarises the 8 books that make up the series:

Paradigm Shift (2.27 minutes)

And see the website at www.AngelTheory.org.

Next, I have prepared a video for each of the four pages which navigates the spreadsheet. I suggest watching all videos before reading on.

Introduction (2.15 minutes)

The Ś in the ŔÉŚ Equation (6.20 minutes)

Macroeconomic Due Diligence (3.16 minutes)

Hawking Inspired ‘Infinite Accumulation’ (4.35 minutes)

In a nutshell, the objective is to prove that (under the conditions set out) we can, by 2024, turn one unit of capital into five units of capital. And by 2039, turn one unit of capital into 25 units of capital.

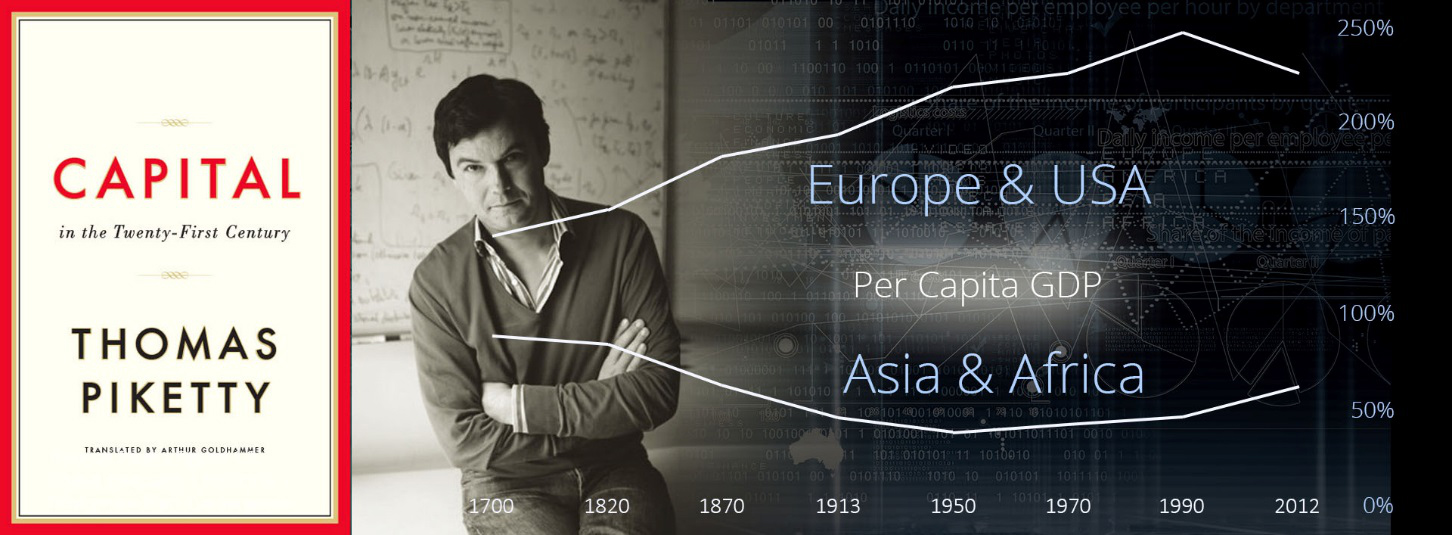

Consider this ‘thought experiment’ – Imagine that within your country, in 2024, most businesses were part of a global network, where business is entangled with many principles of ecology, philanthropy & science, with antitrust laws relaxed due to the many benefits the network would bring. (See Ripple Effects and Elephants)

Now, consider the following two rules:

1. Businesses and their staff can only spend money at other businesses within the network.

2. That one was paid evenly every 2 weeks, and money received must be spent within a month.

In this oversimplified example, with a Śpin of 24, if the network received investment or generated income from outside the network of $1 million, then by re-spending that $1 million every 2 weeks, it will have created $24 million in cash flow; of which about 66% (according to the DMCV) would equate to $15.84 million in real GDP.

Any country in abject poverty that can turn $1 million in investment into $15.84 million in real GDP is heading in the right direction fast. But this is not all, when Éfficiency is close to 100%, almost all the initial Ŕevenue from one year, in the 25th Śpin, will carry the Ŕevenue from one year to then next; in short, ‘Infinite Accumulation.’

The Ś in the ŔÉŚ Equation

There are 8 books of supporting detail that have taken 7 years to prepare. However, for now, we are just looking at the Ś in the ŔÉŚ Equation. For simplicity, I have decreased the figures from the accompanying spreadsheet (1.32c) from billions to thousands.

From the first tab on the spreadsheet, start at Column ‘E’- Row ‘5,’ this is half of the Initial Ŕevenue, $2,748 (which can be from investment, income from trade, or other).

This is allocated to ‘G5’ as initial spending. And in ‘H5,’ we see an Éfficiency of 90%. Then in ‘J5,’ we see a 5% tax deduction. However, tax is now handled in a different way, so effectively we have an Éfficiency very close to 85%, making $2,350 paid to other companies or personnel in the network. This is Śpin 1. The money supply (the cash flow within the network) has now increased by $2,350 to $5,098.

It’s important to know that there is a sophisticated system for personnel, where for the most part, they are paid in ‘Network Credits.’ And in fact, all payments to network companies are made in ‘Network Credits.’ One Network Credit can be considered as one USD but with two conditions: Firstly, it must be spent on one or another good or service (from real estate to a bottle of wine) produced by the network. Secondly, it must be spent within a time allocation. This creates the Śpin.

I have found it simplest to consider this in terms of cold hard cash changing hands. So, in January 2024, Company A received $2,748 in cash in USD. Then, before March, it used the money to buy goods and / or services from Company B and paid in cash, with 15% of the original money being spent on other things we do not know about.

Company B has been paid $2,350 before March for the goods it provided, then in turn, it pays $2,009 to Company C before mid-April, again in cash, buying more goods and services.

Now, the cash flow within the network is $5098 + $2,009 = $7107, from the original $2,748.

It’s important to know that the above is a very simplified version. I have a spreadsheet the size of the moon about how the actual cash flow is spent including staff and 32 different industry sectors. We are not concerned with this today, we are just interested in the Śpin.

Moving along the spreadsheet, we see 8 Śpins in total equals $14,937 in cash flow, made from the initial $2,748 investment, an increase of 544%.

Or if we look at ‘Tab 2 – 2039 – ŔÉŚ 16,’ we see an increase in Éfficiency to 100% and an increase in Śpin to 24, which creates an increase in cash flow of 2400% or 2500%, seen in column ‘DB4.’

Is 24 a lot of Śpins? At first it seemed so to me, but when we consider the average £20 note passes hands 247 times each year, it now seems like a very manageable figure.

ŔÉŚ problems already solved

Macroeconomic Due Diligence

Error 1

In GDP accounting, ‘Total Sales’ are not equal to GDP, as one only counts the final goods, services, and products produced; not the parts used to produce them.

This is solved by the David A. Moss Cash Flow to GDP Variable (DMCV), which is found at AI:211 on the 3rd or 4th tab on both spreadsheets, ‘The Sienna Equilibrium 1.06.’

Error 2

Usually, if a country with its own currency – like Malawi – were to increase output (GDP) by say 500%, then its currency would decrease by the same amount.

Solved by working in US Dollars, not local currency.

Error 3

The high Éfficiency score (from 85% to 100%) would see the Monopolies Commission investigate and antitrust laws enacted (as to have an Éfficiency of 100% is to create a 100% monopoly).

This can be solved, potentially, by working in countries like Malawi with low GDP and no plan to improve. Given the forecast shows an increase in GDP by a factor of 5 by 2024 and tax spending about the same, increasing to a factor of 106 come 2039. Given that most of Malawians live in abject poverty, earning less than $500 a year (yes, I said a year), and most do not have access to electricity, education, or basic health care; it’s well worth some exceptions be made to antitrust laws (that let’s face it, most people have never heard of), if in return the entire country benefits financially, philanthropically, and ecologically. (See M-System 2. ‘Ripple Effects and Elephants.’)

Plan B. The Money Multiplier

If for whatever unforeseen reason we can’t use ŔÉŚ as presented, then the next best thing to use is the ‘Money Multiplier’ presented in David A. Moss’s ‘A Concise Guide to Macroeconomics.’

The money multiplier is when one has some M1 money (cash or checking accounts) which is deposited as savings in a bank. The bank in turn keep’s about 10% in reserve and can lend out the rest. Moss suggests that if all the money lent out was (in turn) deposited again, that the increase in to the money supply would be tenfold. Albeit he immediately interjects to say that, in most cases, the multiplier is much less.

If we can’t use ŔÉŚ as presented above; then if Éfficiency is 100%, we should be able to create a money multiplier of 10. Or in early years, if Éfficiency is 85%, we could create a money multiplier of about 8.

However, ŔÉŚ is preferred due to what I have named Hawking’s ‘Infinite Accumulation.’ After an inspiration from Professor Hawking lead to a simulation of ‘The Conservation of Energy.’

ŔÉŚ – Hawking and The Conservation of Energy

Hawking Inspired ‘Infinite Accumulation’

If we were to say that each Śpin is an hors d’oeuvre and that 24 hors d’oeuvres is plenty; hold on, because the real free lunch is coming up right now.

This is the second part of ŔÉŚ gained by making analogies from particle physics. We started with the most basic analogy of applying Śpin to the economics, and that seems be working out nicely. And whilst the concept of conservation of energy is not as simple as applying Śpin, its results are easy to see. The basic point is energy cannot be destroyed, and when Éfficiency equals 100%, nor can Ŕevenue. As when we get to the 25th Śpin, this is effectively a handover of all Ŕevenue from the year before to the next. So that before we add, any new Ŕevenue from sales to the rest of the world, trading or via investment, the new year starts with the previous years’ Ŕevenue.

Now, that’s a tongue twister, so I will show it to you on the spreadsheet, which makes it easier to visualise. To start, we need to change spreadsheets to the ‘Standard’ version, as the ‘Cautious’ spreadsheet allows for 5% leakage for buying raw materials from neighbouring countries, albeit a good comparative advantage strategy would likely mitigate this need.

So, on the standard spreadsheet 1.32c, go to the second of the tabs that you’ll find at the bottom of the page ‘Tab 2a. 2038 – ŔÉŚ 15.’,

First, we see the Ŕevenue of $102,947,066,421.09 in E:8, This split in two and ends as $98,747,513,256.13 in DF:29.

Why is this figure less than Ŕevenue? Well, if we look at DC:27, we see that we don’t actually have an Éfficiency of 100% as there was a small leakage to ‘land and assets’ bought from outside the network.

Next, we move to a new tab of the spreadsheet, tab ‘Tab 2b – 2039 – ŔÉŚ 16’; and please find column and row CZ:46, in which the $98,747,513,256.13 of Śpin 24 from 2038 passes to the beginning of the following year.

Now, you see why I need to create the S-World software and in particular the UCS Simulator; as the first job of this software will be to micro simulate this to check for where there could be an error. As in economics, there is no free lunch, but here we seem to have two.

Or maybe the model is correct and there is a lot to be said about following and simulating the laws of nature described by M-theory, and we can answer positive to the question, ‘M-theory, an Economic Science?’

What is M-theory? See Books 1 M-Systems and 2. The Economic Theory of Everything on the www.AngelTheory.org website.