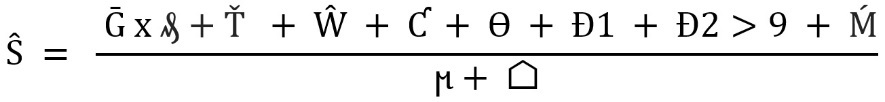

The ŔÉŚ Equation for Paul Krugman et al. | Super-Macroeconomics

Angel Theory – Volume 1 – Paradigm Shift

A More Creative Capitalism

Part 1. A Good Model

Chapter 4. The ŔÉŚ Equation

By Nick Ray Ball 10th October 2018

Super-Macroeconomics

The ŔÉŚ Equation for Paul Krugman et al.

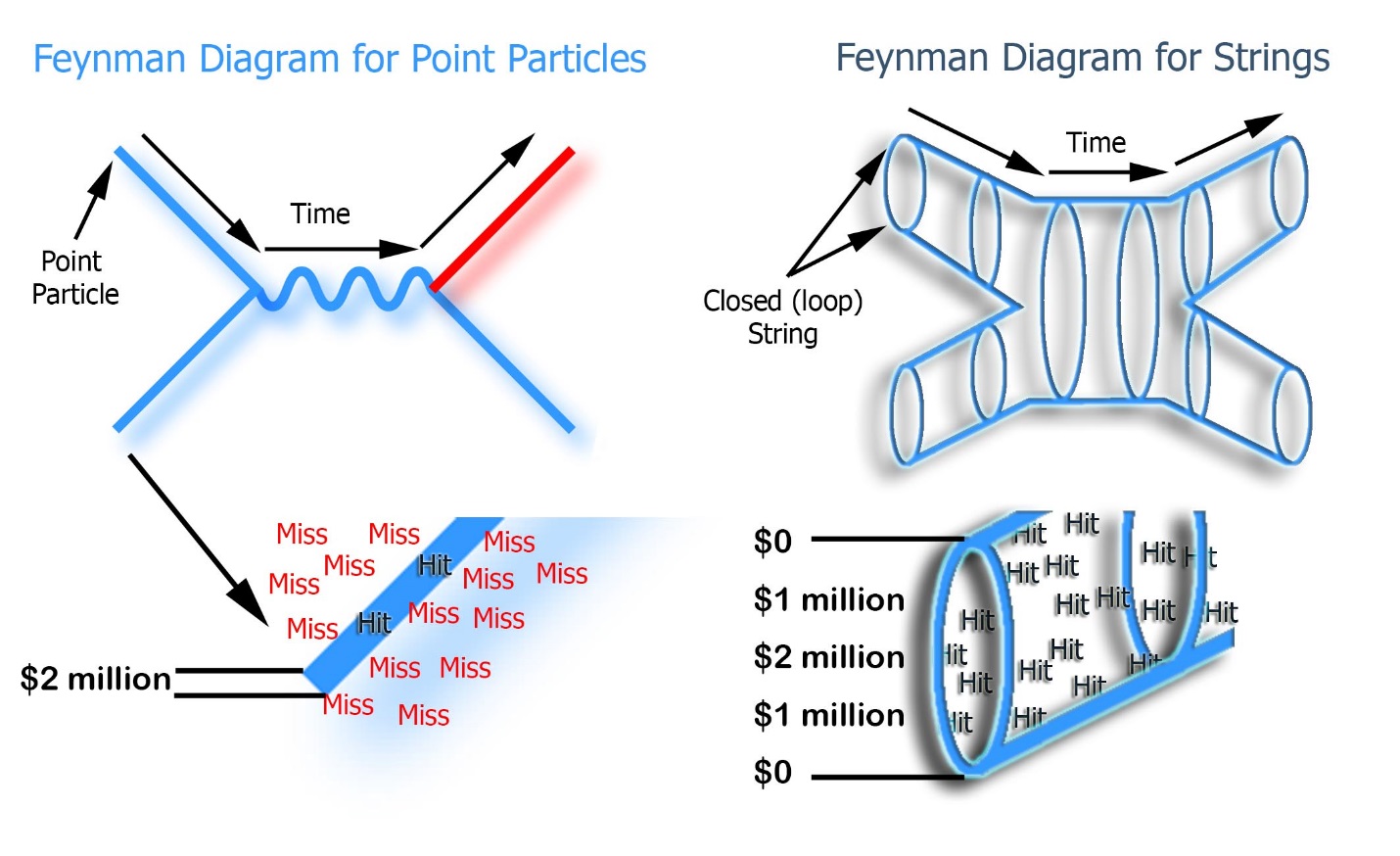

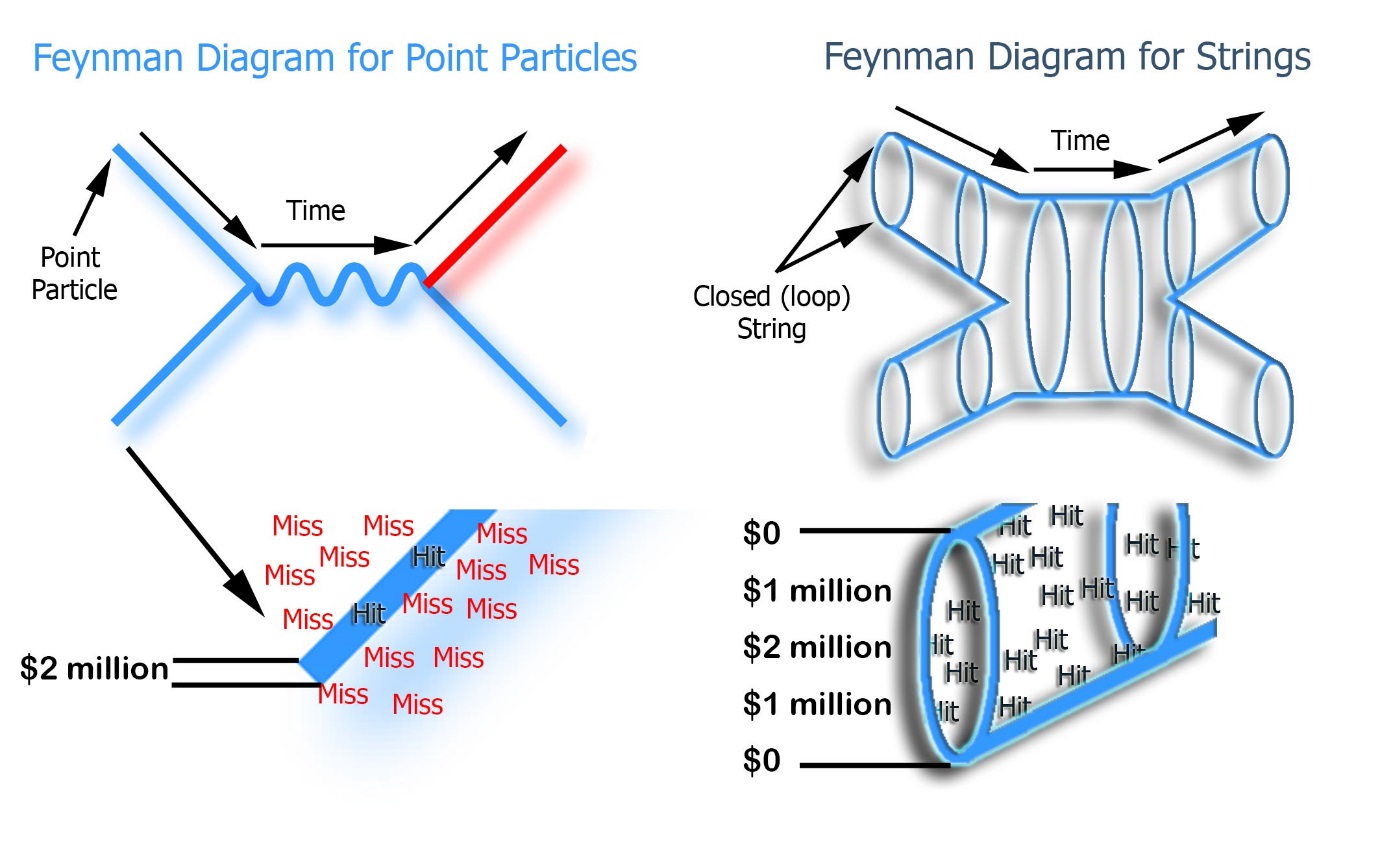

The ŔÉŚ Equation increases the money supply: Ŕ Revenue x É Efficiency (90% if 90% of money stays in network) x Śpin (rotations per year).

Welcome, Professors.

The key points in this presentation which will either make or break the ŔÉŚ equation are summarised in the videos below. However, before watching, it’s important to appreciate that to make a correct simulation, I have added many initial values for variables such as investment, income, tax, and trade. These inputs do give a broader picture of the project, but many are likely to change.

It is only the ŔÉŚ equation itself that needs testing at this point; as if correct, all other variables will be influenced by it, and we would build the actual development around the strengths of the ŔÉŚ equation.

Video introduction:

By assigning 50% of Network Credit spending to government, labour, and interest payments;

we can guide spending and create a production vs. consumption symmetry, so that “your spending is my income, and my spending is your income” (quote from Paul Krugman).

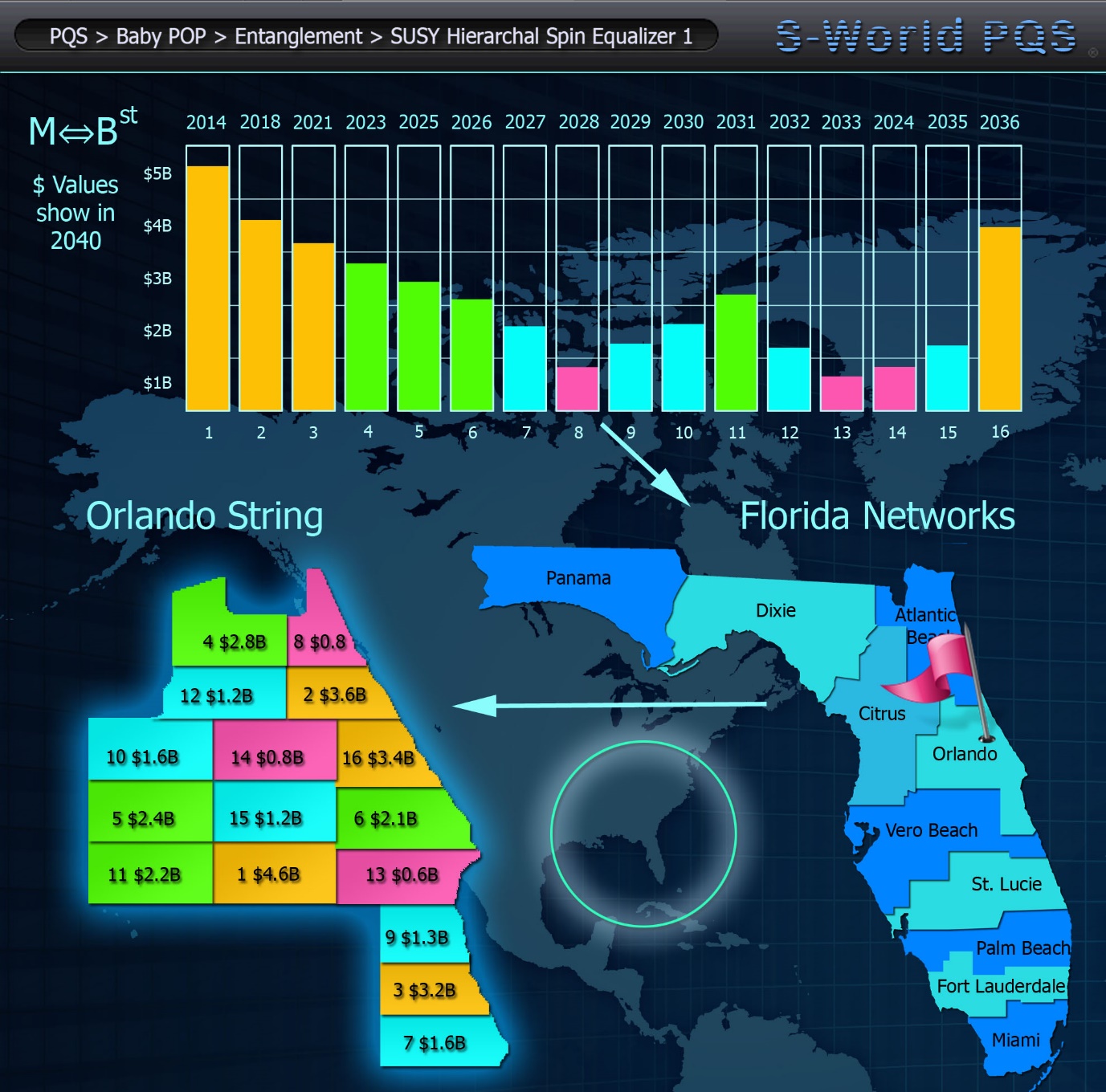

In Video 1, we see that in 2024, with an É of 90%, the Law of Conservation of Ŕevenue carries over 90% of Ŕ to 2025.

Then, in Video 2, we see that the network economy need only create 11% in new Ŕevenue to be in surplus in 2025, and that there is a lot more than 11% likely to arrive.

Lastly, in Video 3, we add Śpin by changing the timeline from once a year to 4 times a year, which increases the money supply, cash flow and GDP; but lowers the Law of Conservation of Ŕevenue.

Video 1. Points 1 to 3

https://youtu.be/Ye-unQ1ufsA (8.01 Minutes)

Part 1. Your Income – My Spending

Part 2. The Sienna Equilibrium

Part 3. The Law of Conservation of Ŕevenue

Video 2. Point 4

https://youtu.be/-CcYyeHA6vA (14.40 Minutes)

Part 4. Additional Ŕevenue – 2025 to 2028

Video 3. Point 5

https://youtu.be/EFJBwoBxeys (11.49 Minutes)

Part 5. The Ś in the ŔÉŚ Equation

To follow the simulation, open the spreadsheet ‘ŔÉŚ and The Sienna Equilibrium 3.04c (02th October 2018).’

Download Spreadsheet

ŔÉŚ stands for Ŕevenue x Éfficiency x Śpin.

Please note that I have added accents to the letters ŔÉŚ so that they stand out.

- Ŕ is for Initial Ŕevenue – Investment, aid, trade surplus, real estate sold internationally, real estate developments & Grand Networks / Charter Cities sold internationally, sales to non-network companies or individuals in the country of origin.

- É is for Éfficiency – The percentage of money that remains in the network after sales.

If 90% of all network companies spending (including raw materials, parts, labour, government allocation, interest on debt, and all operational costs) end up at other network companies, or network personnel, then É is 90%. - Ś is for Śpin, the amount of times the money circulates within the network in a year.

However, at the beginning of the first example, we work at Śpin-Zero and focus on the ‘Sienna Equilibrium’ and the ‘Law of Conservation of Ŕevenue.’ This is, however, not to take away from the power of Śpin to increase the money supply. - The Sienna Equilibrium is the mechanism that organises the “your spending is my income, and my spending is your income” symmetry. So that at the beginning of one year, money is allocated to the network and is distributed across sectors (companies, labour, repayment of investment, government credits, the Peet Tent, and other). Where after, it is spent in such a way as to redistribute the money across the same sectors. A key factor in this symmetry which is in itself a craft, is the creative way labour, government, and investors are paid in ‘Network Credits’ that can only be redeemed at one or another network company. (Albeit currently this is only the case for about 50% of labours disposable spending.)

- The Law of Conservation of Ŕevenue is that when É is equal to 90%, Śpin is zero and the time period is one year, then at the beginning of year 2, 90% of the money the network started with in US dollars will remain in the network economy, at one or another network company the following year.If the network started with a Ŕevenue of $5 billion in cash at the beginning of 2024, the network would have $4.5 billion is cash at the start of 2025. And of course, if É is equal to 100%, all of 2024’s Ŕ will end up as Ŕ the following year, so following the Law of Conservation of Energy, adapted to suite economics.Which looks very similar to how a country’s economy behaves, as most of the money it starts with one year is spent and re-spent, imported and exported; but mostly ends up back in the country of origin the following year. Which was what I set out to do with ŔÉŚ back in 2012 in American Butterfly (see UCS, and Quantum Force Theory).

- A key factor is that the Network Currency (Network Credits) are simply US dollars, with a kind of gift voucher quality; in that they must be redeemed at network vendors/companies within a timeframe. In the case of ŔÉŚ- Śpin-Zero a year, or in the case of ŔÉŚ- Śpin-4 within 3 months.The main reason for working in US dollars is that adding say $5.5 billion in new cash spending to an economy that has a GDP of about $5.5 billion will inflate the country’s currency and existing exports will become too expensive.

- Lastly before we get into the main presentation a quick word on Grand Networks or as Paul Romer, who was until 2018 a senior vice president and chief economist for the world bank named; “Charter Cities.”

Grand Networks – Charter Cities

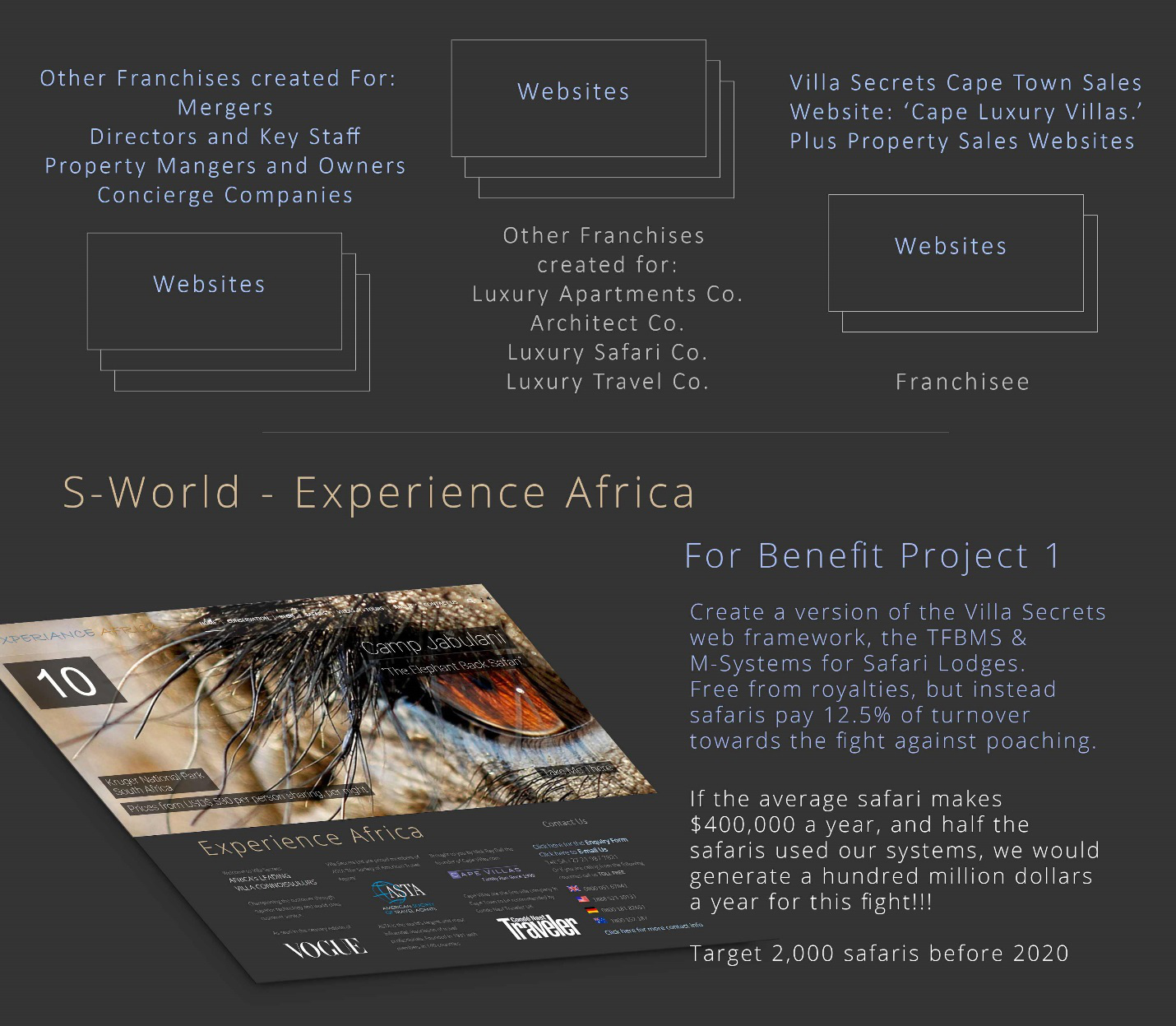

Whilst the idea for Grand Networks has been around since ‘New Sparta – City of Science‘ circa 2011, the current version of this concept was created for the MARS Resort 1 Hypothesis in 2017. The idea being to move away for selling real estate home by home, or shop by shop the network would develop Grand Networks, complete developments for companies and institutions.

And when the ‘MARS Resort 1 – Thought Experiment’ (found at the ned of this chapter) manifested into the Malawi Network the concept stuck. And was reinforced by MIT’s Abhijit V. Banerjee and Esther Duflo opinion Paul Romer’s Charter City idea as told in their book ‘Poor Economics.’

“One possible way to break the vicious cycle of bad institutions is to import change from the outside. Paul Romer, known for his pioneering work on economic growth a couple of decades ago, came up with what seems like a brilliant solution: If you cannot run your country, subcontract it to someone who can.

Still, running an entire country may be difficult. So, he proposes starting with cities, small enough to be manageable but large enough to make a difference. Inspired by the example of Hong Kong, developed with great success by the British and then handed back to China, he developed the concept of “charter cities.” Countries would hand over an empty strip of territory to a foreign power, who would then take the responsibility for developing a new city with good institutions.

And let’s add to this an extract from ‘Straight on Trade’ by Dani Rodrik the Harvard Kennedy School – Ford Foundation Professor of International Political Economy.

“Despite the evident reduction in transportation and communication costs, the production location of globally traded products is often determined by regional agglomeration effects.

When the New York Times recently examined why Apple’s I Phone is manufactured in China rather than in the United States the answer turned out to have little to do with Comparative Advantage. China had already developed a massive network of suppliers, engineers and dedicated workers in a complex known informally as Foxconn City, that provided Apple with benefits that the United States could not match.”

Charter Cities in Malawi

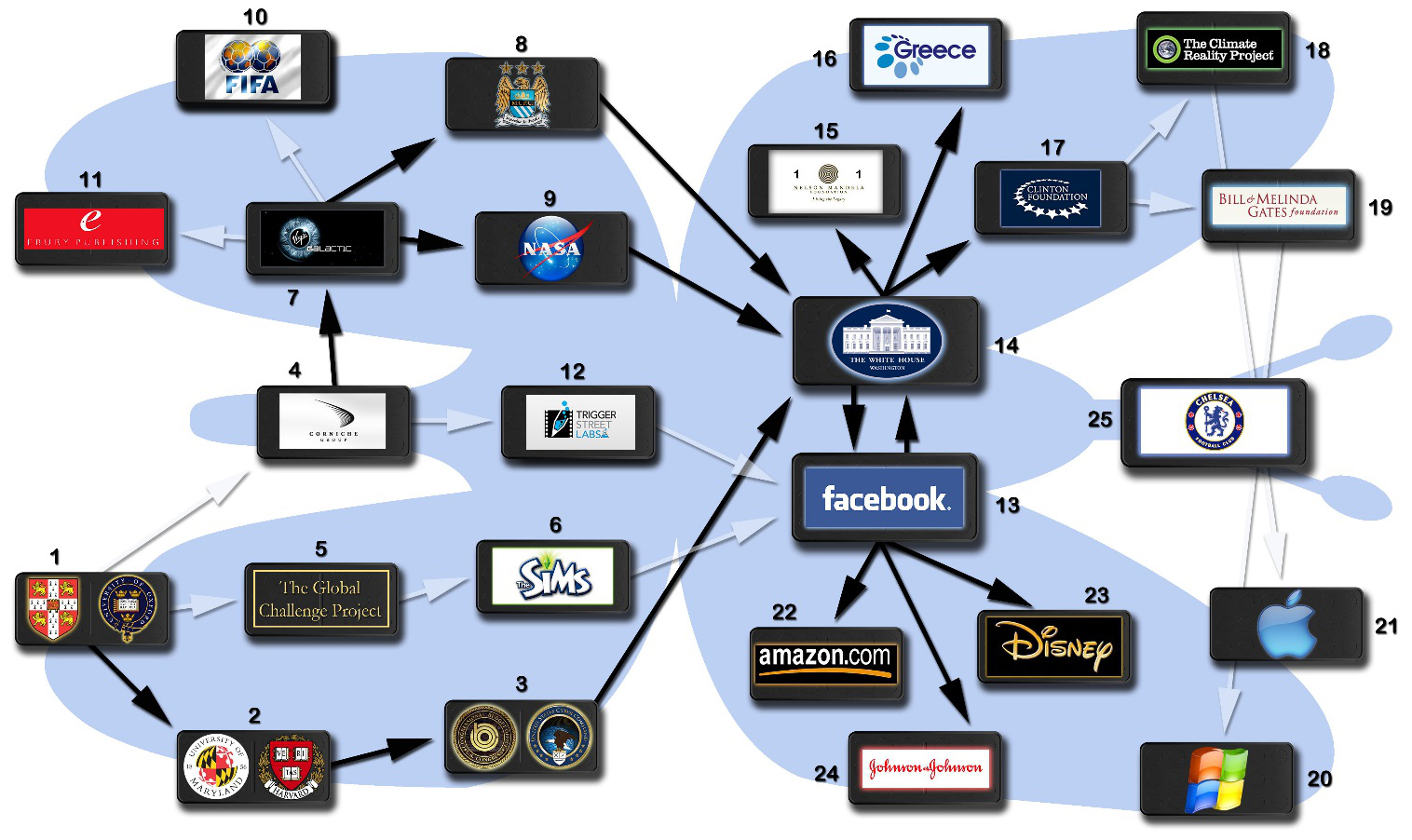

The plan is to create a series of ‘Charter Towns’ for organizations such as the Norwegian Sovereign Wealth Fund, university endowments for the likes of Yale, Harvard, and Princeton; companies like Facebook and Google and others, one per year from 2025.

The ŔÉŚ Equation – For Paul Krugman

Back in 2012, when Paul Krugman released his book End This Depression Now!, I was sure austerity had been and was the correct path for the USA; and for that matter, the whole of the Western world. Despite creating my first economic model, ‘The Kobayashi Maru GDP Game,’ which suggested only a mass stimulus program and a more creative capitalism could end the depression; but at the time however, I did not have enough components for a more creative capitalism, and without which, austerity seemed to make perfect sense.

Six and a half years later, I now have the components, the most powerful of which is ŔÉŚ a way to increase the money supply, that appears so powerful that it must be wrong, right? But for the life of me I can’t find the error, so I am sending it to the most creative macro-economist I have read.

Paul Krugman’s book ‘End This Depression Now!, tells of a masterful alternative to what most people with heads for business back in 2008-12 thought, that the debt crisis, could not be cured with more debt. It just made sense, it was an intuitive answer to a seemingly simple problem of too much debt.

However in End This Depression Now!, Krugman explains that the opposite can also be true, and seeing as I have a passion for deconstructing counterintuitive quantum theory (see M-System 14), I thoroughly enjoyed his hypothesis. And if I had to be in charge back then, I would have probably run with his neo Keynesian solution… ‘probably.’

And because of this turnaround, I can with certainly agree with Mark Twain’s quote:

“It’s not what you don’t know that kills you, it’s what you know for sure that ain’t true.

Fortunately, I don’t have to make such decisions now or in the future, as my role in macro-economics is to create the next gen S-World VSN™ Angelwing and S-World UCS™ economic simulations (see www.AngelTheory.org) that give probabilities of success, from which others can act.

And the not so little task of creating a new sub Saharan economy that will pull the poorest billion citizens out of their 2000-year depressions; and via externalities and ripple effects, slow down the predicted mass overpopulation of Africa (that will kill us all), and stop the poorest countries becoming the next generation of carbon emitters, which will kill us all, all over again. Because I believe that situation, you know… the carbon, is going to be a lot worse that we think, if chaos theory is at all a guide.

Oh, and we get to save the elephants, and fund many other novel endeavours. See the breakthrough chapter:

www.angeltheory.org/book3-14/ripple-effects-and-elephants-for-paul-g-allen.

I will now continue with an excerpt from Chapter 2. ‘Depression Economics,’ from Paul Krugman’s ‘End This Depression Now!’ that leads into this ŔÉŚ Equation presentation.

It’s all about Demand

“Give Riedl some credit: unlike many conservatives, he admits that his argument applies to any source of new spending. That is, he admits that his argument that a government spending program can’t raise employment is also an argument that, say, a boom in business investment can’t raise employment either. And it should apply to falling as well as rising spending. If, say, debt-burdened consumers choose to spend $500 billion less, that money, according to people like Riedl, must be going into banks, which will lend it out, so that businesses or other consumers will spend $500 billion more. If businesses afraid of that socialist in the White House scale back their investment spending, the money they thereby release must be spent by less nervous businesses or consumers. According to Riedl’s logic, overall lack of demand can’t hurt the economy, because it just can’t happen.

Obviously, I don’t believe this; and in general, sensible people don’t.

But how do we show that it’s wrong? How can you convince people that it’s wrong? Well, you can try to work through the logic verbally, but my experience is that when you try to have this kind of discussion with a determined anti-Keynesian, you end up caught in word games with nobody persuaded. You can write down a little mathematical model to illustrate the issues, but this works only with economists, not with normal human beings (and it doesn’t even work with some economists).

Or you can tell a true story—which brings me to my favorite economics story: the babysitting co-op.

The story was first told in a 1977 article in the Journal of Money, Credit, and Banking; written by Joan and Richard Sweeney who lived through the experience and entitled “Monetary Theory and the Great Capitol Hill Baby Sitting Co-op crisis.” The Sweeneys were members of a babysitting co-op: an association of around 150 young couples, mainly congressional staffers, who saved money on babysitters by looking after each other’s children.

The relatively large size of the co-op offered a big advantage, since the odds of finding someone able to do babysitting on a night you wanted to go out were good. But there was a problem: how could the co-op’s founders ensure that each couple did its fair share of babysitting?

The co-op’s answer was a scrip system: couples who joined the co-op were issued twenty coupons, each corresponding to one half hour of babysitting time. (Upon leaving the co-op, they were expected to give the same number of coupons back.) Whenever babysitting took place, the babysittees would give the babysitters the appropriate number of coupons. This ensured that over time each couple would do as much babysitting as it received, because coupons surrendered in return for services would have to be replaced.

Eventually, however, the co-op got into big trouble. On average, couples would try to keep a reserve of babysitting coupons in their desk drawers, just in case they needed to go out several times in a row. But for reasons not worth getting into, there came a point at which the number of babysitting coupons in circulation was substantially less than the reserve the average couple wanted to keep on hand.

So what happened? Couples, nervous about their low reserves of babysitting coupons, were reluctant to go out until they had increased their hoards by babysitting other couples’ children. But precisely because many couples were reluctant to go out, opportunities to earn coupons through babysitting became scarce. This made coupon-poor couples even more reluctant to go out, and the volume of babysitting in the co-op fell sharply.

In short, the babysitting co-op fell into a depression, which lasted until the economists in the group managed to persuade the board to increase the supply of coupons.

What do we learn from this story? If you say “nothing,” because it seems too cute and trivial, shame on you. The Capitol Hill babysitting co-op was a real, if miniature, monetary economy. It lacked many of the features of the enormous system we call the world economy, but it had one feature that is crucial to understanding what has gone wrong with that world economy—a feature that seems, time and again, to be beyond the ability of politicians and policy makers to grasp.”

‘What is that feature?”

“It is the fact that your spending is my income, and my spending is your income.“

What follows is the story of the ŔÉŚ Equation from the principle of ‘your spending is my income, and my spending is your income.’ This phrase helps to simplify the law of conservation of Ŕevenue, which is simply the exercise of creating a network of business that behaves like a country’s economy; where after a year, most of the money has circulated and has come full circle and is available to spend the next year.

Video 1. Points 1 to 3

https://youtu.be/Ye-unQ1ufsA (8.01 Minutes)

Part 1. Your Income – My Spending

Part 2. The Sienna Equilibrium

Part 3. The Law of Conservation of Ŕevenue

Video 2. Point 4

https://youtu.be/-CcYyeHA6vA (14.40 Minutes)

Part 4. Additional Ŕevenue – 2025 to 2028

Video 3. Point 5

https://youtu.be/EFJBwoBxeys (11.49 Minutes)

Part 5. The Ś in the ŔÉŚ Equation

Followed by:

Part 6. AGOA-US Trade

Part 7. Tax, Labour, and Interest on debt

Part 8. The First Followers

Part 9. What If we can’t use ŔÉŚ as prescribed?

To follow the simulation, open the spreadsheet ‘ŔÉŚ and The Sienna Equilibrium 3.04c (02th October 2018)’

Download Spreadsheet

The Standard Model

A note on all Non ŔÉŚ parts to this presentation, like the standard model in physics, a lot of other values for variables are needed to create accurate predictions, note that all ideas except ŔÉŚ are there to assist the presentation prove or disprove ŔÉŚ, and all values of all non ŔÉŚ components, such as additional income, government spending, labour’s spending, and trade are variables that are to be debated separately.

The ŔÉŚ Equation – Your Spending is My Income

By Nick Ray Ball 1st October 2018

The beginning of this presentation works from right to left, as it is a reverse of a previous attempt.

I will write in point form, so we can zoom into any particular case:

Video 1. Points 1 to 3

https://youtu.be/Ye-unQ1ufsA (8.01 Minutes)

1. Your Income – My Spending

a. We start at column (AE) with ‘START HERE’ at the top in large letters.

b. We see 16 equal sectors of ‘My Spending’ in 2024, mostly manufacturing and construction.

c. Check the É Éfficiency (AF:4) has a value of 90%.

d. Now, we have 16 sectors each that spends $154,618,822.66 mostly on manufacturing and construction materials.

e. Now, please navigate down to (AE:28) to see another 16 sectors, this time of ‘Your Income’ in 2024.

f. Now, scroll to the left and column (X:28) and the second 16 equal sectors of ‘My Spending’ in 2024. This time the sectors are government, labour, and interest on loan.

g. Lastly, scroll up to (X:3) for the second set of 16 ‘Your Income’ sectors. So, in total, we have 32 sectors that sell (My Spending) and 32 sectors that buy (Your Income).

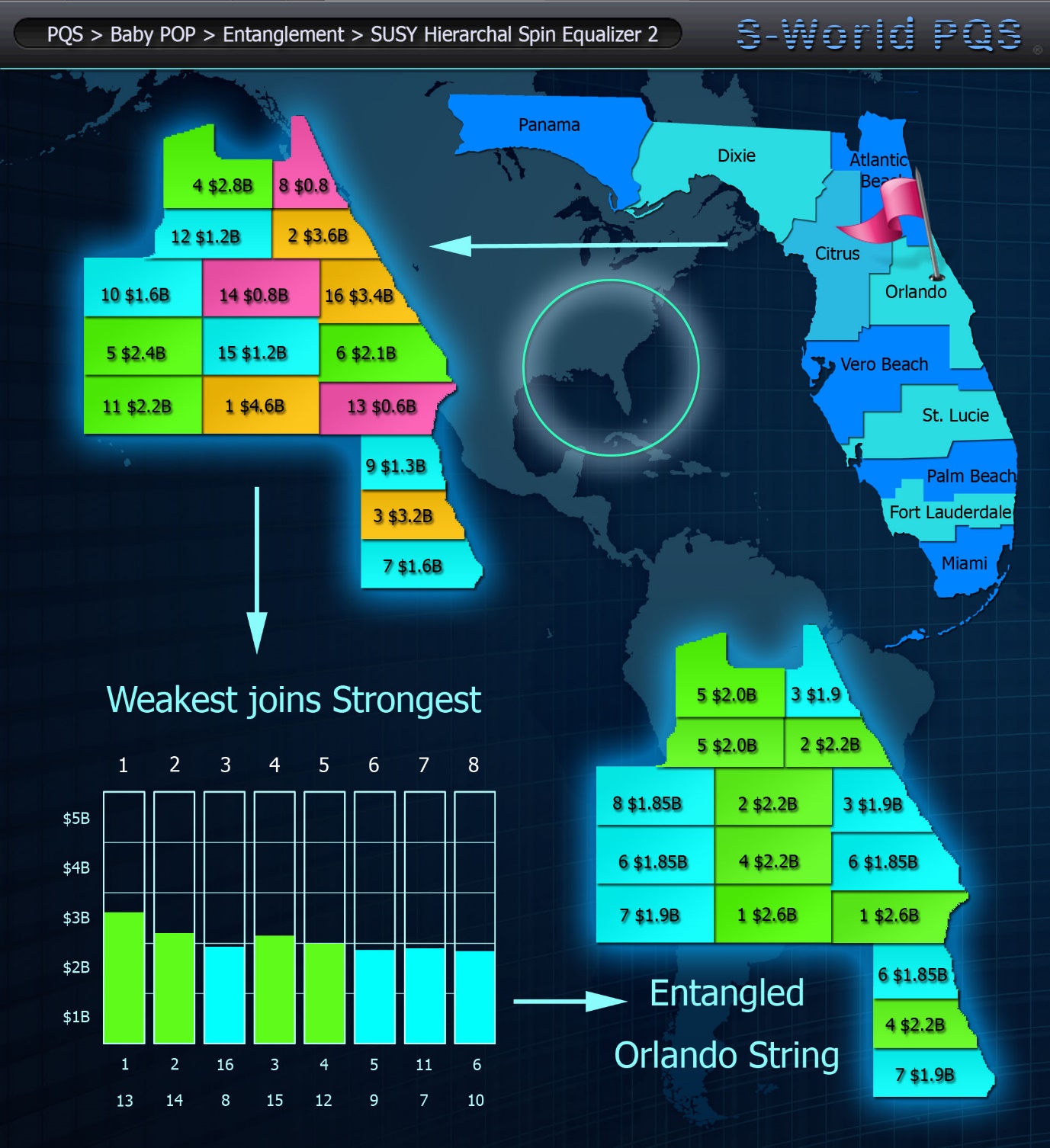

2. The SIENNA Equilibrium

a. We now have 32 sectors; half of which produce, and half consume.

b. The Sienna Equilibrium is the mechanism used to balance the production and consumption so that, at the end of a cycle, a balance is created; and like a standard country’s economy, most of the money that started in one year of the economy is there at the end.

c. In this case, with an É of 90%, 90% of the money the network starts with in 2024 is still in the network in 2025.

d. This example does not present a perfect ‘your spending is my income’ trade balance; as we are working with only 32 sectors, where in fact we would have hundreds if not thousands of companies. And the more different companies there are, the easier it is to balance and create a perfect symmetry.

e. Note also that it seems a lot easier if one can use Śpin, so making a number of exchanges within a year. We will look at this point later.

Returning to the spreadsheet…

f. If we return to (X:4), we come to the second 16 sectors of ‘Your Income’ in 2024.

g. Before looking at the Law of Conservation of Ŕevenue, let’s have a quick look to the left and see the simulation continues to 2025.

h. First scroll to (L:4) and see that, in fact, each sector starts with $343,597,383.68; from which half is deducted for Tax, Labour, and Interest (seen to the right).

i. Critically, these deductions are in Network Credits, which are like a USD gift voucher, redeemable at any network company within a set time period; in this case, before 2025 (one year).

j. But unlike in the US, where banks reinvest deposited money leaving only 5% to 10% in actual currency, all the Initial Ŕevenue is in the network’s central bank is cash in USD.

k. If for whatever reason ŔÉŚ is not permitted, this would change, and the network would follow the standard bank deposit method for increasing the money supply.

l. Continuing to the left, we come to column (I), a repeat of ‘Your Income’ but now moved to 2025.

m. This set of sectors then sells to the 16 sectors in column (G) which become ‘My Spending’ in 2025.

n. Note that this point is the starting point for the ŔÉŚ-Śpin-3 presentation, see spreadsheet tab ‘ŔÉŚ-Śpin-3 V2.05.’

3. The Law of Conservation of Ŕevenue

a. Moving to the right, please navigate back to column (AE) and then (AG) the Initial Ŕevenue column. Now, look at the bottom and we see $2,473,901,162.50 (If É is 90%); and below at (AG:22) the figure $4,947,802,324.99 which includes the second 16 sectors of 2024 My Spending at (AG:45).

b. That figure, $4,947,802,324.99, ‘is 90% of 2024 investment.

c. To simplify, none of the eight additional Initial Ŕevenue streams in column (AJ) from 2025 are allocated in 2024; when in the real world, some would add to Initial Ŕevenue, and in particular aid.

d. Note also that that there is no investment after 2025.

e. Retuning to $4,947,802,324.99 ‘The Law on Conservation of Ŕevenue’ figure at (AG:22).

f. This is now the Initial Ŕevenue left in cold hard cash (USD) after the first year’s trading.

g. So, the network has lost $549,755,813.89 and retained $4,947,802,324.99.

h. I call this ‘The Law of Conservation of Ŕevenue, ‘initially inspired by a desire to better understand Professor Hawking’s teachings regarding the law of conservation of energy; now a significant economic system in the S-World stable.

i. IN CONCLUSION:

Please compare the retention of 90% of cold hard cash by this network of businesses to a single business without the network.

j. For a single business starting fresh with $20 million, it can be efficient and make $30 million in goods, but it needs to sell them to make a profit; and if it does not make the sales, it’s out the game. This business needs the sales and the sales are by no means guaranteed, especially for a new company.

k. However, the same business within this network design starts in 2024 with demand for $20 million, and due to the Law of Conservation of Ŕevenue is guaranteed $18 million in sales the following year. And so, in 2025, it only needs to generate $2 million in sales; which when we consider laws of diminishing returns is almost infinitely simpler than looking for $20 or $30 million in sales.

l. And in addition, because new sales and aid create more Initial Ŕevenue, the rollover of cash year to year increases; as we will see in the next video.

Additional Ŕevenue – 2025 to 2028

Video 2. Point 4

https://youtu.be/-CcYyeHA6vA (14.40 Minutes)

Before I begin this section, please note that the values of one or another new-revenue-stream are not being presented. They are only examples, as indeed is the manufacturing and construction-based economy; which could change to a mostly service and construction-based economy, if after review that was the best model.

The general point is that, due to the Law of Conservation Ŕevenue, the network only needs to make a 10% of the 2024 Initial Ŕevenue to breakeven and can forge ahead given additional revenue from a number of sectors.

With this said, let us begin…

Please move to column (AJ) to see the additional income that can be made in 2025, which is created in addition to the ‘Law of Conservation of Ŕevenue’ cash flow that was rolled over from 2024.

There are 6 different sectors:

a. 1st Tier Pricing in Network & Malawi

i. In 2024, all S-World operations will have been pre-planned in great detail. This detail includes the price of every good, service, or construction set at the optimum level for the greatest success of all Ťender companies. This will vary in practice, but not by much.

ii. Ťender companies are companies that have guaranteed orders from other companies, which would be most or even all, in 2024.

iii. In a way, the 2024 operations are not too dissimilar to the China two-price-system; in which the first price feeds the village, and once fed, entrepreneurs are free to produce more, and sell it in the open market.

However, the S-World one-price-system is far more sophisticated compared to the Chinese one-price-system as it is technology driven, taking advantage of all other software and systems and in particular the S-World UCS™ Simulator.

iv. This additional income stream is for goods made above the Ťender quota that are sold to other companies, either in the Malawi Network, or to other companies in Malawi outside of the Network, at a price very near the original Ťender price. In essence, this income stream is in part non-profit and a form of aid.

v. Note that the one-price Ťender system in 2024 is set to breakeven, and only make profit in 2025; where after, profit will be invested per the POP initiative showcased in Chapter 2.

b. 2nd Tier Pricing in Network & Malawi

i. 2nd Tier Pricing is the same as above; but goods, services, real estate, and other are sold at whatever prices the market can afford.

c. Trade with USA

i. In 2024, the trade with the USA shown on this spreadsheet is exactly equal, a perfect trade balance, see columns (AA) and (AB).

ii. For example, if we start at (AE:4), we see it makes high end fashion. This is sent to the USA in (AB:4) and (via trade hubs) traded for raw materials and manufacturing parts in (AA:4); which are then imported to Malawi and sold to the sector ‘Goods 1. Technology’ in (X:4).

iii. The vehicle for this tariff free trade is the AGOA (The African Growth and Opportunities Act), which applies if all components of the export are domestically produced or produced by other AGOA rules of origin countries – see https://agoa.info/profiles.html.

iv. However, the AGOA does not stipulate a perfect trade balance, so more can be produced and exported, albeit some quotas would apply.

v. Any additional trade creates additional Initial Ŕevenue which we see estimated at $171,798,691.84 at (AK:11).

d. Trade with AGOA

i. Trade with AGOA countries is similar to trade with the USA but is primarily for raw materials, building materials, food, and drink, traded for more complex manufactured goods.

e. Aid and Technical Assistance

i. Having studied the following books: The Bottom Billion and The Plundered Planet by Paul Collier, The End of Poverty by Jeffrey Sachs, Why Nations Fail by Daron Acemoglu and James Robinson, and Poor Economics by Abhijit V. Banerjee and Esther Duflo; I am confident that by the time the software has been fully described, including the S-World TBS™ (tracks all client interactions), the TFS™ (tracks all financial transactions), The BES™ Observer (publicly displays statistics on aid recipient individuals and companies), S-World UCS™ (creates projects as simulations before commencement, down to the cost of a single brick), S-World AE (Aid Éfficiency – aid mostly transferred to companies that are fully tracked by the software), and the latest edition the S-World VSN Angelwing™ Economic Framework…

ii. Then all would agree, that given the OECD tells us that over $142 billion in aid was distributed in 2016, that in addition to whatever aid Malawi is already receiving, due to the 26 different special projects seen in the breakthrough chapter ‘Ripple Effects and Elephants‘ and other chapters in this book, the Malawi Super Grand Network project is worthy of $1,374,389,534.72 in aid.

iii. And possibly much more, as the rollover effects of aid to the Malawi Network would (in time) see more aid delivered than given.

iv. Imagine, if in but a few years, the Bill and Melinda Gates Foundation, The Chan Zuckerberg Foundation, Virgin Unite, Google.org, The Red Cross, or the World Bank could say: “We delivered $100 million in aid; and now, 3 years later, we have recorded $200 million in direct benefits.’ And after, show a very, very long list of exactly what those benefits were and who received them.

v. Now, that’s ‘A More Creative Capitalism,’ and note that the name of this book is from Bill Gates’s 2007 Harvard Commencement Speech, about his desire to see a better economic system that could foster equality and provide help where help was needed.

vi. I dare say, even William Easterly, the author of ‘White Man’s Burden’ would agree that if aid is unavoidable and had to be distributed somewhere, then the Malawi Network as presented would be his choice; as it is a ‘teach a man/woman to fish’ contribution that would not be needed after a few years.

f. Network Charter Cities

The name Charter Cities comes from Paul Romer who until recently was the chief economist and senior vice president at the world bank. Alongside the software, the idea of building Charter Cities has been the central theme of S-World since 2011 and the plan for ‘New Sparta – City of Science.‘

i. The current vision for such a city, or in fact cities is to emulate Foxconn city (the city in China that Apple chose to make the iPhone), incorporate the Googleplex, a holiday resort, and university town.

ii. Network Charter Cities are this idea but created for a single client. In this case, in 2025, I suggest the Norwegian Sovereign Wealth Fund, who has over $1 trillion in their endowment; and according to Thomas Piketty, the author of ‘Capital in the Twenty-First century, are keen to invest in real estate in emerging nations, so why not a Charter City in the Malawi Network?

iii. In general, this would be a minimum of 10 phases, one per year, at $1,374,389,534.72; but the first year is half of that due to productive capacity.

g. Collectively in 2025…

Collectively, in (AK:23), we find an additional $2,534,030,708.33 in new money (in cash) entering the system. And because this new money will also follow É = 90%, this money counts as Initial Ŕevenue

i. The $2,534,030,708.33 is added to the $4,947,802,324.99 Law of Conservation of Revenue rollover from 2024, making $7,481,833,033.32 (AK:25).

ii. However, the network economy does not need this much to report a successful 2025. So long as $549,755,813.89 plus US inflation is generated, the network economy will breakeven.

iii. And a breakeven is a success as the infrastructure, solar arrays, education, technology, and other benefits are key areas for future growth; and at the very least, this project would get $549,755,813.89 in aid.

iv. Thus, if the Law of Conservation of Revenue can work as presented, and we receive more than 20% of 2025 potential additional income, the venture would be a success; so long as we can master the logistics, which in any case would have been planned in intricate detail within the S-World VSN™ and UCS™ Simulations.

v. Even if only an É of 80% can be achieved by 2024, it’s still a winning formula.

h. In 2026…

Next, in 2026, all additional revenue is increased, and I added a second network Charter City. This time, for the sake of picking a winner, I’ve gone for the Harvard Management Company. The general idea here being that Harvard would also assist with advances in virtual education and create their own university town/city, an entire city dedicated to education and research.

i. And we can see at (AO:25), the Law of Conservation of Ŕevenue rollover and new additional income equals $10,908,357,947.77.

i. In 2027…

Next, in 2027, a third network Charter City begins, this time for the USA; either government, a collection of business, citizens, or a combination.

i. Trade increases again, but aid starts to get phased out.

ii. And at (AR:25), we see the Law of Conservation of Ŕevenue rollover from 2026 and new 2027 income equals $15,418,159,515.13

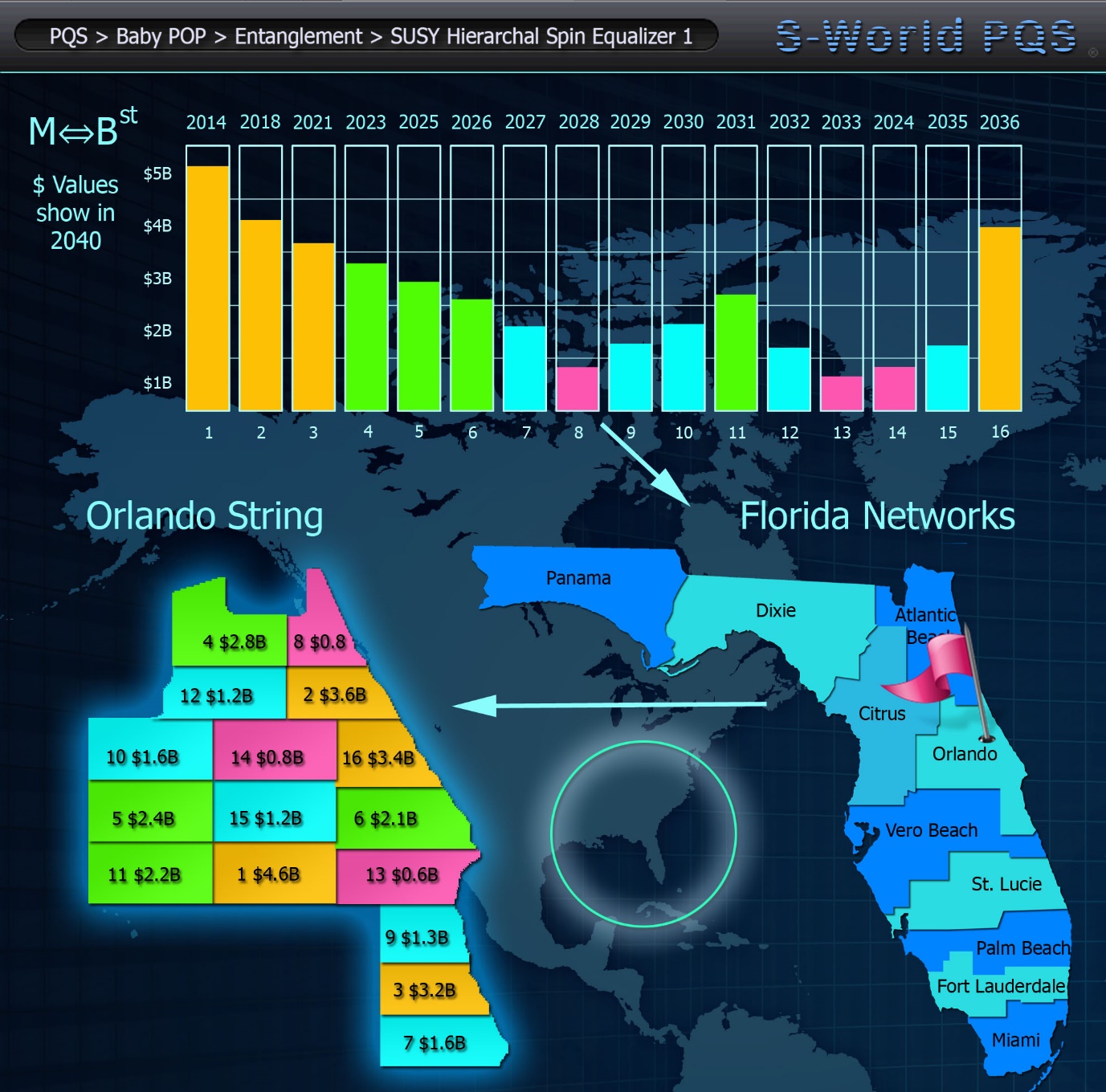

j. In 2028…

Lastly, in 2028, (AU:25), I have simulated a recession. So, one-price (subsidised/non-profit) goods and services increase. But all other such inputs are set to zero; as is aid, leaving the three-network Charter Cites which are scaled back to minimum contractual amounts, and still the network economy in actual cash grows, this time to $16,281,525,252.88 in capital reserves

k. ŔÉŚ Śpin – More than Zero

What if instead of the Law of Conservation of Ŕevenue rolling at the end of a year, it did so after 6 months? 3 months? Or less?

i. I can’t guarantee that it can, but I can’t see any reason why it can’t either. And if it can, then that opens the earlier spreadsheet: ‘ŔÉŚ 2024 to 2039 – Cautious Estimate – 1.32d’; which, by 2039, sees Malawi making about 0.4% of global GDP, or in the ‘Standard Estimate – 1.35c’ 1.85% of global GDP.

ii. So, if we can use Śpin in this way, it has the makings of an economic miracle, from which in the next book, Book 3. ‘The GDP Game,’ we could leverage expectations and see the same for many other countries in extreme poverty.

iii. Changing the landscape and indeed environment for the bottom billion, as with every Charter City comes significant ecological improvement and lower carbon emissions.

iv. Making this one of the only not FIAT plans on the table that could stop the poorest countries from becoming the new generation of carbon emitters in the mid twenty-first century.

5. The Ś in the ŔÉŚ Equation

Video 3. Point 5

https://youtu.be/EFJBwoBxeys (11.49 Minutes)

a. Now, we add Śpin, which creates a significant increase in GDP.

As I have previously said, I can’t guarantee that we can use Śpin this way, but I can’t see any reason why we can’t either.

So, instead of this section being a ‘THIS IS HOW’ statement, it becomes a ‘IS THIS ALLOWED?’ question.

b. What happens when we change from rolling over the Initial Ŕevenue once a year to rolling seasonally once every 3 months?

i. This would have the effect of increasing cash flow and GDP whilst lowering the rollover of Initial Ŕevenue the following year.

ii. I call this action a Śpin.

c. The following journey is for 2024.

i. If we look again at the spreadsheet, we now imagine that the $5,497,558,138.88 Initial Ŕevenue is now spent in January to March. And with an É of 90%, instead of rolling over to the next year, it passes the $4,947,802,324.99 to network companies to spend in April, May, and June.

ii. Technical note, in actual fact, it would be a little more than 3 months for the first quarter, and a little less than 3 months for the last quarter, but let’s put that aside for now.

d. We pick up the trail at Śpin 2 in (AK:36) in orange and see the $4,947,802,324.99 added to the 2024 Initial Ŕevenue of $5,497,558,138.88 in (AK:39) to create cash flow of $10,445,360,463.87 in (AK:41).

i. Where after at (AK:45), we multiply my current best estimate of the ‘CGV’ (The David A. Moss Cash Flow to GDP Variable) of 52%, which is my current best estimate at how much GDP is created from cash flow.

ii. For the mechanics of the ‘Cash Flow to GDP Variable,’ see the following tabs:

The Sienna Equilibrium 1.06 at (AI:211), 66.163% for the sector ‘Building Industry / Factories / Machinery.’

The Sienna Equilibrium 1.07 at (AI:211), 47.738% for sector ‘Building Supplies (Manufactured).’

From which I have estimated a 52% aggregate, which is (of course) to low given the 2 examples. But in general, it’s better to be too low than too high, so I have gone with 52%.

iii. This is telling us that on average, 52% of goods, services, real estate, and other items are produced as complete items that are sold to the public, government, other, or are traded; and 48% of cash flow has been spent on services, software, manufacturing parts, construction materials, or precuring raw materials and minerals.

iv. Therefore, in (AK:46), the cashflow of $10,445,360,463.87 with a ‘CGV’ of 52% will create $5,431,587,441.21 in GDP.

But why stop there?

e. Continuing to the right to (AO:36), we see a third Śpin, this time July to September, creates an additional cash flow $4,453,022,092.49 for a total cash flow of $14,898,382,556.36, and a GDP of $ $7,747,158,929.31.

i. Next, at (AR:36), we see Śpin 4, this time October to December, creates additional cash flow $4,007,719,883.24, for a total cash flow of $18,906,102,439.61, and a GDP of $9,831,173,268.60

ii. All from an investment of only $5,497,558,138.88.

f. The trade-off, of course, is that the more Śpins, the less Initial Ŕevenue passes over via the Law of Conservation of Ŕevenue to the next year; which gets eroded away as a factor of É multiplied by Ś.

i. In this example, Initial Ŕevenue in 2025 is still substantial at $3,606,947,894.92; which if added to the $2,534,030,708.33 in Additional Ŕevenue from the Spin Zero 2025 example, creates $6,140,978,603.25, an increase of $643,420,464.37.

ii. If, however, come 2024, the ‘Additional Ŕevenue’ is predicted much lower, which will (in any case) be an easy prediction to make, as the bulk of it comes from aid and selling the first Charter City; both of which will have been negotiated or not by that point.

Then, the safest strategy is to either adopt the Spin-Zero model in 2024, or try and increase É

g. The higher the É, the higher the 2024 and 2025 Initial Ŕevenue roll over will be.

i. We can test this by going back to the master controller at (AF:4) and changing it to 95%. But first check the current value of Additional Ŕevenue required in red at (AY:40) and see it is $1,890,610,243.96. And now, if we change É to 95% and check again, we see the Additional Ŕevenue required in red at (AY:40) is down to $1,019,762,675.02.

ii. Note: If you have not turned É to 95% you will see a different figure.

iii. In addition, an É to 95% changes the roll over from 2024 to $5,222,680,231.94 and lowers the need for Additional Income in 2025 if using Śpin-0 to $274,877,906.94.

h. How high can Śpin get?

i. The first Angel Theory ŔÉŚ Simulation I created started at Śpin-8 and went up to Śpin-24 by 2039. I created two variations; one was cautious that allowed for a leakage of É of 5% ‘ŔÉŚ-Śpin-24 V1.32d (Cautious),’ and one that did not have leakage ‘ŔÉŚ-Śpin-24 V1.35c (Standard).’

ii. You can see the tabs on the current spreadsheet.

iii. At (CZ:49), the cautious version made GDP of $457,669,054,602.76, which when added to outer network Malawi GDP creates 0.35% of global GDP (DE:64).

iv. And in the standard spreadsheet at (CZ:49), GDP is $1,700,241,463,096.99 (1.7 trillion US dollars) which when added to outer network Malawi GDP creates 1.29% of GDP (DE:64).

v. Now, do not get these simulations confused with myself saying that this is how things are going to be. This is simply me saying that, in this scenario, using the inputs given, this is what the current mathematical model shows However, this model is light years behind the simulation that I can create given the technical assistance to create the software products TBS™, BES™, VSN™, and UCS™.

i. One point that I have thought of recently, is that whilst it is less elegant, we can have different Śpins for different sectors.

i. When including delivery times for goods being exported from Malawi, the time it takes to make the trade, and send the raw materials etc. back to Malawi, manufacturing for export sectors demand fewer Śpins; whereas construction in Malawi could have more Śpins, and goods, agriculture and services that can be created and delivered quickly could have many Śpins.

ii. But before we go there and before I can complete ‘A More Creative Capitalism’, I must find out if Śpin can be used as prescribed, in part or in full.

For all my efforts, I can’t yet break it, but that does not mean it can’t be broken.

j. SUMMING UP

Applying Śpin and making several exchanges within a year increases cash flow and output but lowers the Law of Conservation of Ŕevenue rollover from one year to the next. However, if other conditions such as additional revenue are favourable, by raising É and Ś, huge cash flow and GDP can be created.

i. In addition, É and Ś can be used to conduct monetary policy. If, for instance, Malawi finds a grove at maybe É 93% and Śpin 12, then when the non-Network Malawi economy contacts, we can either increase É and Ś, so increasing cash flow and GDP within the network. Or one could lower É to 90%, increase Śpin to 16, and be happy to lose 5% of Initial Ŕevenue that year, which will have a very significant effect on the Malawi non-network economy and its neighbours. The effect would be relative to the size of Ŕ. But in Malawi and most AGOA countries, a few billion here or there would make a lot of difference, and could turn a recession into a year or higher than average growth.

ii. I hope this point is not lost on Paul Krugman and other new Keynesians. For sure, I think it’s safe to say that if not for the book ‘End This Depression Now!,’ this new application for the ŔÉŚ equation, would not be.

k. THANK YOU.

i. Thank you for watching this series of three videos on ‘The ŔÉŚ Equation.’

ii. The Videos end here but the paper continues…

6. AGOA-US Trade

The African Growth and Opportunities Act

a. In part 6, we take a closer look at trade via the AGOA – African Growth and Opportunities Act https://agoa.info; which, up to July this year (2018), has seen $15.15 billion in aggerate exports to the USA and shows the leading 15 exporters, of which Malawi is not one. Which is an advantage in that there would be no crowding out, but a disadvantage as there will be less infrastructure created around exporting to the USA.

i. My previous comment from part 2 still applies, this article has had very little research, just some ideas that have developed over the years.

ii. If one knows a little physics, consider this section similar to ‘the standard model’ which demands a lot of variables be added before it can make a prediction. It’s the same for this ŔÉŚ Simulation. To see which values for ŔÉŚ we will use from 2024 to 2026, we need values for items such as trade to make a better prediction of ŔÉŚ.

Or at the least I need to see them, so I can better evaluate it.

iii. However, once the prediction has been made; for example, É of 85% and Śpin 1 in 2024, É of 90% and Śpin 2 in 2025, and É of 90% and Śpin 3 in 2026; we can then focus on a model of trade that suits this model. Albeit, in practice, the math may work in reverse, in that trade is estimated, and then the ŔÉŚ model is built around it.

iv. The point is that all the ideas below are just ideas with little planning; which are presented to indicate what trade is necessary. It is more than likely that specifics will change. Indeed, the whole idea of a manufacturing and construction economy could change to a service and construction economy, albeit this would require a lot of technical assistance in the early years and a fair amount of hiring from across Africa and India for software engineers and the like. This, however, may be a good thing in the long haul, as this first wave of personnel will teach the rest of Malawi for generations to come.

v. Some key points in this article are how the trade flows from one network company’s exports to another company’s imports, efforts toward regional agglomeration, and how comparative advantage is conceded to international trade hubs (virtual networks).

b. Starting at column (AE:4), working right to the left, we see ‘High End Fashion.’

i. For example, I will pick Armani who may see the philanthropic and ecological initiatives as brand enhancing, especially when promoted by S-World Films and celebrities, are impressed with this or that social or ecological benefit.

ii. One appeal of Armani and companies like them is that their very inclusion makes the real estate ventures more desirable, in the same way a town with many Ferraris within would.

iii. The practicality in trade is that the manufacturing is relatively simple, and the goods and especially luxury goods are light, so cost little to export, and can (in some cases) be exported by air; albeit is not particularly ecologically-friendly.

iv. In terms of selling goods to the USA market, it will be almost infinitely easier to sell a brand such as Armani apparel compared to non-brand fashion, as it already has a market in the USA.

c. Now, moving to the left, we see in (AB:4) that the country of destination is the USA.

i. Despite the geographical distance being a disadvantage, the USA makes sense as the primary export market due to AGOA – the African Growth and Opportunity Act; which was introduced to me recently in Paul Collier’s books ‘The Plundered Planet’ and ‘The Bottom Billion.’

AGOA offers tariff free trade to the USA if the ROO (Rules of Origin) are adhered to.

ii. The ROO ‘rules of origin’ are that the components within the item traded; for instance, the fabric, can only come from another AGOA country; see https://agoa.info/profiles.html, which include all Southern African countries.

iii. Note also there is a quota system on apparel, https://agoa.info/data/apparel-quotas.html, that would need to be adhered to.

iv. At a guess, I would say that one may also use components made in the USA, but I am not sure.

v. The $154,618,822.66 (AG:4) that is attributed to this trade is, in fact, much less; as in place of one company, there would be many, and this network of companies would have been specifically created to adhere to all AGOA rules and even to predict new rules and adhere to them.

vi. Note, however, that the actual cost of sale found at (L:4) is $343,597,383.68 which includes labour, all taxes, repayment of interest.

vii. In addition, from this $343,597,383.68 – 3.125% will pay for software and S-World film development, and other operational costs are in the mix. Albeit the following costs: accounting, marketing for 1st Tier pricing, all technology development and rent are included; the latter being due to companies buying their buildings before 2024. And in many cases, electricity will only be the cost of upkeep on the solar arrays, as these too will have been bought prior to 2024; or if not, will be bought from future profits.

So, running costs are low, lower than most like for like businesses.

d. Next, in (AA:4), we see that the ‘High End Fashion’ goods are traded for ‘Raw Materials & Small Parts.’

i. This trade and others will have been facilitated by a set of (desirably) more than 10,000 individual S-World virtual companies and websites across the USA; which come into being via the Villa Secrets network and others in complimentary industries such as luxury travel.

ii. Then, as and when the TBS™ and other software adapts to retail and connects to sources of luxury goods, the luxury real estate and travel companies will have the option to sell luxury goods from their current high-end travel and real estate websites; and, as the cost by then will be almost zero, each trade hub will revive more dedicated websites, this time focusing on selling luxury goods with a minor in luxury travel.

And over 2020, 2021, 2022, and 2023; these companies will carve out as much market share as possible, which with maybe 50,000 or so local S-Web websites, could end up as a lot, especially when marketing is expertly applied.

iii. In (AA:4), we are seeing ‘High End Fashion’ traded for ‘Raw Materials & Small Parts’ at a comparative advantage, but the comparative advantage will probably get absorbed by the trading hubs; and in an ideal world, the trading hubs’ profit would be the comparative advantage.

iv. Next, in (X:4), we see that the ‘Raw Materials & Small Parts’ bought from the sale the USA of ‘High End Fashion’ end up as the hi-tech components within ‘Goods 1 Technology.’

v. Next, we go back to column (AE) but this time (AE:5) and see that we have the same ‘Goods 1 Technology’ sector. This time in (AB:5), it trades with AGOA countries and in particular its neighbours. This time for ‘Raw Materials & Small Parts 2’ which are in (X:5) sold to ‘Goods 6 (Parts for Goods).’

e. Now, we have seen this, the rest of the items are relatively self-explanatory.

But I will go into detail on the Gigafactory idea.

i. I was introduced to the Gigafactory by Leonardo DiCaprio’s ‘Before the Flood’ documentary, in which Elon Musk shows Tesla’s Gigafactory and tells that the Gigafactory makes specialist batteries. But this factory will only meet 1% of demand; and that, in time, another 99 are needed.

ii. Since this documentary was made, Musk has started another two, leaving 97% demand.

iii. One idea is that the Malawi Network devotes about half of its investment into building a Gigafactory, with say 25% spent on services and manufacturing needed to support it and say 25% spent on construction.

iv. This is different to what we see on the spreadsheet and would see most Malawi Network output being batteries.

v. Another avenue is that the Gigafactory investment is made on top of the current plan.

f. There are 4 solid reasons why Elon Musk may wish to encourage Tesla and SpaceX in this direction.

i. The Malawi Network is a prototype for MARS Resort 1 which, in turn, requires SpaceX for transport.

S-World VSN™, in its resort development mode, combined with S-World UCS™ (Universal Colonization Simulator) will create MARS Resort 1 as the current end of the MMO Game; which can (in turn) massively popularize the idea of life on Mars, which (in turn) would significantly increase the popularity of SpaceX as the essential transport corridor, without which the game is just a game.

ii. In the Malawi and other earth-bound Grand Networks / Charter Cities, all real estate sold (including commercial and industrial) is marked up by 6.25% which must be spent on non-combustible fuelled transport.

iii. This has been a rule since American Butterfly in 2012; albeit back then, it was just that the Charter Cities would only allow electric cars, and since the idea to popularize the sale and production of the cars is to include them with the cost of real estate.

iv. This idea was created long before I knew of Tesla, but it can be very advantageous for Tesla.

v. Further, on the 2039 spreadsheet tab: ‘ŔÉŚ-Śpin-24 V1.32d (Cautious),’ at (CZ:77), we see that in 2039 – 5% of cash flow equalling $41,807,616,610.10 is destined to Tesla.

vi. And I dare not say how much the standard model predicts!!!

vii. Note also that another 5% of cash flow equalling $41,807,616,610.10 is in this simulation going to a Gigafactory.

viii. Also note that 10% of cash flow is assigned to ecological projects from www.angeltheory.org/book3-14/ripple-effects-and-elephants-for-paul-g-allen and others added in the future.

ix. And a further 5% is for creating desalinization plants, in part for other future country-sized networks in desert locations; but, also, in many other locations in the world where they are running out of water.

x. Cofounder status of S-World UCS™

Whilst I’m sure, if they are too busy, it would be awesome for Elon Musk and Mark Zuckerberg to help with the main S-World UCS™ MMO games, which would have certain characteristics from Sid Meier’s Civilization, a game we all enjoyed.

This aside, S-World UCS™ will have many profitable applications.

It and S-World VSN™ are my current prediction for most powerful and profitable systems.

xi. The S-World GT Idea – Google-Tesla, fully autonomous cars and infrastructure allowing Malawi to be the world’s first country to widely adopt driverless technology. And if Google sees the merit in building a Charter City, their city can also be constructed around their flying cars.

xii. In leaving, a reminder that the different sectors do not currently balance into a perfect ‘your spending is my income’ symmetry.

xiii. However…

xiv. In place of 32 sectors will be hundreds of companies which makes balancing the symmetry a lot simpler.

xv. If we were to add Śpin, it would also make balancing easier.

xvi. One may not need to balance, maybe some sectors will grow faster than others, or new industries are added.

g. Post Script

Trade becomes easier with more countries following the same system, which is the subject of Book 3. ‘The GDP Game.’

7. Tax, Labour, Interest on Debt, and Malawi FL

a. Tax – Network Credit Allocations to Government

The Malawi Network seeks to adopt one single tax, in place of the many taxes that are poorly collected and generally low compared to Western governments.

i. We see tax in column (M) as 18.75%. However, 15.525% of labour’s income is effectively in place of income and salary taxes and is spent on items that governments would like to spend on if they had the money, education, welfare, and social housing (albeit very nice social housing). For a total, in a Spin-Zero environment, of 34.375% of Malawi Network Initial Ŕevenue spent on projects that would usually be governmental. For a total of

$1,889,785,610.24 in 2024 on government assigned spending in Network Credits.

ii. 34.375% of tax, with no evasion and a high chance of increase as additional Initial Ŕevenue is generated, is certainly a progressive tax rate. And few, internationally, would use this tax system as a reason to deny exports, or in general be disapproving.

iii. The difference, however, is that the tax must be paid in Network Credits; and that the government never actually sees the money, instead, it allocates spending of 34.375% of Initial Ŕevenue.

iv. If that detail may make one think twice, remember that (with the exception of companies that have become S-World companies, which by 2024 would only be a small fraction) Malawi still has most of the same tax base that it used to have from the rest of Malawi, that will be sure to rise as the network GDP increases.

v. In great addition (if permitted), the ŔÉŚ Śpin model sees tax receipts on the Initial Ŕevenue close to 100% of Initial Ŕevenue on the spreadsheet tab ‘ŔÉŚ-Śpin-3 V2.05.’

With 2 labour sectors and 3 government generating $1,717,986,918.40 in column (D:23), the same in columns (U:42), and the same once more in column (AJ:75), for a total of $5,153,960,755.20 in government assigned Network Credit spending.

vi. Or if we look at tab ‘ŔÉŚ-Śpin-8 V1.32d (Cautious)’ at (AN:87), we see $13,416,862,712.86 (É-95% Śpin-7 in 2024).

vii. And by 2049, on tab ‘ŔÉŚ-Śpin-24 V1.32d (Cautious)’ at (CZ:87), we see $213,061,977,646.26 (É-95% Śpin-25 in 2049).

viii. Or in extreme macroeconomics, É 100% and Śpin-25 ‘ŔÉŚ-Śpin-24 V1.35c (Standard)’ at (CZ:87), we see government allocation of $810,452,558,653.10.

This simulation is however, in my opinion, only useful as an academic exercise in maximum electricity forecasting; it’s academic, not practical. However, it could be used occasionally, when the world economy slows down, É and Śpin can increase so providing stimulus when needed, this would seem to be an improved method of fiscal policy versus lowering interest rates, as interest rates are not much use when near zero percent.

b. Labour –Spartan Contracts 2018

Supplying Villages, Real Estate, Network Credits, and Cold Hard Cash

Spartan Contracts were originally created in American Butterfly 2012 for the second Charter City, the Orlando Network Simulation. What follows is the latest adaptation of Spartan Contracts for the Malawi Network.

i. At (R:26), we see 25% of Initial Ŕevenue being $1,374,389,534.72 is deducted for labour, this is apparently significantly higher that most emerging economies, and reflects the desire to pay well in profit share.

ii. Of course, like everything else, ideally, payments need to be made in Network Credits; and each Charter Town or City will need to provide most items people would wish to buy and reasonable prices.

iii. Practically, however, we can assign say 5% of É leakage to personnel, that gives $274,877,906.94 in cash that can be spent that year.

iv. One development of Spartan Contracts that has been created due to the different needs between sub-Saharan Africa and the USA is to include a form of welfare; where a percentage of wages and profit share were given to villagers from the personnel’s own village and family if not already benefiting from another S-World Network initiative.

v. We see this at Y:35, 36, & 37. Starting with Y:35, we see Food and Drink is provided. This can be done in one of two ways; in this example, Luxury Goods are made and traded with Malawian agriculture.

vi. However, this has the problem of distribution, as we are targeting 256 locations evenly spread across the land. So, it may make sense, certainly in early years, to make electronics and luxuries (not meat, tobacco, or alcohol) that can be traded within the rural village community, as this type of arrangement already has a market.

vii. African villages are full of entrepreneurs, and this initiative just feeds the existing market, and requires no infrastructure other than electricity, which is handled separately.

c.

One idea that I am particularly fond of is the behavioural economics idea that in these 256 locations, long before 2024, S-World emerges simply as a football league, paying about $1,000 a year per man/woman for maybe 50 people per location, which would cost $12,800,000.00; plus, maybe the same again for facilities that are, in fact, paving the way for a Charter Town.

i. Such a set up creates a team that will be motivated to win their league, as half their income will be prize money for wining their games.

ii. The salary allows full time training, both men and women teams; which might be half football and half training for future Malawi Network jobs.

iii. Having the strongest and the fittest and (in many cases) the most ambitious men and women in a specific catchment area is, in my opinion, the best base to grow from; as it is starting with what many do for fun, and can be performed with almost zero infrastructure, just a field, of which there are millions in rural Malawi, some goal posts, and maybe some grass.

iv. Men and women from the local team will have opportunities at network positions and could lead the way to a company being created in their area; which would (on average) employ about 80 personnel, who from their salary deduction for welfare see maybe an additional 250 people join the football club, but mostly in education roles.

And with a twist, the women’s team would win more money than the male, which has too many positive externalities (ripple effects) to mention.

v. See my article to Richard Thaler’s Nudge team on ‘The Behavioral Economics of Football Leagues and Paying Women More.’

d. In (Y:36), we see education and technology, that can only come after solar arrays have been installed; and the technology, tablets, and VR goggles are delivered. Where after, the S-World football club takes on more members and most spend their time learning in very different ways to what has been tried in the past. This is, however, a very long conversation and is the domain of S-World VSN™ Virtual Social Network.

i. In (Y:37), we see health care, which features a medical centre at the football club which is now growing into a small town.

ii. Albeit in truth, in 2024, I would prefer health care to come from aid, not investment; which progressively migrates to a Malawi Network liability over a handful of years.

e. In (Y:38 & Y:39), we go back to a 2012 American Butterfly idea and Spartan Contracts for most or all personnel; which essentially commit to 16-year contracts that when completed, see the Spartans owning their own home.

In some cases, this may be in rural villages; but as is more likely most profitable for the Spartans is that their homes be built in the suburbs of Charter Cities.

i. If say Harvard Business Management or Yale’s David Swensen see wisdom in building a Charter City, they may have 40 square miles; half nature reserve, and half following an updated version of The Locations Butterfly including a manufacturing sector, artificial lake, and even mountains (well at least big hills).

ii. Where after, the surrounding 200 miles or so will again be half nature reserve and half suburbs; new towns that will become very affluent neighbourhoods in the decades that follow.

iii. Spartans can live in these neighbourhoods or sell their homes and move back to their villages and live like kings.

iv. Note, however, that there are many safety measures in place to make sure a new breed of elites is not created. Currently, this is set to be described in the final chapter of ‘A More Creative Capitalism.’

f. Lastly, in (Y:40, Y:41, & Y:42), we see items that our Spartans might like to buy with their Network Credits.

i. These are the Spartans disposal income and as mentioned earlier, some of this spending can be in cash dollars.

ii. Also, it would make a lot of sense for some non-network business to accept Network Credits as a means of payment, particularly if the main items they sell can be bought wholesale at competitive prices from other network businesses.

g. Interest on Debt & Investment Model 1

As with the trade inputs, this section is necessary to test the ŔÉŚ hypothesis and may well change. I have not read nearly enough books on finance and investing to be particularly sure.

i. As you have seen in 2024 – $5,497,558,138.88 in investment is used as cash flow for business operations in 2024. However, as much again in investment, plus technical assistance, and some aid; for instance, the supply of solar arrays and internet infrastructure, would be useful.

ii. As we seek to create at least one large town similar to Foxconn City, which was introduced to the project by Dani Rodrik’s book, ‘Straight Talk on Trade: Ideas for a Sane World Economy’:

iii. “Despite the evident reduction in transportation and communication costs, the production location of globally traded products is often determined by regional agglomeration effects.

When the New York Times recently examined why Apple’s I Phone is manufactured in China rather than in the United States the answer turned out to have little to do with Comparative Advantage. China had already developed a massive network of suppliers, engineers and dedicated workers in a complex known informally as Foxconn City, that’s provided Apple with benefits that the United States could not match.”

iv. Exactly how much it would cost to create this environment, I can’t say. What I can say is that it will be a lot less due to the S-World UCS™ simulation software, which will work out which business we need and which we don’t; and that if permitted, we can apply the ‘Law of Conservation of Revenue’ and Śpin if a high enough É can be applied.

h. Assuming, for now, that in addition to ŔÉŚ increasing the money supply; aid and technical assistance of $5,497,558,138.88 in investment capital and set up costs are adequate for set up operations prior to 2024. Which is added to by a further $5,497,558,138.88, which pays for 2024 operations and initial stock/material purchases costs.

i. Then, I propose that we only seek investors that wish to set up operations in Malawi. And because of this, we can pay back the interest in Network Credits.

i. If not already purchased by 2024, some of this revenue could be spent on commercial to real estate to house their operations in the new city; some can pay for or boost personnel salaries, and some could pay for goods needed to produce other goods, or (in fact) anything that is for sale via the network.

j. As a result of development of both the Villa Secrets network and the super coupling equation, in general, companies must be at least 50% owned by the personnel who will work there.

So, I propose standard companies be half owned by the investors (POP applies, so most profit is used to expand or create more companies) and half by the personnel. And after the company income has reached a marker (maybe 4 times initial value), the company splits and another 50% is allocated to workers; and this distribution can take place over the next 50 years, with all new personnel being equity holders.

i. The allocation of jobs and equity will, however, be micromanaged so that equity is distributed as widely as possible across the whole population, making sure we avoid creating a new elite that could destabilize the process.

ii. Note also that empowering the day to day workers and managers makes a lot of sense from a business perspective. And indeed, is the backbone principle of the Virtual Network (all companies not in a country with a Charter City).

iii. And as most workers are stakeholders, destabilizing unions would have few, if any, members.

k. So, in 2024 and the immediate year that follow, investors own half the company, with the other half owned but by the personnel.

i. In 2024, I have worked on the principle that the network of companies as a whole breaks even, with personnel profit share being the mechanism to create an even result.

ii. So, if companies do as predicted, personnel get a 10% share of profit. But if they end up 10% or more behind, personnel get only their salaries.

l. Then, in 2025, when the companies make actual profit, they follow the POP Investment system from Chapter 2; so effectively, all profit is used to either expand the company or start new companies.

i. These new companies could be in locations such as California, which would make profit that is not in Network Credits, and some profit from these companies can filter back to investors.

ii. POP Investment could also be in Malawi Network companies or Charter Cities, from which real estate could be bought via POP Investment and then sold to realise a profit/return.

iii. However, the ideology we are most looking for is companies that are keen to see their Malawi Network investment grow and grow. For instance, a technical and service operation for Facebook, Microsoft, Google, Virgin, SpaceX and others. Albeit in these cases we might not be able to share ownership with personnel.

m. Next, is the second $5,497,558,138.88 that creates the 2024 cash flow.

i. In (U:27), we see a repayment of $343,597,383.68 in Network Credits to investors; which is 6.25%, which is not a good return.

ii. However, if we look at the ‘ŔÉŚ-Śpin-3 V2.05’ tab, we see double this figure at 12.5%, and the intention is to increase to 25% at a specific Initial Ŕevenue target. Maybe $43,980,465,111.04, at which point, the extra 12.5% a year on $5,497,558,138.88 is water off a duck’s back.

iii. So, really my current investment model is a Śpin more than zero model, so that a 12.5% return is available from 2024, and investors see a very real path due to Śpin for achieving the 25% return.

8. The First Followers

a. Continuing from the previous point, it’s one thing to have an investment plan and another thing to find investors.

i. In ‘How Google Works’ by Eric Schmidt and Jonathan Rosenberg, we hear the principle of the first followers and an anecdote about a drunk crazy man dancing on his own on top a small hill at a music festival; all it took was for another to climb that hill to create a movement. And, in no time, the hill was full of drunk crazy dancers.

ii. For over 7 years now, interconnecting business plans for Virgin, then Microsoft, then Google, then Facebook have been prepared; and now the plans are epic, and as the network is strongly ecological and philanthropic, with a passion for space, which ticks boxes of the founders of these companions, there is every chance these will be the first followers, and in addition Elon Musk’s Tesla and SpaceX.

iii. With the above as first followers in our Malawian Charter City, others will follow.

iv. There is a lot more to say of course, but right now, seeing as the objective is to speak to the founders of the above companies and hope to gain their technical support in the creation of the software, or at least prototypes of the software; the plan to work with the above, its enough of a plan for company recruitment on a broader scale, as with such illustrious first followers / cofounders, many opportunities will no doubt arise. Virgin, for instance, is a network of over 300 different companies; many of which could see value in inviting in the Malawi Network. And if we can use Śpin as described, all mostly probably will.

For this reason, the first sensible action is to make sure I can use the ŔÉŚ Equation as described. And if it turns out to be wrong; well, given a high É, I believe that there are more conventional ways to increase the money supply.

9. What If

a. So, what if ŔÉŚ is in some way shown to be a false hope?

b. Well, in this case, we could follow one of the standard Western method for increasing the money supply. And to introduce this point, let’s hear from Paul Krugman’s book End This Depression Now!, Chapter 4. BANKERS GONE WILD.

c. Before the 1930s there were two main answers to the problem of bank runs. First, banks themselves tried to seem as solid as possible, both through appearances— that’s why bank buildings were so often massive marble structures—and by actually being very cautious. In the nineteenth century banks often had “capital ratios” of 20 or 25 percent—that is, the value of their deposits was only 75 or 80 percent of the value of their assets. This meant that a nineteenth-century bank could lose as much as 20 or 25 percent of the money it had lent out, and still be able to pay off its depositors in full. By contrast, many financial institutions on the eve of the 2008 crisis had capital backing only a few percent of their assets, so that even small losses could “break the bank.”

d. Now, I can’t say for sure about the logistics and capital controls for transferring billions of dollars in cash to sub-Saharan countries, but I expect the where there’s a will there’s away for this to occur.

e. With this item put aside, for now, let’s say that all the 2024 investment of $5,497,558,138.88 is transferred in USD in cash to Fort Malawi, as described in the ‘A More Creative Capitalism’ chapter: The Spartan Theory; which to sum up in one sentence is desired to be the home base for an international collection of military, police, and rangers tasked with protecting Africa’s Elephants and Rhinos, per the Experience Africa initiative, the first of the 26 Special Projects told in the ‘Ripple Effects and Elephants‘ chapter.

f. Inside the security of Fort Malawi, I think it’s important for people to see all the money; which if the first Jack Reacher story is anything to go by, would create a mountain of money, which I suggest being in an underground vault with a see-through roof, made of plastic that can withstand a conventional missile, just in case.

g. Now that the scene is set, we can work with the story we have just heard, in which US banks are said to be very cautious if they hold 25% of money in the bank and lead out 75%; then so can the Malawi Network central bank. So, with $5,497,558,138.88 in cash for all to see in the bank, it can increase the money supply by issuing $5,497,558,138.88 x 3 = $16,492,674,416.64 to the network business, and at Cash Flow to GDP Variable of 52% generate $8,576,190,696.65 in GDP.

h. Of course, the problem comes from the Network Credits, as companies can’t pay non network supplies with them (albeit, maybe in some circumstances, they could); and in fact, this bracketed point is worth some thought, because if non network suppliers were happy to take Network Credits or trade for something produced by the network, which is basically the same thing, then the Western method for increasing the money supply would work well.

i. However, if suppliers were not willing to accept Network Credits (or S-World has prohibited this from happening, as maybe it would adversely affect local currency), then we need to consider that if É is 90%, in this model it is 10% leakage x 3. As É applies to all three sets of companies that receive the $16,492,674,416.64, and that when we calculate É leakage, it must be $16,492,674,416.64 x 10% = $1,649,267,441.66, which will have to be paid from the $5,497,558,138.88 in cash, leaving $3,848,290,697.22 in the central bank; which will either have to see additional income of $1,649,267,441.66, which as we have seen is within the margin presented, but is far from comfortable, or one must seek a higher value for É, or business outside of the network would need to accept Network Credits as tender.

j. Which creates a similar way to expand the money supply relative to what ŔÉŚ could, with higher income models simulated by decreasing the amount the network central bank needed to hold in actual currency or increasing É.

k. Or of course, one could do a combination of the above and ŔÉŚ?

Currently, I have not given alternatives to ŔÉŚ much thought as ŔÉŚ seems perfectly adequate, if permitted.

l. Before moving to the ‘ŔÉŚ on MARS Thought Experiment’ section, I will leave with a quote form Robert J. Shiller’s book ‘Finance and the Good Society,’ as it re-orientates this article back to the primary point, which is to help the poorest citizens of the world and create the 26 Special Projects (and many more that will follow) which are created as ripple effects of the Malawi Network and others like it.

m. “The financial system conforms to a large degree to financial theory, which has a sort of beauty that can inspire minds, but also a sort of ugliness, at least in its present form.

The financial crisis that we experience from time to time are only part of the story, that ugliness can provoke some to dismiss the whole concept of financial capitalism. But it would be foolish to do so, for that would cost us the ability to accomplish some of our most cherished goals.”

Finance and the Good Society – Robert J. Shiller

ŔÉŚ on MARS – A Thought Experiment

Let us end with the thought experiment that at the end of 2017 brought ŔÉŚ out of the doldrums where it has sat since 2013.

Imagine that, in 2048, Elon Musk’s SpaceX assisted by Sir Richard Branson, Paul G. Allen and others have delivered on their promise to create a transport corridor to MARS; and a base called MARS Resort 1 was under construction. This environment is logistically perfect for the ŔÉŚ equation to become the base economic factor for the development, and the bold space pioneers and entrepreneurs who are laying the foundations of a sustainable colony on MARS.

1. MARS Resort 1

4 Logistical Challenges

Presenting 4 ways in which ŔÉŚ is easier to implement on Mars than on Earth.

a. Personnel Paid in Network Credits

Other than saving money to send back to earth or buying imports, the only way to spend money in MARS Resort 1 is with one or another MARS Resort 1 company, operation, or member of personnel; and so there is no problem paying in Network Credits, which are currently like US dollar gift vouchers that can only be redeemed at network ventures and have an expiry date.

b. Trade is Simpler

Trade on MARS Resort 1 is far simpler than on earth; as the only non-inner resort trade is via spaceships whose cargoes are infrequent and easily monitored. Imports will come, but I expect the only export will be valuable minerals, metals and novelty items such as items made from Martian’s rocks.

Because trade is simpler and infrequent, one is far less reliant on it, one must plan to make as much as possible on Mars.

c. Antitrust

In MARS Resort 1, especially in the early days where everyone was working to create the colony, the idea that the operation would be deemed anticompetitive is absurd.

d. Tax

Quite simply, a MARS colony, be it 10 people or a hundred thousand, can make up its own tax system without any fuss.

Now, please take a leap of faith and imagine that Elon Musk and other space barons, including Richard Branson and Paul G. Allen, had looked over the 7 years of S-World Grand Network (New City planning) and had mentally bought into the MARS Resort 1 Network; and wished to create a prototype Grand Network (Charter City) on earth to test the theory before spending the many hundreds of billions of dollars on MARS Resort 1.

2. Finding a Similar Country to MARS on Earth

Our thought experiment now continues by trying to find a country similar to MARS. First, we consider GDP, MARS starts with Zero; and by the time there are 1000 personnel, it will still have a small GDP relative to earth countries. Therefore, to find a country that could most easily follow the MARS Resort 1 plan and adopt ŔÉŚ, we need to start with a country with a very small GDP, and very little infrastructure. In essence, a location where we can basically start from scratch, just like on Mars, albeit not quite.

Many of the AGOA countries would do, and so far, Malawi seems best with a reported GDP of $5.5 billion and lots of unproductive farmland; half of which can be developed and the other half returned back to a forest, to create more oxygen, and in general make a rich environment at the reforested nature reserve would strategically entangle itself with the 16 Charter Cities and 256 Network towns.

a. Personnel Paid in Network Credits

This question is now 6 years in development, and one can see it was a major part of the first American Butterfly – S-World UCS ™ chapter in 2012.

The first up to date solution to this was to pay in Network Credits; and make sure that if É was 90%, that 90% of whatever personnel spend their money on can be provided at a competitive (or best) price by the network.

However from a practical point of view, especially in the early years we can assign half of the non-Network Credit spending, the 10% leakage from É to personnel, so effectivly about half of their disposable income can be in actual USD that can be exchanged for or Malawian Kwacha.

b. Trade

Trade is far more complex on earth than MARS; and for a while, this looked like it could unravel the Malawi Network plan, until Paul Collier the Oxford University professor of economics and public policy, introduced AGOA and free trade with the USA; or alternatively, EBA which is a more complex arrangement with the EU.

However, it’s one to thing to have the opportunity for tariff free trade, and another to sell your goods. This problem can be mitigated by choosing the investing companies well; companies such as Armani, or Tesla’s Gigafactory which create products that have a niche consumer base and are far easier to sell, due to their branding.