The Theory of Every Business

American Butterfly 1

The Theory of Every Business

By Nick Ray Ball 16th April 2012 to 27th July 2012

INDEX

Retrospective Introduction

“Add Introduction”

Page 4: Before Reading

Introduction

“Einstein Says….”

Page 10: General Summary

Chapter 1

Economics, S-World & the Core Network

Page 16: US Economic Analysis

Page 22: S-World Virtual Business Network

Page 28: The Core Network

Chapter 2

The Suppliers Butterfly

Page 31: The Suppliers and Manufacturing Butterfly

Page 45: A Brief introduction to POP

Chapter 3

The Theory of, just a little bit more than we know now

Page 42: The Universities & “Spartan Contracts”

“The Theory of Just a little bit more than we know now”

Page 54: Super University Resort Hospitals “SURH’s”

“The Theory of more than we know now”

Page 56: Alternate Energies

“The Theory of a lot more than we know now”

Chapter 4

The Locations Butterfly

Page 62: Location, Location, Location

Page 64: The Locations Butterfly

Chapter 5

Economic Stimulus & Investment

Page 70: Economic Stimulus and Investment

Page 74: Phase one Investment

Chapter 6

Facebook Business Development

Page 80: Facebook Business Development

Page 82: Facebook Gifts

Page 86: “Lx.”

Page 89: Facebook Stores

Page 93: Cities of Science

Page 103: All Facebook Profits Condensed

Chapter 7

S-World

Page 106: Sienna’s World

Page 108: S-World Virtual Social Network

Page 114: S-World Virtual Business Network and Software

“Philosophical String Theory”

“String Theory”: A Genuine Contender for the “Theory of Everything”

By Nick Ray Ball May 2nd 2011

Nick Ray Ball: “Would mathematics in whatever form predicting future events partially validate the theory”?

Anthony Rauba: “Some but not all of the math is, thus theory, but as to predicting the future? I refer you to Asimov’s “Psychohistory” from Harry Seldon of the “Foundation Series”.

“You may not predict what an individual may do, but you can put in motion, things that will move the masses in a direction that is desired, thus shaping if not predicting the future.”

Nick Ray Ball: “The only way to accurately predict the future, is to make it happen”

Apple’s 1997 turn around “Think Different” Campaign: “It is only those crazy enough to think they can change the world that can.”

Margaret Mead: “Never doubt that a small group of committed citizens can change the world. Indeed, it is the only thing that ever has.”

If you are reading this, you are one of those citizens

The Theory of Every Business

Retrospective Introduction

add introduction!!

American Butterfly

The Theory of Every Business

Introduction

Einstein Says

Page 10: General Summary

General Summary

9.50 pm: Monday, 16th April 2012

Dear Tanya

Welcome to “American Butterfly” and the 43th Chapter of “The Spartan Theory”.

Part business plan, part hypothesis, on the one hand we have a business development plan destined for Facebook, on the other a hypothesis as to how such a plan could assist the US and Eurozone economies. We shall start with this sub-chapter’s name: “Einstein Says…”

Until August 2011, all I knew of Einstein was “big hair”, “clever bloke”, and I probably knew he wrote the equation E=MC2, I really can’t remember.

I can remember not knowing what the “C” stood for, and being surprised to learn it was “The Speed of Light”, which in my eyes made the equation cool and interesting. Since then I’ve done some research, which I’ll not get into right now; I prefer to cut to the chase about the title.

Einstein says: “If you can’t explain something simply, you don’t know enough about it.”

As such, if I can’t explain the “American Butterfly” thesis to all, I don’t know enough about it.

“American Butterfly” is not traditionally academic; its workings are not influenced and are not an extension to university-based teachings. Attempting to present the work in a “hi brow” manner akin to a government report, or a business plan made by a collection of academics, seems deliberately off-putting. Hence the thesis is written in a simple manner, so as to be clearly understood by all.

The Project’s Ambitions:

“American Butterfly” seeks to create a global network of qualified businesses and to use part of the money raised to assist economies. In the case of the USA, the network will absorb the federal Medicare and Medicaid liabilities, which combined with a few other initiatives, will evoke long term confidence, and with long term confidence restored, growth will return.

The Core Network:

The project inspiring this thesis was started in 2000. By 2004 it was a world’s first in virtual low bandwidth technology combined with a global distribution network to be displayed on the internet and TV. Since then, many have assisted, creating components added in various areas. In April 2011 two lightning bolts of inspiration saw the project change to a 24/7 operation, A few thousand man hours and hundreds of pages of details later, “American Butterfly” is presented.

Already with a next generation on-line global networking concept that had attracted the interest of a major conglomerate, the first lightning bolt was for the network to be owned by the companies on the network, like the internet where no single company benefits, but instead, all that use it receive the benefits. In addition it was decided the profits which normally would be destined for its creator, should be used for philanthropic endeavors and economic stability initiatives, increasing brand awareness, generating good PR and safeguarding the very structure which is key to all businesses successes, both on and off the network.

The second lightning bolt was to make the thousands of local operations’ centre’s needed to support the network independently profitable. Basing them in resort-styled property developments would result in all the building companies and suppliers morphing into the core network. Closely followed by the companies and suppliers already involved in the trade within, all to be synchronized by the same financial and business software, and all eligible for assistance from the Operation Centre.

Investment comes from such companies, alongside big business and technology firms, including investing in and owning the network, this would result in the companies jointly owning the resort, thus hedging investment with a capital asset, and so making the resort development’s success not reliant on selling property.

Chaos Science:

On the 1st of May 2011, theoretical sciences were introduced to the project; they are now a key ingredient. You will not find “Chaos Science” in the dictionary. For all intents and purposes, I made it up. I needed a name for the projects’ mathematical inspirations and “Order Theory” sounded like a dark Orwellian novel.

The basic principle is to use a mathematical sequence of numbers that are not infinite, and with the aid of software create an economic framework which can support long term predictions. This is achieved by boxing profits from each resort company network at a fixed figure, such as $2Billion. Profits are then injected into the next resort network, which has the immediate advantage of seeing a new set of tenders and consumers.

Where this principal really makes a difference is within what is called: “The Pressure of Profit” (POP). Once two resort company networks simultaneously reach their profit limit, the flow of capital into the third has greater force, therefore the more companies, the higher the pressure, and the faster new resort networks are created. This principal sees the first (parent) resort company, owning stake in all future sibling companies, as their cash injections are returned in the form of real estate, industry, or commercial buildings alongside a new income generating business.

Economic Black Holes:

The “American Butterfly” business model, concentrates on the “Profit vs. Revenue” ratio of all networked companies and employees.

For instance, if a resort development spent a total of $3Billion on construction, half of which went to suppliers, current estimates show a 59% “Profit vs. Revenue” ratio, for every dollar spent, 59 cents are returned to resort companies as profit. In comparison the Fortune 500 has an average of just 7.5%, as this ratio is not important to them, as long as they make a profit and return dividends to shareholders, then all are happy. It is, however, an economically poor business model, as for every cent they make, someone else loses the same amount.

Adding all taxes with the exception of corporation tax, results in an average of 18%; as such the real “Profit vs. Revenue” ratio goes up to 77%, leaving an economic black hole of 23%. A software initiative called the “PQS” (Predictive Quantum Software) is specified to monitor and decrease the black hole percentage.

American Butterflies:

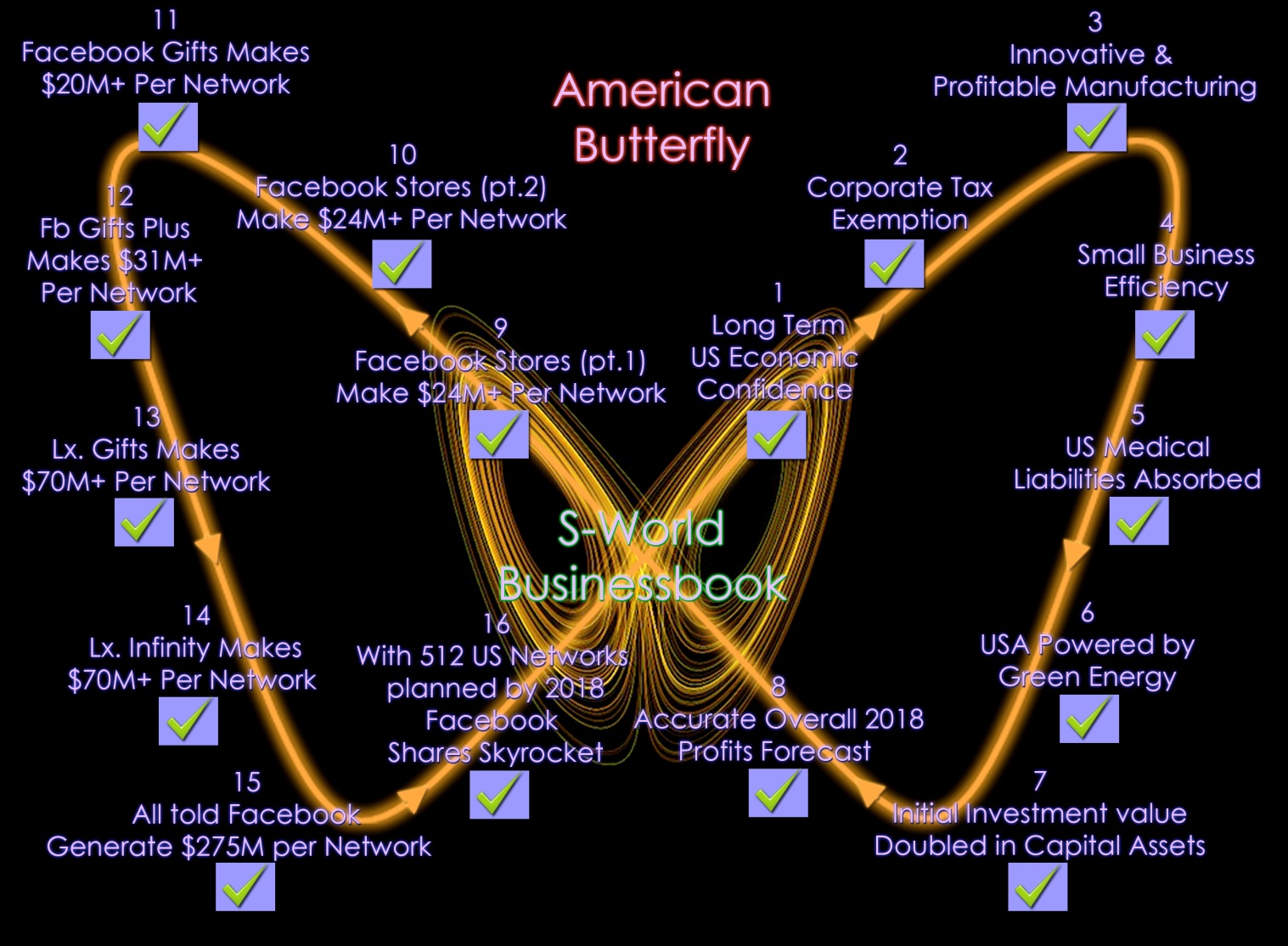

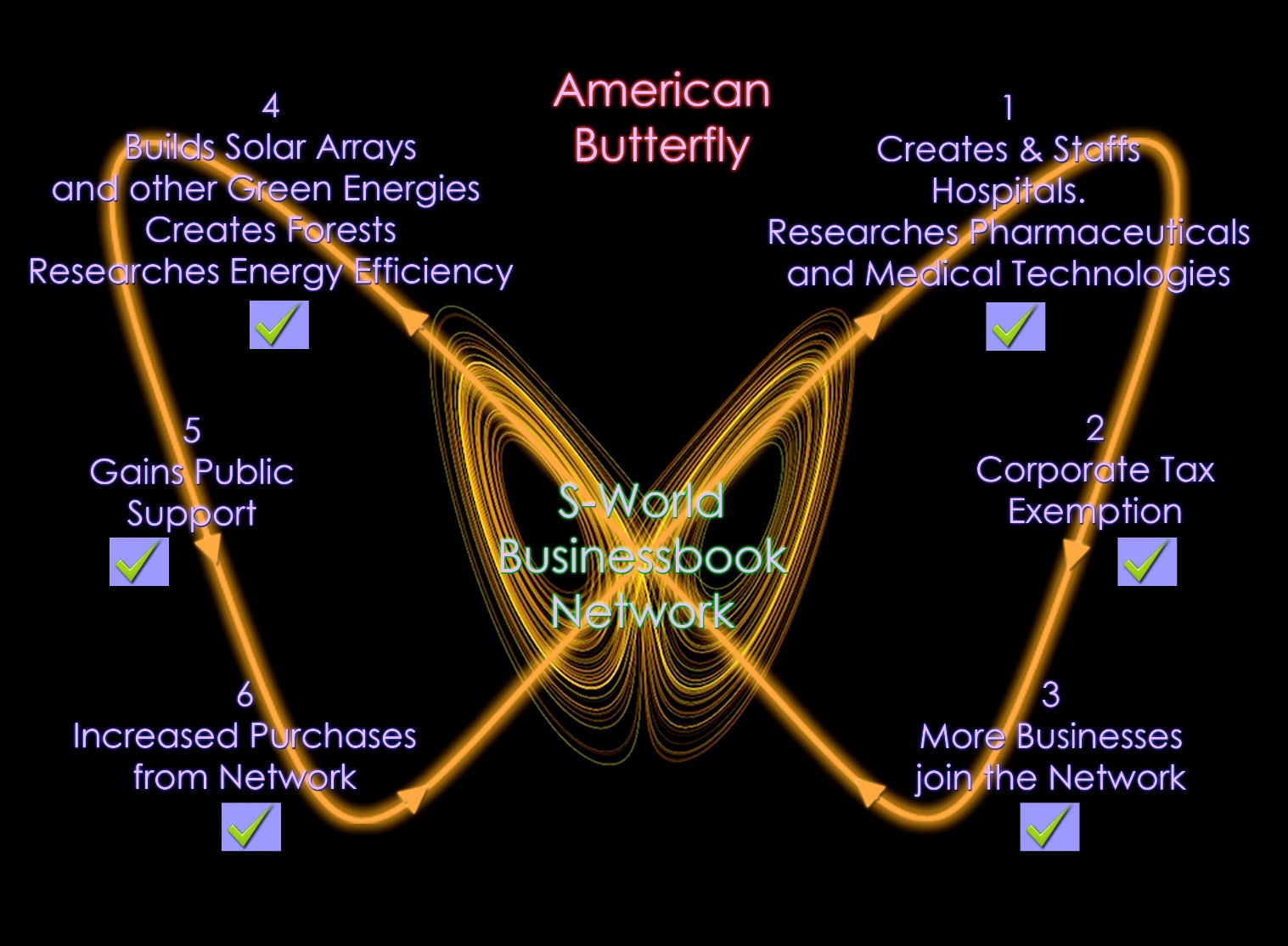

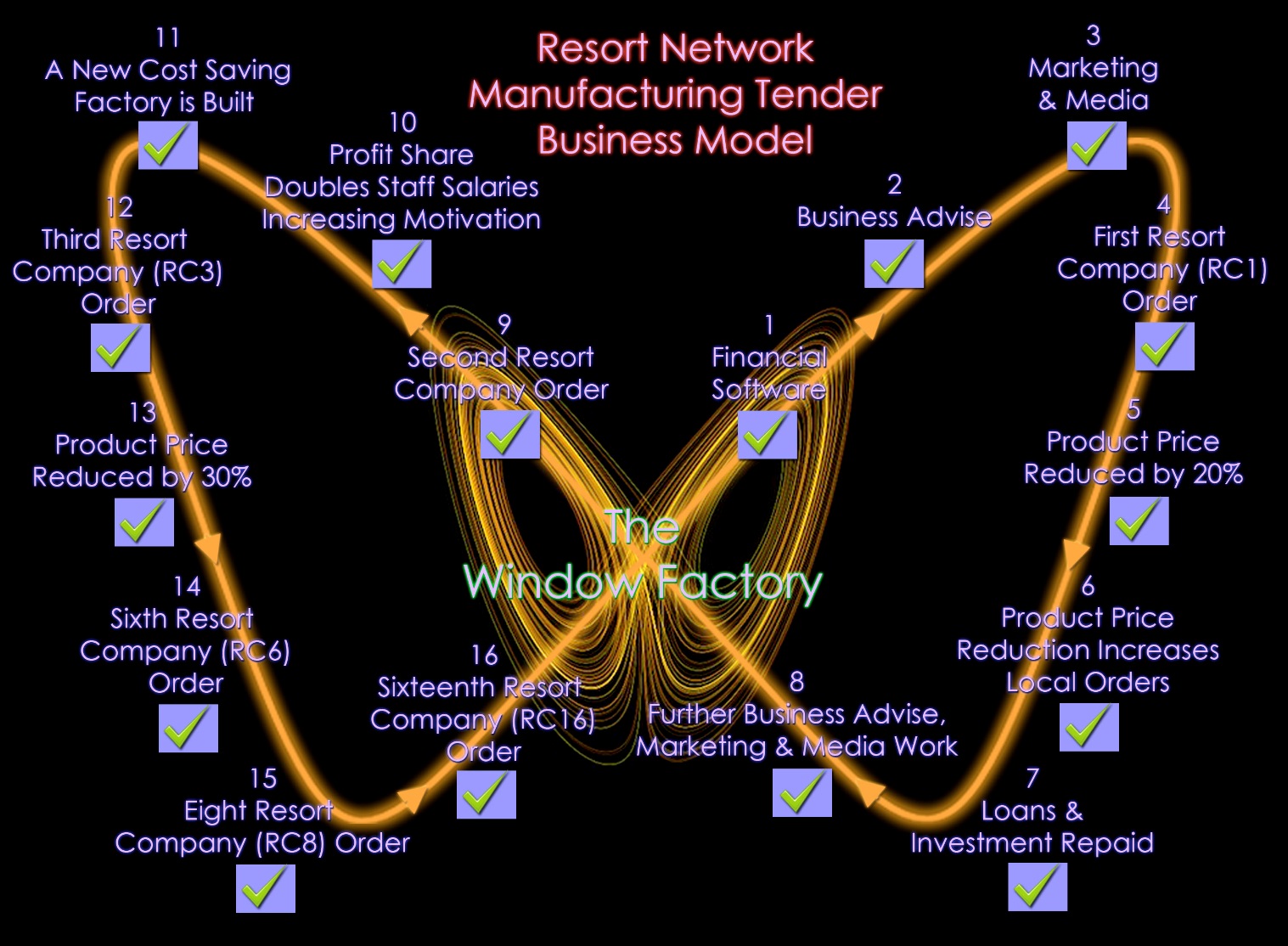

To our right, we see the first “Butterfly Effect” graphic, throughout “The Theory of Every Business” three such butterflies are presented, alongside 16 individual questions about the specific topic.

These questions form an integral part on the American Butterfly business plan, and the PQS probability software design. They also assist the reader in focusing on important features within American Butterfly,

In general the questions should be answered only after reading through The Theory of Every Business, as all chapters are related. If you chose to answer the questions please do so objectively, we are currently at an early stage, and questions answered in the negative are extremely useful.

On the other side of the coin, if you feel the esteemed presented is too low, please advice. For instance the first question in the “Suppliers Butterfly” describes the financial software and suggests it will make a 5% saving before asking:

Is the 5% improvement reasonable?

Higher ________ OK ________ Lower ________?

If you feel such a system would save 20%, please write in 20%

Please answer and consider the questions under the premise that both Facebook and the US Government offer their full support.

The butterfly as seen to our right is a compilation of two question sets, points one to eight are general questions asked periodically throughout all the American Butterfly books. The second question sets are specific to Facebook profit centers.

Before moving on to an analysis of US long term economics, it seems appropriate to mention the four names of this project:

- S-World / businessbook is the name of the main product & business network. Pre development is found on www.s-world.biz,

- “The Spartan Theory” was originally written between the 4th and 26th of April 2011, all that has been written since are the details. It is currently in 3 parts: “S-World”, “Sparta Rises Again” and “American Butterfly”

- EEE stands for the “Ecological Experience Economy”, which is the name for the economic theory, an extension to the current Experience Economy.

- “American Butterfly” is the science, network, business and economic plan applied to the USA. The word “butterfly” is in respect of an interpretation of “the butterfly effect” as applied to business and economics: circular events evolving from action and reaction

“Chaos Theory”

Chaos theory is a field of study in mathematics, with applications in several disciplines including physics, engineering, economics, biology, and philosophy.

Chaos theory studies the behavior of dynamical systems that are highly sensitive to initial conditions, an effect which is popularly referred to as “the butterfly effect.”

Small differences in initial conditions (such as those due to rounding errors in numerical computation) yield widely diverging outcomes for chaotic systems, rendering long-term prediction impossible in general.

“Does the flap of a butterfly’s wing in Brazil,

cause a tornado in Texas?”

“Chaos Science”

“Solving the problems identified by “Chaos Theory”

Chapter One

Economics, S-World & the Core Network

“US Economic Analysis”

To find a solution one first needs to understand the problem. The popular reported problem is over-borrowing by the US, Western governments and their citizens. This certainly was a trigger. However a very current problem is “confidence,” the chief economists and bankers in the USA have no confidence in the future due to Medicaid, Medicare & Social Security payments. (The US equivalent of the UK National Health Service and government pensions)

In 2010 these liabilities (payments that need to be paid) cost about $1.5 trillion; this year the USA received $2.2 Trillion in federal tax revenue, leaving $700 Billion for all the rest of its commitments, which cost a further $2.2 Trillion, resulting in a loss of about $1.5 Trillion, which needed to be borrowed to balance the books.

It’s an election year in the USA and as such there is not a lot of talk about austerity, however next-term austerity will be introduced, as the large tax cuts President Bush made just before 9/11 are due to end, as such whichever party is in power need not make a policy to increase tax, but rather they should make no policy to extend the tax cuts in full.

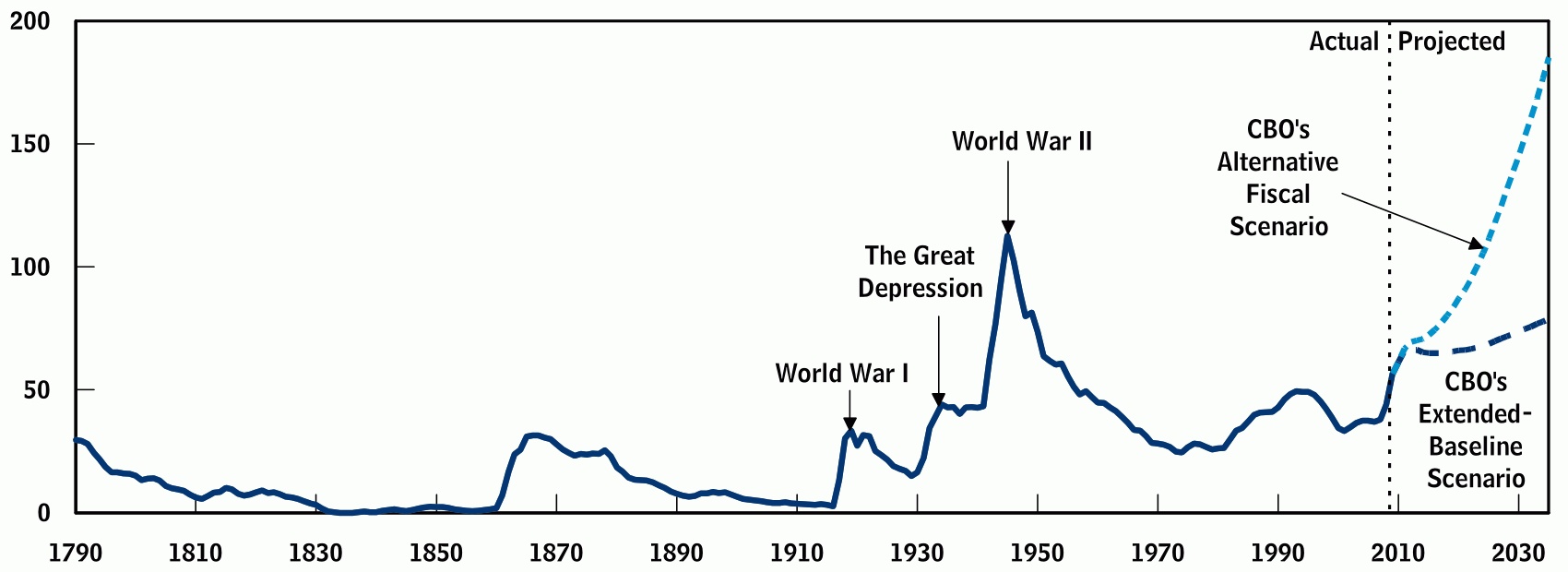

(Retrospective Note: This event happened and was well publicized, however somehow the US managed to entangle this decision with other tax initiatives, and it got dubbed “the fiscal cliff” where it was considered allowing all taxes increases and budget cuts to apply at the same time would force a recession. As such only a tax rise for the super rich was implemented. Which considering the circumstances was a fair decision, however it has enacted the CBO’s Alternative Fiscal Scenario, as seen to our right, this scenario is no longer speculation, rather fact)

Since the beginning of the 20th century governments have calculated both growth and stagnation in their economies. In general the USA has seen steady growth for about 10 years, then a recession for a year or so, followed by more growth. So considering histories, many presume the current stagnation will end in due course. If so, the US would increase its tax income by about $500 billion, thereby lowering the amount needed to borrow to about $1Trillion.

If one considers the USA austerity policy in terms of not necessarily lowering this figure, but rather not increasing it, then the concept changes. $1 trillion a year, at an interest rate of say 3% would mean an increase in cost to the USA of $30 billion each year.

Over the last 10 years despite 4 years of stagnation, if we factor in inflation and currency values, all the businesses in the USA increased their sales by an average of 1.8% each year. Last year all the US businesses generated $15,294 trillion, 1.8% of that figures equals $275 billion. A good growth time federal tax yield is 18%, as such on a good year the US federal government, in business terms, increase their tax yield by an extra $50 billion each year.

So if the USA austerity measures manage to keep borrowing at $1 trillion incurring a $30 billion expense, while increasing its tax yield by $50 billion, effectively year on year the US will be $20 billion better off. So one could rightly ask, why are the economists saying there is a problem, why is there no confidence?

The problem is that in about 10 to 15 years, due to the increase of the aging population, the increasing cost of medical technology and pharmaceutical bills, Medicaid, Medicare & Social Security costs, are going to double, as such the idea that the USA austerity measures can freeze borrowing at $1 trillion a year is not possible, as in 10 to 15 years an extra $1.5 trillion is required, which if borrowed at 3% would add an additional $45 billion, resulting in the USA making an effective annual $25 billion loss. This loss in academic terms is called an increase in Public Debt vs. GDP (Gross Domestic Product). (Computations are based on all the goods and services sold). This ratio is the yardstick for economic success or failure.

Here is a graphic that sums it up nicely, the light blue dotted blue line representing the CBO’s (Congressional Budget Office’s) predicted scenario, the dark blue representing their politically toxic austerity recommendations and tax increases. (The tax increases that did not happen on the 1st January 2013)

I say politically toxic as any government enacting a decrease in Medicare & Social Security spending would effectively be breaking the law. The law says they can increase taxes to pay for it, but they can’t decrease payments, as Medicare & Social Security are for all intents and purposes pension retirement plans. In essence US Citizens have been forced to pay a considerable amount of money into a pension plan all their lives, only to discover the pension company has invested the money carelessly and is going bust.

Where was the money invested?

It was invested into itself: The USA total debt is $15,670 trillion, however the USA public debt (owed to countries, banks and private investors) is only about $11 trillion. The balance of about $5 trillion is the pension fund spent on wars and electioneering (making promises to win elections to the long term detriment of the country).

An interesting website to look at is the USA debt clock: http://www.usdebtclock.org/ at the bottom it really spells out the trouble the USA has with Medicare: Medicare Liability = $84 trillion, Prescription Drug Liability = $21 trillion and climbing. Social security however is only $16 trillion, which sounds like a lot, but in comparison to the combined medical liabilities it’s close to insignificant. Solve the medical problems and all else will fall nicely into place.

In 2007 Ben Bernanke, Chair of the Federal Reserve was asked: How urgently should the U.S. put plans in place to address its budget challenges? His reply: “The longer we wait, the more severe, the more draconian, the more difficult the objectives are going to be. I think the right time to start was about 10 years ago”…… Now it’s 2012 and it’s crunch time,

America Butterfly Question, AB1: Under the premise that the information presented is accurate, do you feel, if the US Medical liabilities were absorbed via corporate responsibility and in addition by the 2040’s another initiative was enacted that resulted in the US becoming far less reliant on fossil fuel it would restore confidence in the US long term economy?

Definitely ________Probably ________Unlikely ________?

So what is the solution?

The American Butterfly solution is simple enough in theory. It’s only a matter of time before there is an on and offline trade goods and services network as popular as Facebook’s social network. In the new era of the communications age, no one can stop this, all one can do is try to get there first and use the money responsibly. Whoever owns such a network will have more power that any financial institution, or for that matter, any government. However, unlike Facebook, the network to be entitled S-World/Buinessbook is not owned by any one company, it is effectively owned by all companies connected to the network.

If that network were to make a sophisticated plan to cover the USA Medicare and prescription drugs liabilities, it would be doing a great service to the USA. As such, if acclaimed by economists and loved by the masses, the network could ask for and be awarded a few legislative concessions, which would guarantee success. Two concessions are currently put forward.

First, with the promise of a carbon footprint improvement, a relaxation of property development zoning conditions occur, including the ability to rezone farmland for residential and commercial purposes.

Second, corporate tax exceptions for all that use the networks financial software. This may at first seem like a big consideration, however if you go back to the USA debt clock and look in the top right corner, you will see corporate tax accounts for less that 8% of the US federal tax yield, and under 4% of all tax revenues. It makes little money and many argue it is a deterrent to making profit. Certainly it encourages both tax avoidance and evasion, which in time lowers returns on the more profitable payroll and income taxes. For all intents and purposes corporation tax is a false economy; testament to this is the fact that governments across the world are currently reviewing its need. As soon as one major economy relaxes it, businesses will en masse move to that country, until the rest follow suit.

The corporate tax scenario is what I call “a circular event” influenced by my interpretation of “The Butterfly Effect”. In essence, analyzing the cause and effect of one action on another, then another, looking for a path leading back to and enhancing the initial event or transaction. In this scenario: The network takes care of the US Medical bills, in exchange the USA offers corporate tax exception to companies on the network, so more companies join the network, as such, the network makes more money and can afford to pay for the US Medical bills, the cycle repeats going round and round, more companies, more capital to absorb the cost of US federal medical liabilities.

While fossil fuel dependence is rarely mentioned as an economic threat by the CBO and leading US economists, it is an equal or greater threat. Initially as global usage increases so will its price, as the stocks start to deplete, its price will rise again, and when it’s gone, it’s gone. Talk of nuclear fusion is a gamble, possibly even a dangerous gamble; the process of sustained large investment in solar and other alternate energy sources needs to start immediately.

If for 16 years a 33% higher investment than is required for the annual US Medical liabilities was invested into alternate energy, and electronic cars were popularized by the 2040’s, enough energy would be generated to run the USA. After which the income generated from said energy would be enough to pay for all US medical liabilities and many other items.

An initiative to cover the USA’s medical bills will see immense gratitude from their government and will of course be popular with the people, its popularity, however, tainted by the need for it in the first place. Green energy however not only solves economic problems, it helps to solve Global Warming, and as such the initiative will gain public support en masse. As such a second circular event intertwines with the first:

The network takes care of the building of Solar Arrays, in exchange the global public sees the benefit from buying from brands and companies on the network, so companies on the network make more money, as does the network itself, thus increasing its ability to build more solar arrays and hospitals.

Here is a graphic that highlights the two continuous circles, the first of five implanted over a “butterfly effect” graphic

America Butterfly Question, AB2: Considering in 2010 corporate tax only generated 4% of US tax revenues whist Medicaid and Medicare cost 34% of the Federal Budget, would it make sense to give a corporate tax exception to companies that absorbed the 34% cost?

Definitely ________ Probably ________Unlikely ________?

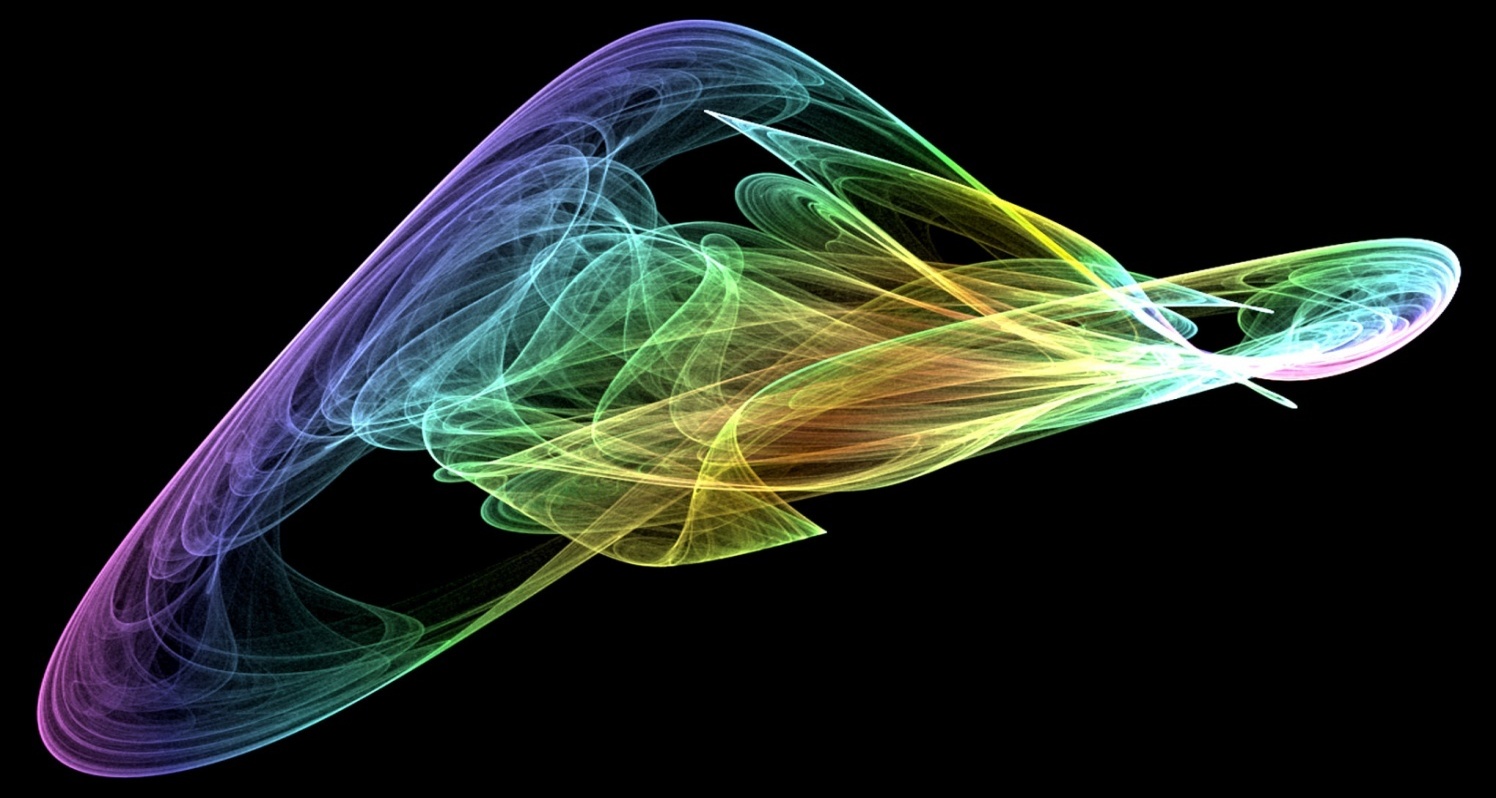

To the right we see a more complex circular image of “the butterfly effect”, a fundamental building block for the PQS economic software (Predictive Quantum Software). Imagine if you will as above, a two-dimensional representations of millions upon millions of companies and their staff plotted in such a manner as to optimize the flow of money, and objectives we wish to achieve.

Then imagine a three-dimensional image similar to that shown below, the third dimension repenting time, the future, so one can look to the future and assess the future objectives one wishes to achieve in relationship to current events, the most obvious example being good PR.

Given the opportunity, one of the first brainstorming exercises will be to make a huge blow up of the image below and have everyone start sticking post-it notes on it, looking for other circular events.

In Cape Town 2009 at my team’s regular work shops with the “En Lighten” braining group we used this method, to inspire “The Facebook Gift’s Application”. A simple option added to Facebook’s happy birthday reminder, offering a gift service and the further option via a year planner to send gifts automatically.

One can see the prototype via this link http://www.s-world.tv/Facebook/home.html which is well worth following as it demonstrates how, given a competent supplier network one simple idea generates much profit. All who have seen it said they love it and would use it, as such due to its popularity it opens the door to Facebook opening a full e-commerce service.

By adding a direct retail division and including the profit made by the suppliers’ significant profits are forecast, as are presented in the penultimate chapter.

The “S-World Virtual Business Network” is expected to eclipses such figures.

S-World Virtual Business Network

Alongside Facebook Gifts, the following S-World software, travel and real estate concepts are covered in detail within the concluding two chapters of this book, and various chapters on the www.s-world.biz website.

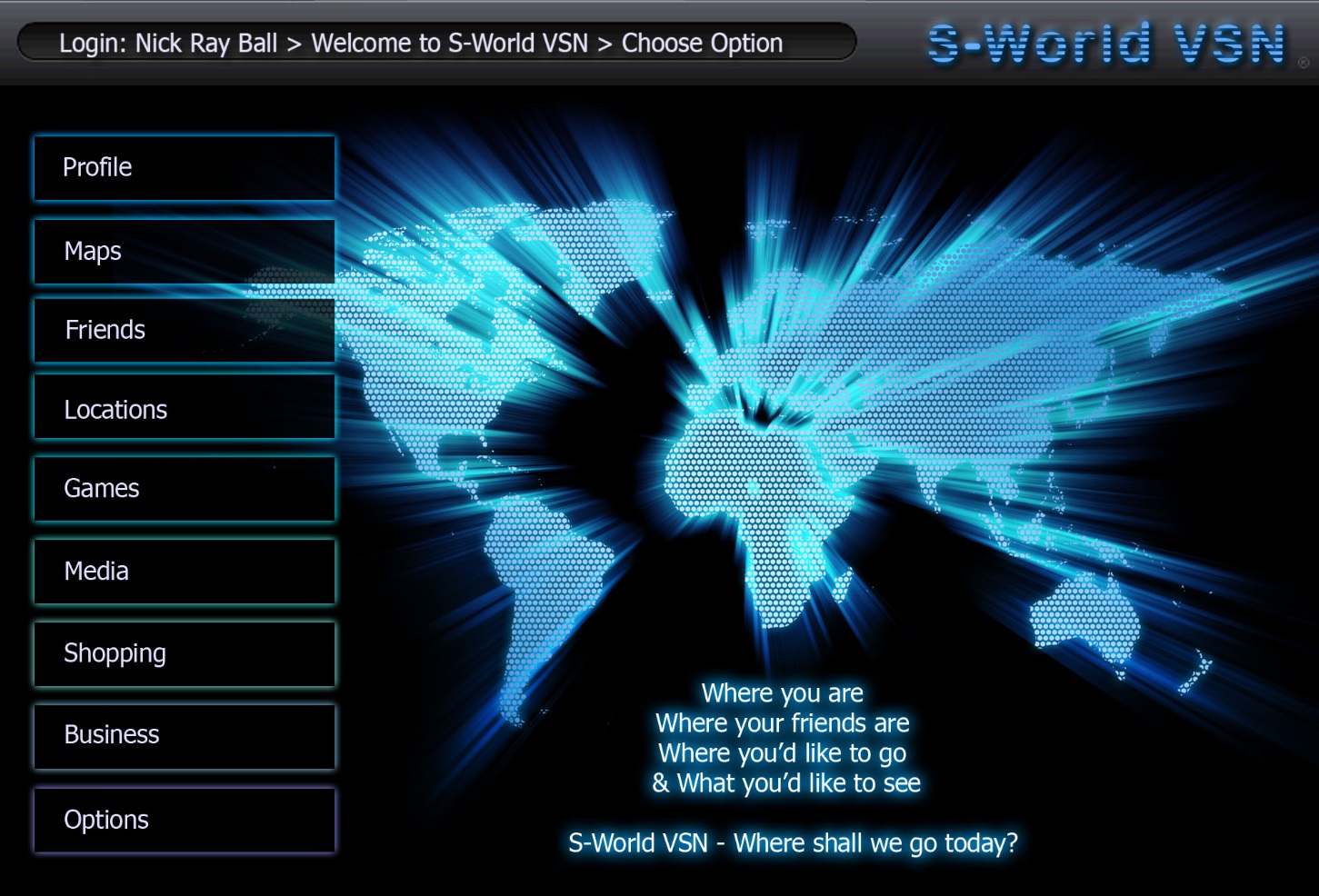

Much like Facebook gifts, the S-World environment S-World VSN (Virtual Social Network) is at its heart a simple concept, in essence the internet viewed via a 3D simulation of the world, popularized by the ability to see where your friends are via their cell phones GPS’s, and the ability to “teleport’ (zoom) to their location seeing their Avatar within a 3D virtual representation of their location, where one can look and walk around seeing all that can be seen. If one’s friend is lost, one could even give them directions.

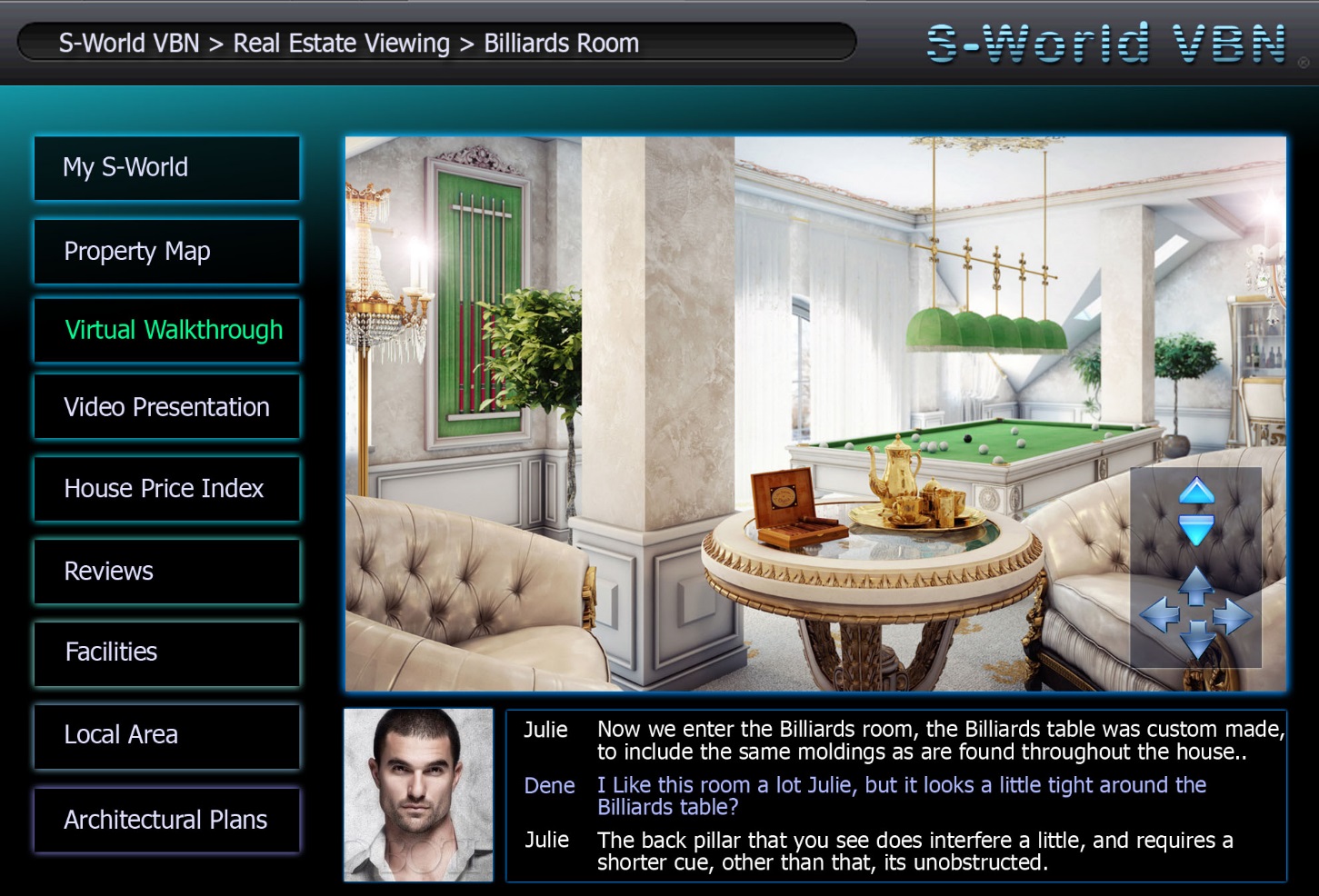

In S-World, everything is as it should be except the shops, which change to the S-World and Businessbook’s member’s shops. Once a shop is entered one can interact with the company’s sales staff, via their Avatar or Skype. Or just browse a sophisticated display of the company’s services or stock displayed, photographed, filmed and rendered in a superior fashion, for little or no cost by the media teams that support the network. In retail, for instance, instead of a photograph of a dress, movie clips on the catwalk and various locations are presented. For travel and Real Estate, a detailed 3D walkthrough of the venue is available alongside photographs, reviews, client ratings, engineer’s and architect’s plans.

Whilst the gimmick of the virtual world is walking into the shops, the shops could be accessed by many portals, Facebook, websites, search engines, smart TV’s and smart phones to name but a few.

All goods sold on the network via S-world, Facebook gifts, S-Web or other internet portals, are rated by clients. Poor ratings see product lines or accommodation venues dropped, thus the network becomes and incorporates a “per human experience” search engine.

The voting panel is accessed via the S-World profile page, which can come in many forms, its default a 3D room with various doors for various actions, once inside one has access to all products and services purchased presented in a engaging manor. As an attractive incentive, members S-World retail credits are given each time a vote is cast. In addition to this, many staff and companies on network are impressed by profit share and dividends, which are paid in the form of network credits, and can be used to buy anything from houses to ant farms. To further incentivize the voting until previous votes have been cast new credits can not be used.

There are many factors making the voting system very hard to hack and manipulate. The most obvious being, if one does not buy a product, one can’t vote on it. Voting is often a tiresome process thus votes will not be detailed, just a simple choice of, poor, good, or excellent. Various safeguards protect against “luck of the draw” votes, negative people vs. upbeat people’s votes averaged over time.

All search engines are desired as primary partners, who receive payment for each purchase made via their introduction. As goods are rated by humans, search engines can happily and fairly rank high vote scoring S-World & S-Web affiliated websites above all others.

While S-World is designed to replace the e-commerce on the internet, stand alone websites for retail, travel, real estate, and services are far from ignored.

S-Web provides attractive database-driven free websites, offering many formats and designs. Clients simply upload product pictures, write a description and add prices. If a company already has a database- driven website the databases are synchronized. The main financial advantage for all is the ability to add complimentary stock and services from any other company on the network, taking a commission each time someone makes a purchase. The process also works in reverse; other companies on the network can choose to display and sell your goods and services.

There is another contingent to the S-World e-commerce family: S-World UCS was first envisaged in 2004 it combining a tutorial simulation, in the form of a colonization game, which, when mastered, allows one to conduct real business.

(Retrospective Note: S-World UCS has now become the central part to the S-World software and takes centre stage within the fifth part to American Butterfly “Quantum Time”)

Put together Facebook gifts, S-World VSN, S-Web, S-World UCS and the “per human experience” search engine and one has every right to say the combination will take a big bite out of e-commerce market’s share, especially considering the good PR and branding. The internet is a hit or miss unmonitored devise, there is little point reinventing the wheel, unless the wheel is square. The internet is like a square wheel. S-World & S-Web improves the experience and representation. The “per human experience” search engine monitors and so improves the quality of goods and services for the consumer, making the square wheel circular, with the exception or rogue traders and cowboy films, every one wins.

S-world is not designed only as an internet and smart phone device. Over the next few years smart televisions will become the norm. S-world is designed to become the industry standard operating environment. Not only is S-World a great product, the overall network from the start has made provisions for the creation of many localized TV series, and high-budget series and films each year. The larger the network, the more media created.

Current Media Company’s essential to both positive PR and the goal of becoming the industry standard operating environment for smart TV’s are included in the share options available for ownership of S-World alongside the technology companies and electronic communication devices manufacturers.

There is no individual company that will own S-World. S-World will be owned by all that help to build and promote it. All that is sold on the S-World network is from partners, so the financial aspect is simple; the exact mark up/levee/commission varying from industry to industry, profits to be split between the partner companies that create S-World and the referring entity, be it a search engine, a media company, a TV manufacturer, or the browser on a computer or smart phone.

S-World – Global Travel Systems

Currently about 20% of holidays are booked on line. About 50% of people choose their destination via the internet, then book through a high street operator, largely for safety reasons.

Tourism accounts for about $900 billion each year, and business travel seems to be higher. It certainly is in the USA, total global travel estimates are about $2.5 trillion, 3.5% of Global GDP, a percentage not to be taken lightly. Once again, there is no point introducing a system if it is not an improvement. A number of initiatives help to do just that.

First, Safety: As S-World is part of a major organization, travelers can book without concern for false representation as assisted by the “per human results” search engine.

Second, the Agent Initiative: knowing the industry intimately, first-hand knowledge is a very important factor. High street travel agents and large travel agencies have staff who usually have never been to the country they are recommending, let alone the venue, and are usually offering the venue that offers the highest commissions. S-world travel seeks to recruit individuals from the towns that clients wish to visit. The system offers the venues, thus S-World travel reps and agents only need refine the clients’ choice.

Different representatives will be available to clients. For instance, if a group of fun-loving twenty something’s wishing a lively holiday, choose a “nearly made it” model or actor, it makes sense as they can recommend villa parties, lively beaches, advise on the best nights to go to clubs and indeed in most cases get themselves on the guest list. However if one wished a cultured holiday experience mixed with visiting some wine estates, the customer can choose a representative with similar interests.

Third, S-World 3D Virtual Representations: Simple photographs and write-ups rarely tell the whole story, especially if wide angle lenses are used. While one can be relatively sure a top-end hotel is fairly well represented, small hotels, guest houses and villas are not so particular.

By taking a walk through the venue, one ascertains the entertainment flow, size of the swimming pool, view from windows, indeed one could feasibly pick a particular room because of the view. Throughout the 3D walkthrough, icons are available that show real pictures and a collection of guest comments and general blurbs are available. The option to walk around the venue, seeing how far it is to local attractions, and indeed see what local attractions are available, is an influencing bonus.

How exactly is S-World going to map much of the world in 3D when Google has been trying for a year and has mapped only a very small proportion would be a fair question, the first key is simplicity, preferring to partner and use “The Simms” technology where an 8-year-old can design and furnish a house within twenty minutes is a good starting point.

The operation centers have a large staff contingent called “Spartans” who can assist. S-World travel representatives will render accommodation venues and local surroundings as their name will be attached. Some tourism boards will pay to be rendered alongside venues that wish a level-two representation. The largest factor however will be the gamers playing S-World UCS. All one needs is a pen laser and a camera and hey, presto, that street in “Call of Duty” is your street.

S-World – Global Real Estate Systems

The same advantages presented in travel, also can be used in real estate, not that many people would ever buy a house they have not seen. However via the S-world representation they can eliminate properties that are not suitable. Knowing the industry well, it is strongly advised if a client is looking in a certain area, be it a specific town or general area, it’s best to see every house from every agent, maybe over a hundred, with a few hours on S-World and a task that less than 1% of people ever perform is achieved with ease.

Location, location, location is a major factor within the business plan, adding percentages to houses due to enhancing or detracting local features. It’s simple enough to attain the land registry document of houses sold in any area, which gives a baseline price for different house types, both in bedrooms and size, adding the location factors, and further tightens up an estimate. Add an agent’s personal opinion, where they are penalized for exaggerating and one has an accurate base line sale price.

For sellers that are not duly fussed over and coached, the sale price maybe 10% more as, purchasers will perform what is known as a love buy, based on their emotions only. On the other hand if a client is in a hurry to sell, they can price the property under the estimate. Banks and financial institutions selling a repossessed property can offer even lower prices, and in this case, one could see property moguls buying on the S-World representation alone. Once a critical mass of Real Estate is displayed on S-World, most would assume if a property was not represented, it was overpriced. Alongside suggested selling prices will be suggested prices for remodeling the property and upgrading where needed.

The Core Network

American Butterfly is far from just an internet-driven solution, looking at the longer forecast of 2036, commissions and levee’s made from internet sales are not the main profit centre, the majority of the profits come from the suppliers, not just their internet sales, but all their sales.

To get there one must take one step at a time. Creating a global network is far more complex than a social network, for one. Hundreds of thousands of databases need to be synchronized, the greater challenge however is all small companies (under 500 staff) must use the same financial software, and in certain areas concede financial control of their businesses to the network.

Taking one step further back will explain why they would do this.

Operation Centers / Resort Town’s

The initial creation of the network is dependent upon the connection of approximately 500,000 mainly small businesses by 2016 in such a way that businesses are comfortable to concede a fair degree of financial control. This requires many one-on-one meetings by software, marketing and financial staff.

Said manpower needs bases and operation center’s, from which staff can spread out and meet with the businesses, whereby business can come and visit and discuss, whatever it is they would like to discuss, bringing their products to be photographed and filmed at the operation center’s media studios.

If one had to pinpoint the single most important consideration within all the work, the idea to make the operation centers independently profitable, is probably the one most would choose.

The concept was first documented on the 15th April 2011 in a letter to “The Corniche Group.” It is indeed what many would say, the major factor that changed the business plan into an economic plan.

As such bases became resort towns and operation center’s universities, the beauty of it all arises when the companies that build the town then the companies that trade in it, become the core network.

One can’t start trading in a resort until it’s built, and even with preferential planning permission, I expect we are looking at 2016 before inner resort business starts. Besides the technology companies and suppliers to the S-World Network, we start with the businesses involved in the building of the town. Not the builders and developers, that task is mainly performed internally by dedicated department within the operation center’s themselves, but the suppliers, all the suppliers, many levels deep, until one gets to the raw supplies such as sand and clay, around 250 separate businesses per development.

Each resort initially sees investment from Big Business, to the tune of $1 billion plus, 75% going directly to construction, 25% pro-rata over 4 years funds the operation center. Alongside the good PR, access to S-World, license to trade and shared access to all that will come from research and development, investors own the property and industry that is built, whether it is real estate, retail or office space, attractions or industry, and so investments are hedged by a capital asset, indeed an asset forecast to be worth twice the company’s initial investment.

Small companies in the 6000-square mile local catchment area, invest a further $1 billion plus, which due to the property hedging can come from finance companies, if necessary.

Over the first two years, all company’s profits are pro rata collected to the tune of $1 billion which in turn is used to bolster the resort construction fund. In total, in the region of $2.5 billion goes into the construction process, of which after contractor and labor fees 50% is destined for supplier companies. If there are 500 such companies, each on average has guaranteed orders of $1.5 million over 4 years, companies that produce goods that are used more, receiving more.

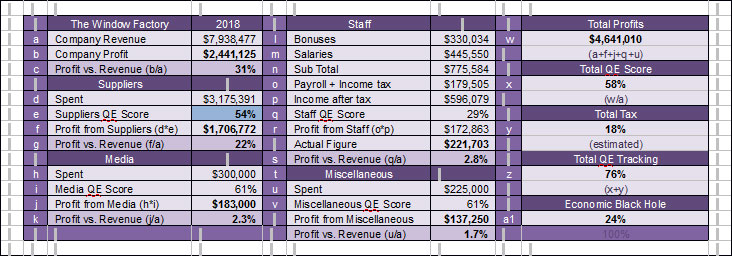

Next we have an example in the form of a windows manufacturer called “The Window Factory”. Windows are a more expensive part of the building process than say, light switches, as such in the example we will work on a yearly guaranteed order of $2.5 million.

“Οικονομία”

The Beginning of Economics

Greece 350BC

The word economics stems from the Greek word “Οικονομία” defined as: The management or a household, or the building of a home

“Οικονομία: The management of a household”

Chapter 2

The Suppliers Butterfly

To our right, we see the second circular events butterfly including 16 factors. This example is presented to demonstrate how much profit the first wave of building supply companies can look forward to.

To assist the understanding of the process this presentation is interactive, as you can see, under the 16 headings on our butterfly there are check boxes. Over the following page is a spreadsheet that suggests an increase or decrease in profitability assigned to each box, alongside a brief explanation. Please read the explanation and its predicated increase or decrease and write your opinion in the each box.

This serves three purposes:

First: Answers will assist the process, and may lead to an increase or decrease in the forecast or result in a more detailed explanation presented.

Second: Correct answers become a validation exercise.

Third: The exercise is designed to engage the mind, and make the reader appreciate the mathematics, it’s one thing to read a profit forecast summary suggesting a 5174% return on investment, it’s another to have looked at and agreed with its every detail.

As a general rule, with all questions, due to a large degree of leeway, most, if not all estimates have been set lower that most would forecast. For instance in the authors personal experience, the loss of all financial staff and accounting costs, alongside the correct financial data presented and advice from a dedicated operation centre would have lead to a 50% rise in profitability, however for cautions sake only a 5% rise in profitability is recorded. When answering questions, please do not follow the authors caution, please give a genuine estimate, not guarded or over exaggerated, writing in higher or lower percentage rises where applicable.

Before getting into specifics, the resort expansion program needs to be highlighted:

In the last section we heard that $2 billion plus, is directly invested into each resort, where after the first $1 billion in profit from all networked companies is reinvested, in theory creating capital assets worth twice the investment price. The time it takes for the initial $1 billion in profit to be made and reinvested is estimated at just over two years.

After which by the end of the fourth year another $1 billion in profit is projected to be generated, this $ 1 billion is matched or increased by a new set of mainly small businesses, thus enough capital is available to start another resort and operation center, within a 6000 square mile radius of the initial resort.

After which, via the “Baby POP” cash injection process, this procedure repeats over 22 years until 16 resorts and operation centers are created within the 6000 square miles, approximately one every 28 miles.

All told, including home building, shops, offices, malls, marina’s, attractions, hospitals, university campuses, municipal buildings, a sports village and infrastructure over the first four years 2014 to 2018 upwards of $2.5 billion is spent. For this excursive we will assume half goes to the contractors and laborers and the balance on supplies, bricks, mortar, roofing, bathrooms, tiles, windows and the like.

For this example I have created a fictitious window manufacturing company entitled “The Window Factory” specializing in residential aluminum windows. To supply all the homes in a resort “The Window Factory” receives an annual order worth $2.5 million.

Like many or even most US small businesses in the construction industry, we shall suggest the currently this company is simply treading water, making enough to cover costs only. To start proceedings “The Window Factory” will take out a $2.5 million loan, supplied by a network bank, paying interest only, as such “The Window Factory” starts its network life making a 6% annual loss.

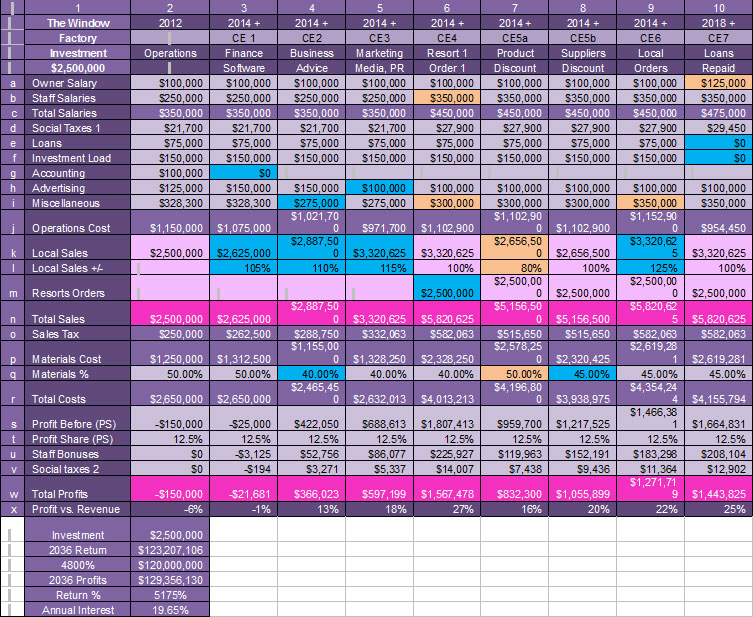

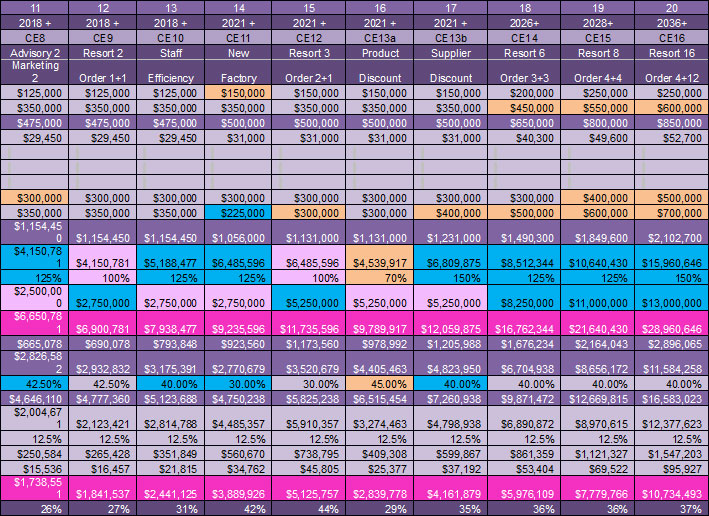

Above we find the suppliers and manufacturing butterfly spreadsheet, the blue squares indicate a profitable event, the orange representing an event that increases costs, pink squares indicating money in, and grey indicating expenses.

Column 2, row (n) “Total Sales” indicates The Window Factory is receiving $2.5Million a year. In row (r) “Total Costs,” including the interest on the investment loan, are at $2.65Million: As such row (w) “Total Profits” is equal to -$150,000, beneath this, row (x) indicates the company’s profit vs. revenue ratio is at minus 6%.

SB is short for “Suppliers Butterfly Question”

SB1. Colum 3 – Financial Software: The first blue box in row (g) indicates a decrease in costs, as all financial tasks from bookkeeping to auditing, are handled by the staff at the operation center.

The second blue boxes (k & l) are as one, the lower (l) indicating a 5% rise in financial efficiency. The software is directly linked to the bank removing most human interaction. Instead of one check and balance system, the software has four running concurrently, due to the financial systems, cash handling aside, human error and fraud become all but impossible.

Due to the increase in financial efficiency, is the 5% rise in revenue recorded in row (l) justified?

Please indicate your answer in the fields below, if higher or lower write in the percentage

Higher ________ OK ________ Lower ________?

SB2. Colum 4 – Business Advise: Over the first 4 years a team of a hundred or so senior analysts, logistics experts, engineers, software developers, network officers and industry specific business persons will spend six months working on the task of making all the window companies on the network more efficient, from cost savings, to sales techniques, to sourcing cheaper suppliers.

Over time, with hundreds of window companies on the network, each company’s triumphs and failures are recorded and analyzed, the information used to assist others.

At The Window Factory’s home resort & operation center, dedicated analysts gather all the data from the think tank, tweak the software and share the knowledge and findings. As a result, a 16% reduction in miscellaneous expenses is forecast (from energy to staples), a 10% increase in sales is predicted and material costs are expected to be reduced from 50% of total sales to 40%.

Higher ________ OK ________ Lower ________?

SB3. Colum 5 – Marketing Media & PR: Initially the dedicated Media & Marketing division working from the operations center make the S-World & S-Web applications, including photographing, filming & 3D rendering of the products, alongside the S-World presence, S-Web creates a state of the art website for The Window Factory, that alongside their own windows and accessories, offers many different types of windows from the other companies on the network, alongside many other building services, patio’s, bathrooms, kitchens, etc., which when sold generate extra revenue.

One also needs to factor in, the general good will of the people in the catchment area knowing that a purchase from “The Window Factory” is securing their pensions, healthcare and indeed helping to save the planet.

All factors combined increase sales by 15%, Higher ________ OK ________ Lower ________?

SB4. Colum 6 – Resort Order 1: The main advantage for The Window Factory and all other manufacturing companies is guaranteed orders from the networks to which it is affiliated.

SB4 is not a question field, as it is a definite action within the business plan. The first order from a resort network is placed; an increase in materials, sales tax, salaries and miscellaneous spending increases costs to $4Million, while sales increase to 5.8Million, after the staff profit share bonus, “The Window Factory” is now making over $1.5Million in profit.

SB5 a. Colum 7 – Product Discount: With profit up from zero to $1.5Million plus, a profit vs. revenue ratio of 27%, The Window Factory can afford to reduce the cost of its products by 20% as is desired by the resort network. However the resort does not reduce its $2.5Million order rather orders more, this effects the price of materials which rises from 40% to 50%. Overall profit is halved. (This is not a question field)

SB5 b. Colum 8 – Product Discount: However as the suppliers to “The Window Factory” are applying the same system their costs have also been reduced, but as more raw materials are used, not to the same factor as such the price of materials lowers from 50% to 45%. (This is not a question field)

SB6. Colum 9 – Local Orders: Due to the 20% discount in price it is forecast that local orders increase by 25%.

Is this a reasonable assessment? Higher ________ OK ________ Lower ________?

SB7. Colum 10 – Loans Repaid: Between 2018 and 2021 all loans are repaid. (This is not a question field)

SB8. Colum 11 – Advisory 2, marketing 2: With over 4 years spent at the operations centre on business analysis, network growth, improvements in software alongside continued marketing and internet work , material costs are expected to fall by 2.5% & and 25% increase in local sales is forecast?

Is this a reasonable assessment? Higher ________ OK ________ Lower ________?

SB9. Colum 12 – Resort Order 2 (1+1): In 2018 construction in the second resort is destined to begin, however the large investment into RC1 has been spent, and whist a continued housing and retail operation is expected for cautions sake, only a small operation is forecast at 10% of previous costs, hence one sees an increase of $250,000 in (m) the Resorts orders row. Please note the (1+1) this indicates, one big order (first 4 years) and one continued operation. (This is not a question field)

SB10. Colum 13 – Staff Efficiency: Please note row (u) “Staff Bonuses” and the row above (t) “Profit Share”, 12.5% of the profit made by the company is shared amongst the staff. By 2018 after 5 years staff salaries have effectively doubled, if the company had made more sales their salaries could have tripled. Staff are offered first phase property purchase options in future resorts and subsided eco friendly automobile purchases at 30% below manufacturing costs with a 4 year 50% buy back, making a $10,000 car cost $52 a month, the same cost as one would pay for a day’s hire.

As such wastage of raw materials is expected to be reduced lowering material costs from 42.5% to 40% and local sales are forecast to increase by 25% as all, especially the sales staff are motivated to increase profitability.

Note this increase in sales and efficiency is factored over five or six years.

Is this a reasonable assessment? Higher ________ OK ________ Lower ________?

SB11. Colum 14 – New factory: By 2021 enough profits have been made to build a new efficient factory and dedicated alternate energy power source, lowering miscellaneous spending (including electricity) by $125,000 a year and lowering materials costs, as some materials that were purchased from suppliers can now be made at the factory. Material costs are predicted to lower from 40% of revenue to 30%.

Increased quality is expected to increase local orders by 25%.

Is this a reasonable assessment? Higher ________ OK ________ Lower ________?

SB12. Colum 15 – Resort Order 3 (2+1): In 2021 two resorts are building within their 4 year initial investment cycle, as such an additional $2,500,000 a year in orders is placed, due to the factories efficiency no other staff are needed, however miscellaneous spending increases by $75,000

(This is not a question field)

SB13 a & b. Colum 16 & 17 – Discount 2: Product price can now be lowered by 30%, The Window Factories products are now 50% lower than its 2014 price, material costs rise back up to 40%, miscellaneous spending increases by $100,000.

As products are now 30% cheaper alongside continued work from both the media and business advisory departments a increase in local orders of 50% is forecast.

Is this a reasonable assessment? Higher ________ OK ________ Lower ________?

SB14. Colum 18 – Resort Order 6 (3+3): In 2026 three resorts are being built simultaneously generating orders of $2,5Million each, alongside three others are expanding and providing orders of $250,000 each.

Over the 5 years due to the media department, business advisory service, staff motivation and increased good will within the local community as the medical and ecological initiatives become more visible local orders are expected to rise by 25%.

Is this a reasonable assessment? Higher ________ OK ________ Lower ________?

SB15. Colum 19 – Resort Order 8 (4+4): In 2028 orders from the resort increase again, there are now 4 resorts in their initial hi budget phase and 4 in their continued lower budget phase. More staff bills and miscellaneous expenses are incurred.

Along with two years progress by the various departments at the operation centre, a further increase in local good, the marketing budget is raised by 25%, all told over two years a 25% increase in sales is forecast.

Is this a reasonable assessment? Higher ________ OK ________ Lower ________?

SB16. Colum 20 – Resort Order 16 (4+12): By 2036 the 16th and final resort begins, by this point staff bonuses are now double their basic salary, this alongside the extra 8 years of marketing, business analysis and by this point earth changing PR as the combined resorts across the USA attend to all Medicaid and Medicare liabilities, alongside producing green energy for over half of the USA.

Due to the above, over the final 8 years a 50% increase in local orders is forecast.

Is this a reasonable assessment? Higher ________ OK ________ Lower ________?

End of Suppliers Butterfly Questions

Note: The 2014 to 2036 figures do not include, building contracts offered to the operation centre’s building company for building developments, infrastructure and private housing outside the resort. The local sales row only forecasts sales to other building companies and individuals within the 3000 square mile local area. A fair to large amount of private and government contracts are expected further, increasing income.

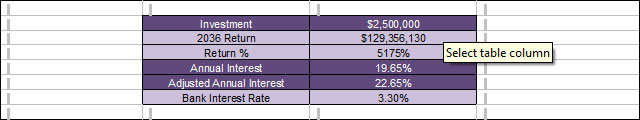

Summing up, for a $2,5 million arranged investment, working on a guarded (low) estimate the building company should expect to have accumulated $130 million by 2036 a 5175% return, the equivalent of putting the $2,5 million in the bank at a 19.65% interest rate. However this model does not include inflation as such 22.65% is more accurate.

America Butterfly Question, AB3: Has the case been made that within manufacturing the window factory business model is innovate and profitable?

Defiantly ________Probably ________Not Really ________?

On the subject of inflation, in general terms it makes little difference to the model as under normal economic circumstances expenses and product prices would increase at the approximately the same rate.

However the desired effect of the “American Butterfly” solution is to see inflation level out, and in some areas decrease while GDP (what the USA sells) and salaries increase, thus the money in everyone’s pockets increases while products stay the same price, or decrease as in the case of products from “The Window Factory”

A typical example is in energy, the process of digging or drilling for fossil fuel then transporting it, then processing it is expensive, and as it is a limited commodity, supply and demand further raises its cost. Once manufactured, Solar Arrays and hydro power save on maintenance and have no such cost implications, added to that eclectic, cars’ prototype batteries can power a car 300 miles on a single charge costing only $10.

A more specific example of this is in the cost of housing. At first, it is hoped for resort property values will increase making investments more attractive. By 2036, with supplies at half the price they are now, and in general after 22 years, with many improvements in building economics and logistics created at the research centers, one would expect the cost of construction to be greatly reduced.

For example if in 2014 a property costs $300,000 to build (including land and infrastructure) if building supplies cost are reduced by 50%, in 2036 the same property will cost $225,000. At the same time, today the average post tax household income is $50,000; if by 2036 it rose to $75,000, the same house will cost three years household income, as opposed to six.

This brings the American Butterfly solution back to the core of economics, as the word economics was invented by the Greeks, who called it Oikonomia, and it was defined as: the management and building of a household. Building houses since the beginning of democracy has been the foundation of economics.

At first this may present a quandary. Since all citizens would effectively have twice what they have now, it might be difficult to comprehend. Many would think, if it was that simple, why is it not so now?

There are many additional factors that will be illustrated throughout the thesis; the spreadsheet below looks at the, “Profit vs. Revenue” ratio, which is further highlighted on the bottom row (x) of the main “Window Factory” spreadsheet presented a few pages back.

An analysis performed on the Fortune 500, (the top 500 revenue making companies in the USA), including their global operations, showed their combined revenue in 2011 was $10.8 trillion with average profits at $750 billion. As such their “Profit vs. Revenue” ratio is 7%. For every $1 they take in they make 7 cents profit.

Below is the “American Butterfly” supplier’s model “The Window Factory” in 2018 showing a 31% “Profit vs. Revenue” ratio (c). As such for every $1 they take in, they make 31 cents in profit, making “The Window Factory” four times more financially efficient than the average Fortune 500 company.

However, as all networked companies work as a unit the “EEE” (Ecological Experience Economy) economic model assisted by the “PQS” (Predictive Quantum Software) looks deeper, factoring the suppliers of “The Window Factory”. All told for every $1 “The Window Factory” receives the combined primary network companies make 58 cents. A financial efficiency increase of just under eight times the Fortune 500 companies if considered as a collective. This ratio rising as the years go on.

Going further as “American Butterfly” is an US economic solution, in financial efficiency terms one includes government tax yields (t), thus for every $1 paid to “The Window Factory,” 76 cents is accounted for, leaving what is commonly known as an “Economic Black Hole” factor of 24%, which by the time the PQS has received 22 years of development the “Economic Black Hole “ is desired to drop to zero, as that is the specific function of the PQS.

The above spreadsheet alongside the influences from physics that inspired the profit vs. revenue approach to American Butterfly are later presented in great detail within the American Butterfly part 3.

David vs. Goliath – Small vs. Big Business

Physics aside, there is a very practice explanation as to how small companies can outperform established global companies in such a fashion.

First: As far as big companies are concerned, it matters little to them what their profit ratio is as at the end of the day. The only thing their shareholders care about is profits and dividends. If we take a look at Walmart, the USA’s largest revenue-making company, last year it took $420 billion in at its registers, and made $16.4 billion in profit, a “Profit vs. Revenue” ratio under 4%. The company makes profits, share prices go up and dividends increase. The share holders are happy, so the board is happy, so the CEO is happy.

However, this business model is not a good economic model as for every dollar they make, another company does not. The “American Butterfly” model works differently. For example, initially the primary source of income is the construction of the resorts, from a $1.5 billion order (tender) to supplier companies; one seeks to generate as much profit as possible. In the case in question: “The Window Factory” vs. “Walmart”. The Resort Company Network profits would be $1 billion vs. Walmart Corporate profits at $58 million.

Second: Loyally, drive, and the communal desire to make as much profit as is humanly possible. If one told all employees at Walmart that they would be paid regardless of whether they came to work or not, few would turn up the next day. By the same token, offer the executives double the money to work at a rival firm, few would stay put.

The resort suppliers business model consists of many small business owners who are of course loyal to themselves and staff on profit share, thus regardless of basic salary, every day is seen as another day to make more profit, and so increase profit share.

America Butterfly Question, AB4: Has the case been made that given competent operation center management and next generation business & networking software, an alliance of many small businesses can be more efficient than a single large business?

Definitely ________ Probably ________ Unlikely ________?

Leave a Reply

Want to join the discussion?Feel free to contribute!